In the real estate market, the commercial townhouse segment (shophouse) was sought after by investors and flourished in 2015. The selling price and rental price of shophouses are sky-high due to the many advantages of being used for both living and doing business or renting out the premises.

However, over the past 2 years, this type has gradually quieted down. Especially since the COVID-19 pandemic broke out in Vietnam and lasted for a long time, the shophouse segment has become even more sluggish, even many investors have reduced prices but there are still no tenants or buyers.

For more than a year now, Ms. Le Mai Ha (Hoan Kiem, Hanoi ) has been continuously selling a shophouse of more than 75 square meters in an urban area in Hoang Mai district. The selling price has decreased by 20% compared to the purchase price of nearly 14 billion VND in mid-2021, but still no one is interested.

Her shophouse is 4 stories high and has been completed. The rental price is 30 million VND/month, the profit rate is only over 2% a year. However, since the purchase, the shophouse has often been in a state of no tenants, leaving the premises empty.

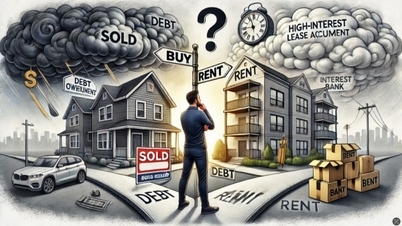

Many shophouses worth tens of billions of dong are unsold. (Illustration photo).

Ms. Ha lamented that every month she still has to pay interest and principal of the bank loan of more than 100 million VND for the 6 billion VND loan. The rental income is "meager", the pressure of interest rates is heavy so she had to sell at a loss, but after more than a year of advertising, she has not found a buyer.

In the same situation of not being able to sell or rent, Mr. Mai The Anh said that in early 2021, he bought a shophouse in the urban area on Le Trong Tan Street (Ha Dong District) for 24 billion VND. This project was handed over in 2022, but until now, commercial activities are still weak, the number of residents is sparse. This causes the shops here to only serve a limited number of residents in the project, with almost no visitors. Currently, only a few shophouses are open for business, nearly 80% of the remaining doors are closed.

At first, I thought the urban area would develop and many people would come to live, so shophouses were the best choice, but the reality was not as expected. The business here is mainly for local people, but due to habit, they often go to shopping malls for entertainment, and go to the traditional market for shopping, so the general situation of shophouses is sluggish.

Mr. Thế Anh said he put up a sign for rent at 35 million VND per month, hoping to cover part of the bank loan interest, but the shop has been vacant for nearly a year. Now that the interest grace period has expired, and the pressure of interest is high, Thế Anh has accepted to sell at a loss of 30% but has not found a buyer.

According to Ms. Le Linh, a real estate broker in Hoang Mai district, the sluggish situation not only occurs in shophouses in new urban areas with few residents and on the outskirts, but also in shophouses in the center of Hanoi, it is very difficult to sell and rent. Due to the impact of the COVID-19 pandemic, the difficult economic situation, many people who cannot do business are forced to return the premises or negotiate with the landlord to reduce the price.

" Many rental properties in central Hanoi have had to reduce rental prices but are still unsold, so shophouses being unsold is inevitable," said Ms. Linh.

Analyzing this issue, according to the investor of a project in Hanoi, whether investors make a profit from shophouses depends on various factors. For a product to increase value or ensure a good source of income, the investor of that project must ensure the internal infrastructure and social infrastructure. Only then can it attract internal and external customers to the project. With shophouses, whether the rental income is good or not depends on the ability to fill the residents of that apartment/urban area project.

“ Before investing money, investors should look at the capacity of the project investor, see how far they have deployed the project’s infrastructure, the potential for development and attracting customers in the area and how close the project is. Potential investors will synchronize the infrastructure before attracting residents to live there. Only then, when the number of users is large and bustling, will the shophouse have value in terms of business and stable rental ,” he analyzed.

Sharing the same view, Ms. Duong Thuy Dung, Senior Director of CBRE, said that shophouses are only truly potential when they meet the following factors: the project has the ability to fill up quickly; good utility services; must have a large enough internal resident community and fourthly, there must be smooth connections, attracting the resident community outside the project.

To achieve profit and safety, investors should choose a shophouse with a moderate value of 2-7 billion VND, so as not to have to spend too much money initially without knowing whether the return is commensurate or not. Investors should not invest in a shophouse in the short term of 1-2 years but must have a medium to long term plan of 3-5 years or more.

Buyers also need to pay attention to the commercial floor area on the first floor. If the product area is too small, only about 75 m2, it will cause difficulties in business. Many products are bought and then left there because they cannot be used for commercial exploitation.

Ngoc Vy

Source

![[Photo] Closing of the 13th Conference of the 13th Party Central Committee](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/08/1759893763535_ndo_br_a3-bnd-2504-jpg.webp)

Comment (0)