The US Federal Reserve's expected interest rate cut in September and US presidential candidate Donald Trump's support for lower interest rates and tariffs are combining to boost demand for gold, said Arslan Ali, currency and commodity analyst at FX Empire.

“Lower interest rates typically make non-yielding assets like gold more attractive to investors. Additionally, former US President Donald Trump’s support for tax cuts, lower interest rates and higher tariffs has further supported gold prices. This policy stance is seen as potentially inflationary and could weaken the US dollar, making gold a more attractive safe haven asset,” said Arslan Ali.

However, this expert commented that despite these many favorable factors, the strength of the USD is still restraining the increase of gold.

“US retail sales in June remained steady at $704.3 billion, indicating steady consumer spending. Despite a stronger dollar, the stability of retail sales, coupled with the Fed’s cautious stance on rate cuts, has contributed to gold’s recent rally.

Investors are turning to gold as a hedge against future Fed rate hikes and economic growth prospects,” said Arslan Ali.

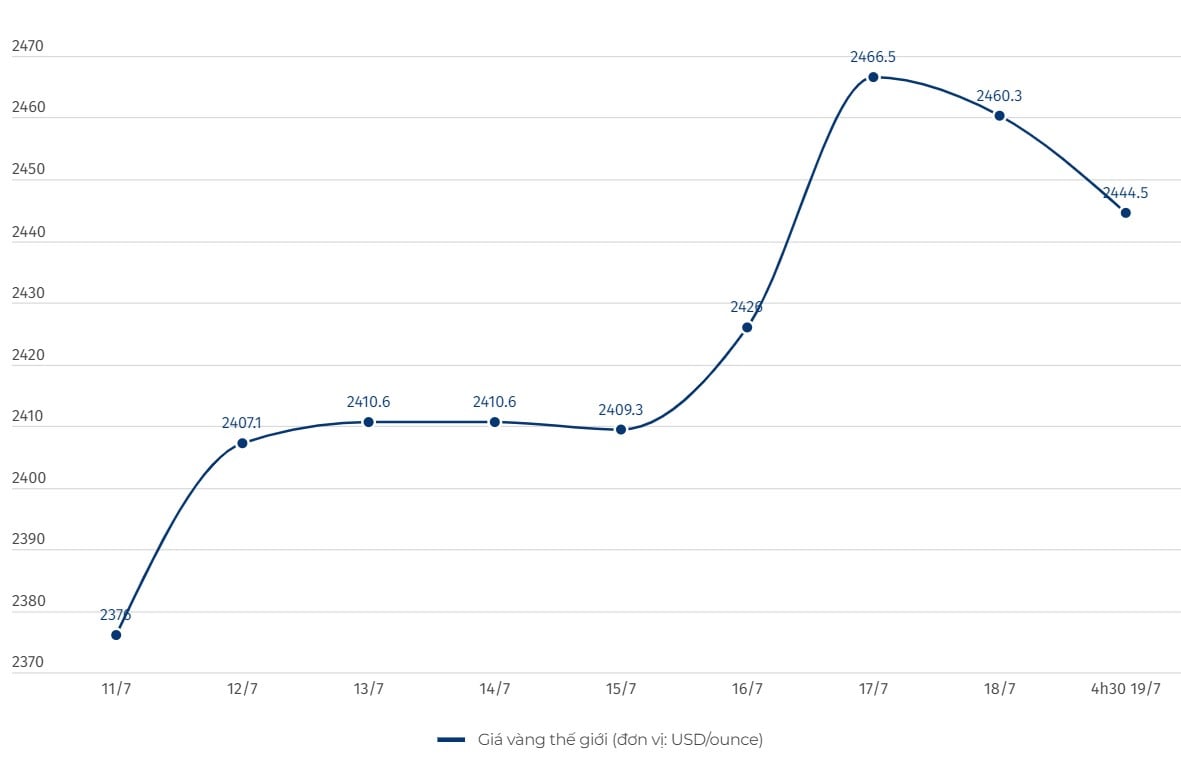

According to this expert, if gold can maintain the level of 2,462.54 USD/ounce, it can push the price to the resistance level of 2,484.03 USD/ounce, followed by 2,495.38 USD/ounce and 2,508.05 USD/ounce.

Arslan Ali said that a break below $2,462.54 an ounce “could trigger a sell-off,” taking gold off support levels at $2,451.33 an ounce, $2,434.87 an ounce, and $2,420.02 an ounce, respectively.”

Meanwhile, senior market analyst Jim Wyckoff of Kitco Metals commented that there is a growing belief that the Fed will cut interest rates this fall, as the market is now seeing a 100% chance that the Fed will cut interest rates at its meeting in September.

There has also been some recent safe-haven demand driving the current rally in gold. There have been reports that Chinese consumers are buying more gold recently amid concerns about China’s economic health.

Technically, investors see the August gold price as having a strong overall near-term technical advantage. The next upside price objective is to produce a weekly close above solid resistance at $2,500/ounce.

Important overseas markets today saw the USD index firmer. Recorded at 4:15 a.m. on July 19, the US Dollar Index, which measures the greenback's movements against six major currencies, was at 103.915 points (up 0.46%).

Meanwhile, Nymex crude oil prices edged up slightly and traded around $83.25 a barrel. The benchmark 10-year US Treasury yield is currently at 4.179%.

Source: https://laodong.vn/tien-te-dau-tu/gia-vang-dot-ngot-sut-giam-co-dang-lo-1368511.ldo

![[Infographic] Notable numbers after 3 months of "reorganizing the country"](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/4/ce8bb72c722348e09e942d04f0dd9729)

![[Photo] Students of Binh Minh Primary School enjoy the full moon festival, receiving the joys of childhood](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/3/8cf8abef22fe4471be400a818912cb85)

![[Photo] Prime Minister Pham Minh Chinh chairs meeting to deploy overcoming consequences of storm No. 10](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/3/544f420dcc844463898fcbef46247d16)

Comment (0)