| Cocoa Industry: Lack of Long-Term Strategy EU Deforestation Regulation: Cocoa Coffee Industry Has Complied |

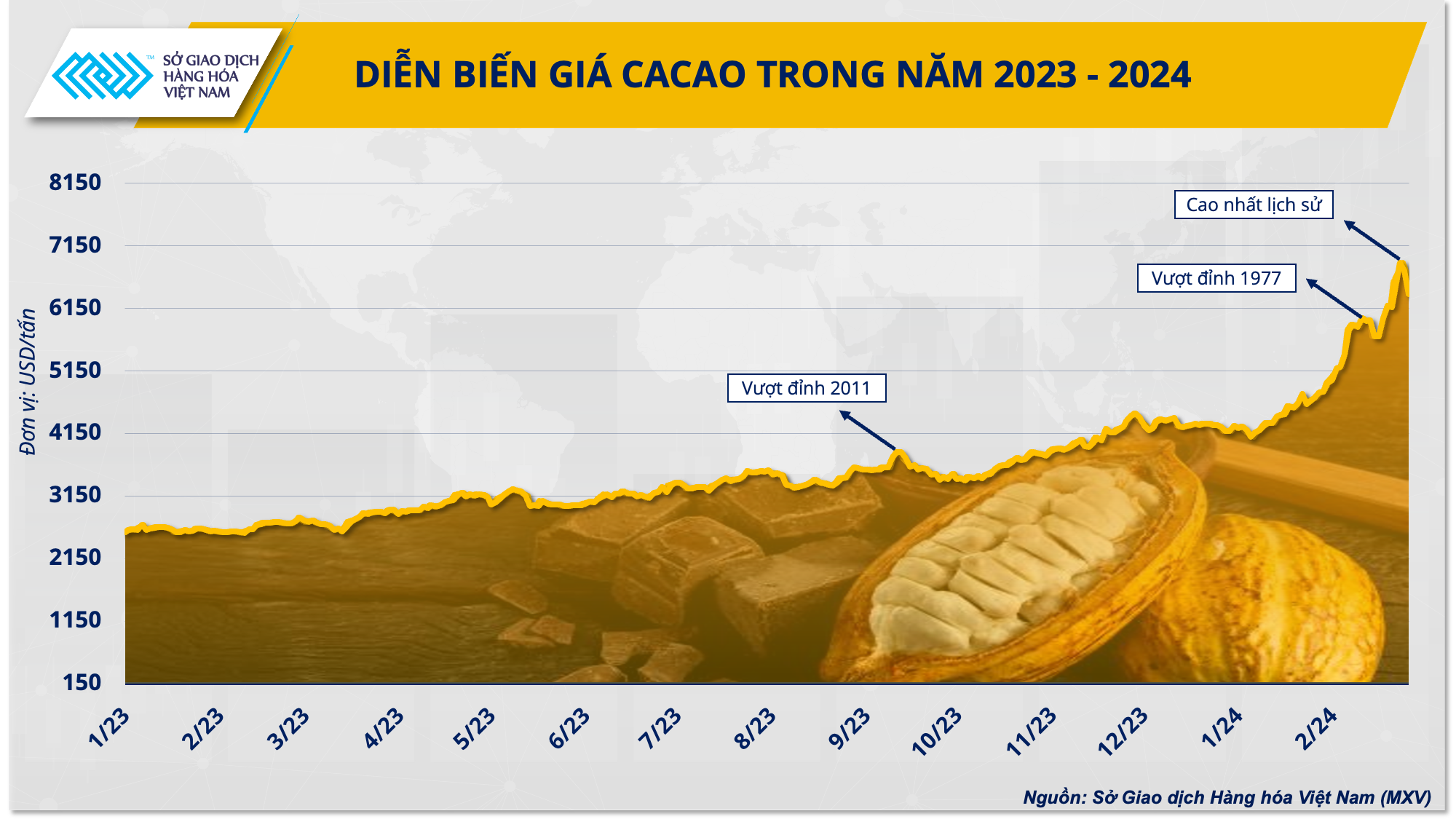

Cocoa prices are trading at an all-time high, surpassing the peak of 1977. In the context of a negative supply, cocoa prices are expected to write a new page in history and bring this crop back to its true “poverty-relief” nature.

Cocoa prices set new peak after 47 years

After 47 years, cocoa prices surpassed the 1977 record for the first time on February 8 and are on track to create more new peaks. According to the Vietnam Commodity Exchange (MXV), cocoa prices on the New York Intercontinental Exchange (ICE-US) closed on February 26 at $6,557/ton, up 54.72% compared to the beginning of 2024 and 22% higher than the peak set in 1977.

|

| Cocoa price developments in 2023-2024 |

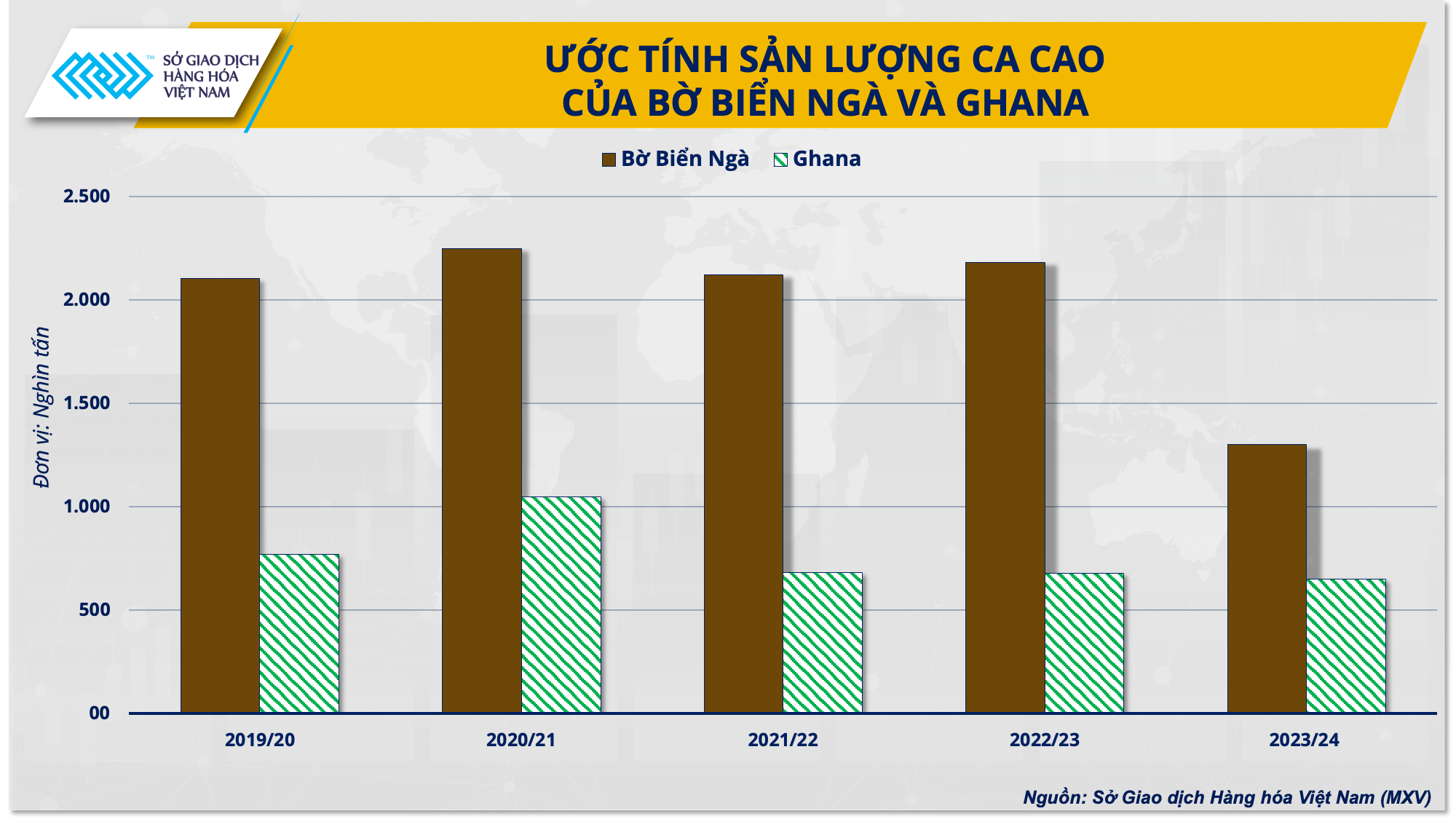

The risk of supply shortages in Ivory Coast and Ghana, the two countries supplying over 70% of the total global cocoa production, is one of the key factors pushing cocoa prices up. According to data from Ivory Coast Customs, from October 2023 to February 25, the country's cocoa exports decreased by 32% compared to the same period last year, to 1.16 million tons. At the same time, from September 2023 to January this year, the volume of graded and packaged cocoa in Ghana also decreased by 35% compared to the previous period.

In addition to the shortage of supply, the soaring demand for cocoa before Valentine's Day also resonates, pushing prices to new peaks. According to statistics at the Vietnam Cocoa Conference, the global chocolate industry is consuming more than 4 million tons of cocoa beans annually, equivalent to 80-90% of the world's total output.

|

| Mr. Pham Quang Anh, Director of Vietnam Commodity News Center |

Commenting on the prospects of the cocoa market, Mr. Pham Quang Anh, Director of the Vietnam Commodity News Center, said: “ World cocoa prices are likely to remain at high prices until the end of the first quarter, or even the second quarter of this year. The cocoa supply-demand deficit may last for the third consecutive year as El Nino is still raging in the world’s two leading producing countries.”

2023 has left a "mark" on the world cocoa industry

Before officially surpassing the 1977 peak, cocoa prices on the ICE-US Exchange recorded an impressive increase in 2023. According to MXV records, by the end of December 2023, cocoa prices had reached 4,196 USD/ton, an increase of 72% compared to the beginning of the year. This is also the commodity with the highest growth rate among all commodities being linked at MXV in 2023. At the same time, the impressive increase also helped cocoa prices in the past year surpass the peak of 2011 - the time when the ban on cocoa exports from Ivory Coast was issued.

Concerns about supply shortages in Ivory Coast and Ghana remain one of the core reasons for the surge in cocoa prices. Since the beginning of 2023, prolonged heavy rains in the two countries have caused disease outbreaks, pushing cocoa production to the risk of a sharp decline. By the fourth quarter of 2023, El Nino appeared, and the main cocoa production region experienced one of the worst heat waves in history, causing serious crop damage. According to a synthesis of sources, cocoa production in Ivory Coast in the 23/24 crop year is estimated to decrease by about 20% compared to the previous crop year, to 1.3 million tons. Along with that, in Ghana, output is expected to decrease to a record low in 14 years, fluctuating between 650,000 and 700,000 tons.

|

| Estimated cocoa production of Ivory Coast and Ghana |

Concerns about a global supply shortage were further heightened as cocoa inventories at the ICE-US Exchange fell to their lowest level since mid-2021. As of December 2023, total cocoa inventories at the Exchange had fallen 13.49% from the beginning of the year to 4.17 million bags.

Opening up prospects for cocoa tree revival

Currently, many cocoa-producing countries are still "sitting on fire" due to crop failures, but MXV believes that this context is creating opportunities for this potential industry to turn a new page.

Cocoa is considered a “key crop” that can help West African farmers “change their lives”. However, in reality, this crop has not yet fulfilled its role as a “poverty-relief tree”. According to Wageningen University and Research Foundation, the average income of cocoa farmers is less than 2 USD/day, below the World Bank’s poverty line.

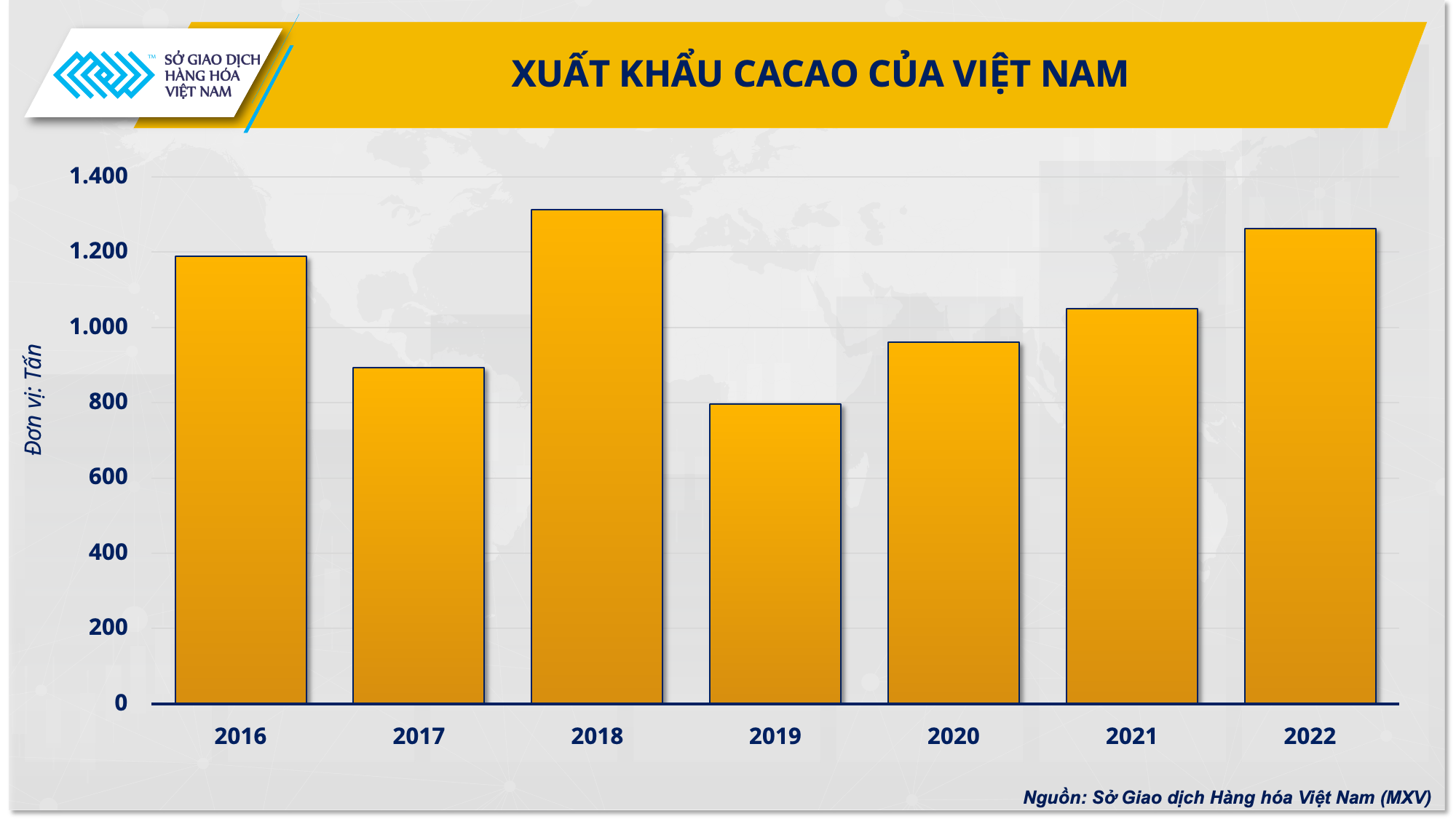

Similar to countries in West Africa, according to MXV's synthesis source, the income of cocoa farmers in Vietnam is only from 1.5 to 2 million/month - an income level not enough to cover living expenses. Poor economic efficiency and low productivity are the reasons limiting the potential for cocoa development in our country. Therefore, currently, this crop is mainly intercropped with other plants such as cashew and coconut. According to Reuters statistics, in 2022, Vietnam's cocoa bean output will be around 2,000 tons, accounting for a modest proportion of approximately 0.04% of the total global cocoa output.

Since 2023, when cocoa prices have continuously set new peaks in history, cocoa trees have the opportunity to return to their true nature of "escape from poverty". With gradually improved economic benefits, this could be a new "turning point" for farmers to develop cocoa as a key crop in Vietnam. In particular, according to the criteria of the International Cocoa Organization (ICCO), Vietnamese cocoa beans have the second best quality in Asia.

|

| Vietnam's cocoa exports |

“Taking advantage of the high price, Vietnam is facing a “golden opportunity” to revive cocoa growing areas. In the context of tight global supply, the appearance of “made by Vietnam” cocoa products can be a bright spot in the global supply chain. In particular, with good quality, our country’s cocoa products can access many new markets, spread the value of Vietnamese goods around the world and create a new beginning for the industry’s future prospects,” Mr. Pham Quang Anh emphasized.

Source

![[Photo] Hanoi morning of October 1: Prolonged flooding, people wade to work](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/1/189be28938e3493fa26b2938efa2059e)

![[Photo] Panorama of the cable-stayed bridge, the final bottleneck of the Ben Luc-Long Thanh expressway](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/391fdf21025541d6b2f092e49a17243f)

Comment (0)