Monthly rally broken

The world stock market had a positive trading week. Despite the government shutdown, the US stock market continued to set new records. This shows that US investors do not seem to be too worried about the consequences that may cause to the economy and the market. At the same time, the world financial market is basically not too pessimistic about what is happening in the US.

For the week, the S&P 500 rose 1.1%; the Dow Jones recorded a similar increase and the Nasdaq rose 1.3%. World stocks rose across the board last week: Europe (+2.9%), South Korea (+4.8%), Hong Kong (+3.9%).

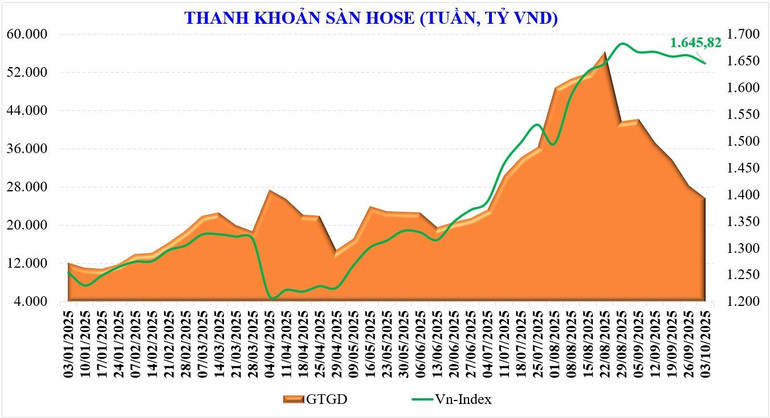

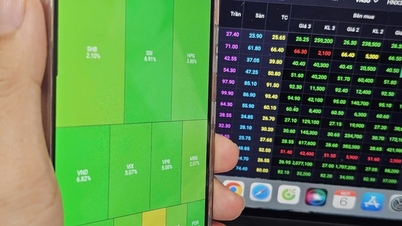

Regarding the Vietnamese stock market, the VN-Index continued to perform negatively last week. The index's four-month consecutive increase was halted in September, and thus, the VN-Index still missed the 1,700-point threshold this month after many unsuccessful attempts.

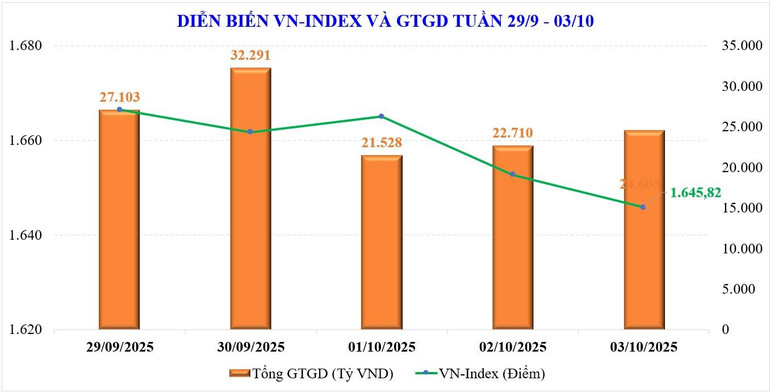

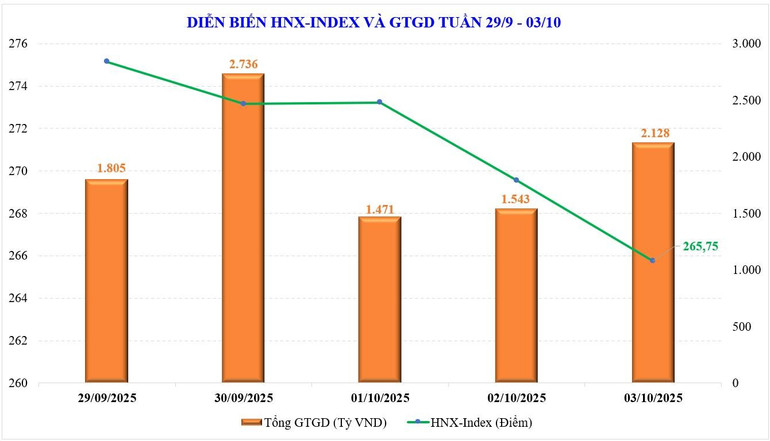

Last week, the market maintained a sideways trend with a narrowing range. At the end of the week, VN-Index closed at 1,645.82 points, down 14.88 points (-0.9%) compared to the previous week. VN30 stocks increased +0.37%. Midcap stocks decreased -4%, marking 5 consecutive weeks while Smallcap stocks also decreased sharply -3.6%.

Closing September, the VN-Index lost -20.51 points (-1.22%), while the VN30 index only slightly decreased -0.12%, Midcap decreased -4.33% and Smallcap dropped -1.89%.

Some groups of stocks that went against the market trend last week include: Vingroup (+5.4%), Seafood (+0.9%)... On the other hand, the groups of stocks that put pressure on the market include: Real estate (-8.6%), industrial park real estate (-6.6%), chemicals (-5.4%)...

Market liquidity continued to decline last week. The average trading value last week was only VND28,071 billion/session, down -9.3% compared to the previous week. The matched trading value also dropped -8.7% to VND25,453 billion.

According to statistics, liquidity in September increased by +112% compared to the same period, but decreased by -32% compared to August, to 37,600 billion VND. Accumulated from the beginning of the year, the liquidity of the whole market reached 28,376 billion VND/session, an increase of +34.6% compared to the average level in 2024, and an increase of +28.6% compared to the same period.

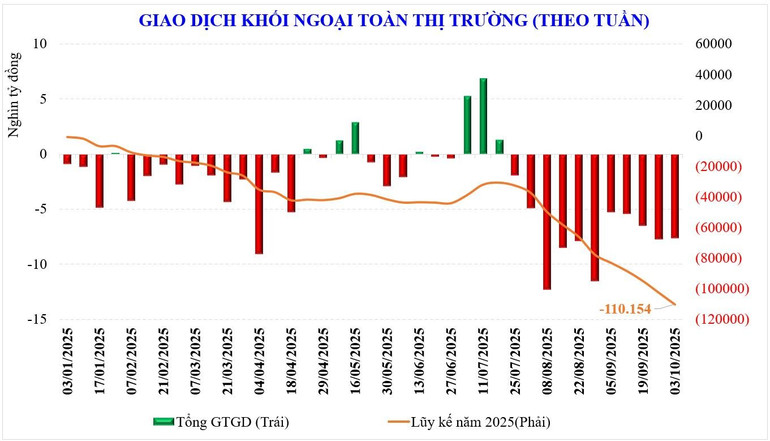

Foreign transactions were also similar with the net selling level of the previous week. Foreign investors net sold -7,595 billion VND, marking the 11th consecutive week of net selling. Since the beginning of the year, foreign investors have net sold -110,154 billion VND, exceeding last year's level (-92,600 billion VND).

Last week, foreign investors net bought VIC (+221 billion VND), TCB (+205 billion VND), LPB (+158 billion VND), while net selling VHM (-786 billion VND), MWG (-712 billion VND), FPT (-551 billion VND)...

Last week, securities companies' self-trading net bought stocks such as: VHM (+ 186 billion VND), ACB (+ 118 billion VND), SHB (+ 101 billion VND)... while net selling other stocks such as: V PB (- 515 billion VND), EIB (- 370 billion VND), PC1 (- 185 billion VND)...

Wait for good news to remove the waiting mentality

The domestic stock market is expected to be positive again next week thanks to the good news that will appear. Besides the increasing expectation of the FED's interest rate reduction trend globally, domestic news will be the main driving force for the return of cash flow.

The official domestic macroeconomic figures will be announced early this week. However, at the Government meeting last weekend, the Minister of Finance said that the forecast GDP growth figure for the third quarter of this year will be over 8%. This will reinforce the full-year growth scenario that the Government has set as its target.

In the new week, information about business results of enterprises will continue to appear more. This is the main information and directly affects the development of cash flow. Positive macro news, combined with increased corporate profits will create a better push for cash flow to return, breaking the somewhat sluggish level in September.

The highlight of the new week is FTSE Russell announcing the results of its market classification review, which will be officially announced on October 8 (Vietnam time). This is when FTSE Russell will announce updates related to the assessment of markets, including the possibility of Vietnam being considered for upgrading from a Frontier Market to a Secondary Emerging Market.

In a positive scenario, many forecasts show that if FTSE announces that Vietnam's market will be upgraded, the liquidity bottleneck of the past month will be removed and foreign capital flows are expected to return.

However, except for the above factors, due to seasonal factors, the market in October usually has a low performance. The market may be positive in the first half of the month and gradually become cautious in the second half of the month.

Therefore, in the most optimistic scenario, both factors of GDP growth and upgrading will converge, creating an opportunity for the VN-Index to surpass 1,700 points, setting a new peak like some major markets in the world at this time.

In a cautious scenario, the market is "indifferent" to good news or reacts negatively, a correction to retest the 1,600-point support zone or break through it will also be a good opportunity for investors to restructure their portfolios for this fourth quarter.

At present, the market reaction is still the most accurate answer to the new news. The most important thing is how good or bad news will affect the cash flow in the market. In other words, money needs to come back and join strongly, then the sideways trend will be broken.

Source: https://nhandan.vn/thi-truong-chung-khoan-tuan-toi-tin-tich-cuc-dang-nhieu-len-cho-dong-tien-kich-hoat-lai-post913194.html

![[Photo] Opening of the 13th Conference of the 13th Party Central Committee](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/6/d4b269e6c4b64696af775925cb608560)

![[Photo] Prime Minister Pham Minh Chinh chairs the Government's online conference with localities](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/5/264793cfb4404c63a701d235ff43e1bd)

![[Photo] Opening of the 13th Conference of the 13th Party Central Committee](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/10/6/d4b269e6c4b64696af775925cb608560)

![[Photo] Prime Minister Pham Minh Chinh launched a peak emulation campaign to achieve achievements in celebration of the 14th National Party Congress](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/5/8869ec5cdbc740f58fbf2ae73f065076)

Comment (0)