Thanks to a loan of 3.5 billion VND from Agribank Tam Dao branch, Mr. Nguyen Van Thuyen, Quan Dinh hamlet, Tam Dao commune, invested in raising egg-laying chickens, earning a profit of 300-500 million VND per year.

The Nam Nam broiler farm of Ms. Tran Thi Van, 44 years old, in Cay Sop area, Quan Dinh village, Tam Duong Bac commune, regularly maintains a flock of nearly 20,000 laying hens, broilers, and breeding chickens. Ms. Van said: 3 years ago, thanks to timely loans and guidance and assistance from Agribank Tam Dao branch staff, her family was able to build an additional automatic, closed barn to avoid disease; expand the scale of farming to 2,000 laying hens, nearly 15,000 broilers and breeding chickens supplied on site. In the first 9 months of 2025 alone, revenue from broilers and eggs was more than 3 billion VND, after deducting expenses, the profit was more than 250 million VND. The farm also created jobs for more than 10 workers, with an average income of 10 million VND/person/month.

Ms. Tran Thi Van takes care of a flock of broiler chickens about to be sold at the Cay Sop farm, Quan Dinh village, Tam Duong Bac commune.

Ms. Nguyen Thi Huong in Dong Sinh village, Ho Son commune also borrowed 300 million VND from Agribank Tam Dao branch to invest in planting more than 1.05 hectares of Black Summer grapes mixed with pennywort and Korean melon, creating regular jobs for 4-6 workers, earning 200-250 million VND per year...

Over the years, Agribank Tam Dao has always closely followed the policies of the Party and the State, the operational strategies of Agribank Vietnam and Agribank Vinh Phuc II branch, along with the economic development goals of the locality, actively propagating and expanding utilities in payment and treasury services; applying the IPCAS program (automation of the whole industry); preferential policies for potential customers, customers with long-term loyalty to the unit...

The unit regularly trains, updates knowledge and innovates the attitude and service style of the credit officers and transaction officers; assigns competent and reputable credit officers to stay close to the area to find customers with potential to mobilize capital. Along with that, attaches importance to the appraisal and examination of loan applications; guides customers to use capital for the right purpose and effectively. Focuses on lending to shift the economic structure; develops large-scale livestock and poultry farming; invests capital to restore traditional craft villages.

With many synchronous solutions, by the beginning of September 2025, the total mobilized capital of the branch reached more than 1,554 billion VND, an increase of 212 billion VND compared to the beginning of the year, a growth rate of 15.8%. The total outstanding loans to the district's economy by the end of August 31 reached more than 1,402 billion VND, an increase of 110 billion VND compared to the beginning of the year, a growth rate of 8.51%. From the capital source, the unit has disbursed loans to more than 3,500 individual customers with a total outstanding loan of 1,356 billion VND, of which more than 96% are farmers. The timely loan capital has helped thousands of new borrowers have capital to carry out production, business, purchase production materials... to develop the economy effectively.

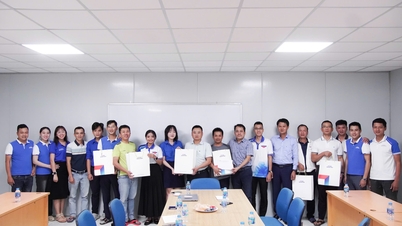

AgriBank Tam Dao branch staff met with loan customers to grasp the situation and provide instructions on capital preservation.

Mr. Nguyen Hong Ha - Director of Agribank Tam Dao branch said: Right from the beginning of the year, the unit has built a realistic business plan, focusing on lending capital to serve agriculture and rural areas. Implementing good corporate culture. Thanks to that, it has mobilized capital from the population and economic sectors, received capital from international credit and financial institutions through the superior bank, created a loan fund, and attracted more and more depositors.

In the current tight credit conditions, Agribank Tam Dao branch still provides enough capital for the "agricultural and rural" sector to develop production and business in the area, promoting the new rural construction program. In 2025, the branch strives to increase mobilized capital by 10-15% compared to 2024. Outstanding loans increase by more than 10% compared to 2024. The ratio of loans serving the agricultural and rural areas maintains a proportion of 96% of the capital structure; ensuring profits and full payment of tax obligations to the State, contributing to the development of the local socio-economy.

Xuan Hung

Source: https://baophutho.vn/agribank-tam-dao-kenh-dan-von-giup-nong-dan-mien-nui-hieu-qua-240074.htm

![[Photo] Prime Minister Pham Minh Chinh receives Secretary of Shandong Provincial Party Committee (China) Lin Yu](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/26/821396f0570549d39f33cb93b2e1eaee)

Comment (0)