|

| German industry 'falls behind' - is the foundation of the German economy shaky? (Source: Financial Times) |

A range of German industries are struggling to recover from the Covid-19-induced recession, pointing to a bleak economic outlook ahead, audit and consulting firm PwC said in a recent report.

The report notes that German industry's recovery has been slower than the average for other sectors and that the situation has worsened in recent years.

After studying the revenue growth of companies earning more than 500 million euros ($556 million) from 2000 to 2022, researchers found that German companies' profit margins have nearly halved over the past 22 years.

Among all sectors, the industrial sector was hit harder and recovered less well than expected when the crisis hit.

The report also said German industry needs to come up with a plan to improve its competitive edge, a difficult task given that more and more German companies are going through difficult times.

A survey by the German Association of Mid-sized Companies (ZGV) painted a similar picture among mid-sized companies, with 49% of the 42,000 surveyed reporting a drop in sales in the second quarter.

This result is consistent with a report by the Ifo economic institute that showed business confidence is deteriorating. The Ifo business climate index continued to decline in June 2023, falling from 91.5 points in May 2023 to 88.5 points. The deterioration in business confidence is a sign that the gloomy economic outlook is lingering.

An analysis published by the International Monetary Fund (IMF) on July 17 projected that the German economy will shrink by 0.3% in 2023 due to the negative impact of the energy price shock and tightening financial conditions.

Meanwhile, German inflation has picked up again after months of slowing down, especially in five important economic states of Germany including North Rhine-Westphalia, Bayern, Brandenburg, Hessen and Baden-Wuerttemberg. Preliminary figures released by the Federal Statistical Office (Destatis) showed that the inflation rate of Europe's largest economy increased from 6.1% in May to 6.4% in June 2023, higher than the forecast of 6.3% given by analysts.

In the five key states, inflation rose to 6.2% in North Rhine-Westphalia and Bavaria, 6.7% in Brandenburg, 6.1% in Hesse and 6.9% in Baden-Wuerttemberg. With these figures, Germany's inflation situation will be bumpy ahead.

In early July 2023, the German government approved the draft federal budget for 2024, with sharp cuts in spending after years of heavy spending to cope with the Covid-19 pandemic as well as high energy prices due to the conflict in Ukraine. This draft budget proposed spending for next year up to 445.7 billion euros ($485.2 billion), 30 billion euros less than the planned level for 2023. Despite the reduction, spending will still be 25% higher than in 2019.

The cuts to new borrowing are even more drastic, with new borrowing planned for 2024 at €16.6 billion, down from €45.6 billion in 2023. This new debt is within the limits allowed by the Constitution, and the “debt brake” will also be observed for the second consecutive year, limiting new annual borrowing to 0.35% of GDP.

Finance Minister Christian Lindner described the draft as an important step towards fiscal normalization after years of budgets bloated by hundreds of billions of euros in new debt to deal with the Covid-19 pandemic and the aftermath of the conflict in Ukraine, with all ministries, except the Defense Ministry , having to participate in this belt-tightening effort.

The European Central Bank (ECB) is currently doing its best to reduce persistent inflation in the Eurozone by aggressively raising interest rates. The ECB has increased interest rates by 400 basis points since July 2022, which means that borrowing costs in the Eurozone have more than doubled.

In an effort to curb demand to reduce inflation, the ECB has also reduced the amount of reinvestment banks can make of maturing bonds, making financial conditions even tighter. Tighter financial conditions are discouraging companies from expanding investment.

A ZGV survey found that 27% of companies surveyed intended to reduce investment in the second quarter, up from less than 9% in the first quarter of 2023.

There is no sign that the ECB's tightening cycle is coming to an end any time soon. On the contrary, the ECB has repeatedly stated that monetary policy will remain tight to ensure inflation falls back to its target of 2%.

According to the ECB's latest forecast, inflation in the Eurozone will still hover above 2% in 2025.

Source

![[Photo] Hanoi morning of October 1: Prolonged flooding, people wade to work](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/1/189be28938e3493fa26b2938efa2059e)

![[Photo] Panorama of the cable-stayed bridge, the final bottleneck of the Ben Luc-Long Thanh expressway](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/391fdf21025541d6b2f092e49a17243f)

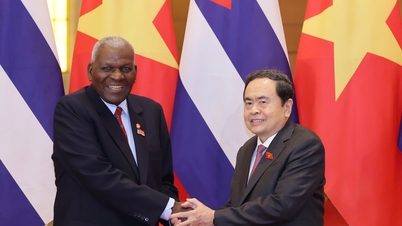

![[Photo] President Luong Cuong receives President of the Cuban National Assembly Esteban Lazo Hernandez](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/4d38932911c24f6ea1936252bd5427fa)

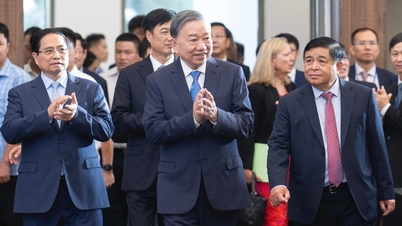

![[Photo] The 1st Congress of Phu Tho Provincial Party Committee, term 2025-2030](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/1507da06216649bba8a1ce6251816820)

Comment (0)