Liquidity reached an 8-month high as the market raced to take profits from real estate, securities and banking stocks, causing the VN-Index to reverse and decline.

After 5 consecutive sessions of increase, VN-Index repeatedly tested the important resistance level of 1,100 points. However, in yesterday's trading session, the market began to fluctuate within a narrow range, causing many securities companies to recommend investors consider taking partial profits.

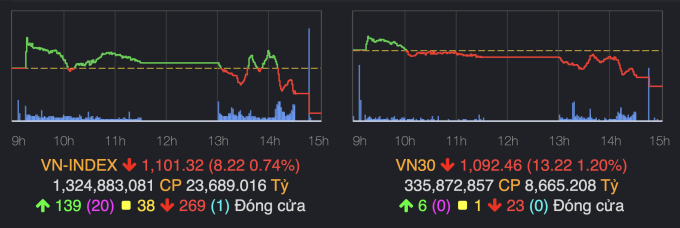

This morning, the HoSE representative index increased by more than 1,115 points in the ATO session. Immediately, the active selling pressure appeared more and more, gradually pulling the index down, at times falling below the reference. After that, VN-Index hovered above the reference within a narrow range.

In the afternoon, the index quickly turned red. Although it exceeded 1,110 points at times, the massive selling pressure pushed the representative index of the Ho Chi Minh City Stock Exchange below the reference level. At the end of the session, the VN-Index fell more than 8 points to 1,101.3 points.

The entire HoSE floor had 269 stocks falling, nearly double the number of 139 stocks rising. In the VN30 basket alone, the performance was even less positive with 23 stocks falling, pulling the index down more than 13 points.

VN-Index "fell" in the afternoon due to strong profit-taking pressure. Photo: VNDirect

The market turned down as investors rushed to take profits on stocks. Liquidity reached nearly VND23,690 billion, the highest since April 22. Of which, industry, real estate, banking and securities were the sectors with the most transactions.

According to VNDirect, the banking industry contributed 6 representatives in the top 10 stocks that caused the market to lose the most points, led by the stock codes of three banks BID, TCB and VPB.

Except for VCB and PGB which increased in price, SGB stopped at the reference level, all bank stocks decreased today. NVB decreased the most with 4.4% but liquidity was insignificant. This industry recorded a series of stocks with transaction value of hundreds of billions of VND, market price decreased sharply such as STB,VIB , EIB, LPB.

In the securities group, the number of stocks that decreased also accounted for the majority. More than 1,200 billion VND poured into VND code - the highest in the whole market, mainly due to investors selling off, at times the active selling force accounted for nearly 97%. This pulled the VND market price down 6% compared to the reference, near the end of the session, the board appeared to buy at the floor price. In addition, the securities industry also recorded many stocks with large liquidity, decreasing in price such as SSI, SHS, HCM, VCI.

The real estate industry's board is more colorful. Today, this industry has 9 stocks hitting the ceiling and 1 stock hitting the floor. Most of the large stocks in the industry fluctuated with a significant amplitude such as DIG and CEO both falling more than 5% compared to the reference, DXG falling 4.6% and CII falling 3.6% or NLG also losing 3.3% of its market value.

Not only domestic investors, foreign investors also traded busily when selling more than 2,750 billion VND and spending more than 2,440 billion VND to buy stocks. The transaction value of foreign investors reached the highest level in the past month and a half. The balance continued to lean towards net selling with a margin of more than 300 billion VND, mainly VNM and GEX.

Siddhartha

Source link

![[Photo] Students of Binh Minh Primary School enjoy the full moon festival, receiving the joys of childhood](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/3/8cf8abef22fe4471be400a818912cb85)

![[Photo] Prime Minister Pham Minh Chinh chairs meeting to deploy overcoming consequences of storm No. 10](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/3/544f420dcc844463898fcbef46247d16)

Comment (0)