The total absolute value of bad debt continues to increase, but due to the strong expansion of outstanding loans, the ratio of bad debt to total outstanding loans has recorded a downward trend - Photo: AI drawing

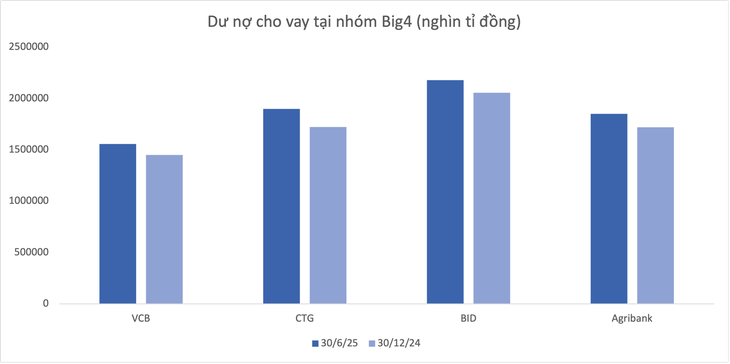

Data from financial reports shows that, as of June 30, 2025, total outstanding loans at 28 banks reached about 14.9 million billion VND, an increase of nearly 10% compared to the beginning of the year.

Bad debt "swells" in absolute value

The "Big 4" banking group alone accounts for nearly 7.49 trillion VND, equivalent to 50% of the total outstanding debt of the entire system. Of which, Vietinbank leads the loan growth with more than 10%, the lowest is BIDV at about 6%.

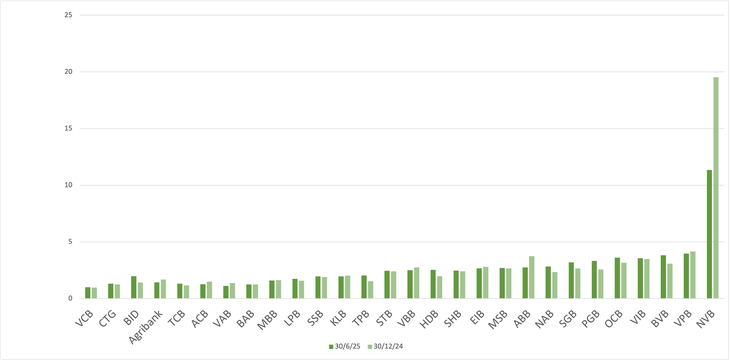

The data also shows that Saigonbank (SGB) is a rare bank that recorded a decrease in outstanding loans (-7.2%) in a very vibrant general picture. On the contrary, NCB (NVB) had the highest growth rate of 21.7% after 6 months.

Next, a series of banks have outstanding growth rates compared to the industry average such as VPBank (18.8%), HDBank (17.8%), ABBank (16%)...

Data: Semi-annual financial statements 2025

The total value of bad debt as of the end of June 2025 at 28 banks reached VND294,215 billion, an increase of more than 12% compared to the beginning of the year. In terms of structure, most of the increase came from the substandard debt group (group 3) and the group with the possibility of losing capital (group 5).

However, the average bad debt ratio of listed banks decreased from 2.16% at the end of the first quarter of 2025 to 2.04% at the end of the second quarter, according to Wichart data.

A stock analyst said that in case total outstanding loans increase sharply, while bad debts do not decrease, the ratio of bad debts/total outstanding loans is still "better".

Normally, newly disbursed loans have not yet turned into bad debt because the time has not been long enough for them to become overdue.

Not to mention that in the context of loosening monetary policy, debt restructuring may be more favorable, helping many loans continue to be extended instead of being recorded as bad debt.

BIDV's bad debt increases rapidly

In terms of absolute value, BIDV (BID) attracted attention when it had bad debt at the end of June 2025 of more than VND 43,140 billion, an increase of more than VND 14,100 billion after half a year, contributing greatly to the increase in bad debt of the whole system. In which, BIDV's debt with the possibility of capital loss increased by 45%, reaching VND 28,701 billion at the end of the second quarter.

In the remaining Big 4 group, Vietinbank and Vietcombank also increased bad debt but at a lower rate. At Agribank alone, debt with the possibility of capital loss decreased by more than 13%, to 19,583 billion VND, causing the bad debt ratio to decrease slightly.

Bad debt ratio in banks (%)

VPBank is also among the banks with the largest "swelling" bad debt scale with 32,945 billion VND as of June 30, an increase of more than 3,876 billion VND (equivalent to 13.3%) compared to the beginning of the year.

TPBank and Sacombank also increased by VND2,034 billion (53%) and VND1,516 billion (11.7%) respectively. SHB also increased nearly VND1,580 billion in bad debt after half a year.

In the group of smaller banks, PGBank and Nam A Bank (NAB) witnessed a significant increase in bad debt value, 42.5% and 40% respectively.

On the contrary, there are also a few banks with bad debt balance decreasing after the first six months of the year including NVB, VietABank, Agribank, ACB and ABBank...

Deposit growth at many banks is slowing down?

According to data from Wichart, in the first 6 months of the year, the bad debt balance (from group 3 to group 5) of the entire banking industry increased by more than 16% compared to the end of 2024, reaching 267,329 billion VND - this is a record high. Meanwhile, at the same time, the risk reserve balance of banks reached 213,393 billion VND, an increase of only 3.2%.

On another note, bank deposit growth is slowing, especially in 2025. To compensate, banks are stepping up issuance of securities, including bonds, with a marked increase from late 2024 to 2025.

Source: https://tuoitre.vn/no-kha-nang-mat-von-cua-bidv-tang-vot-cuc-mau-dong-toan-nganh-ra-sao-20250815200340415.htm

![[Photo] Soldiers guard the fire and protect the forest](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/27/7cab6a2afcf543558a98f4d87e9aaf95)

Comment (0)