This is the sharing of Mr. Nguyen Duc Vinh, General Director of Vietnam Prosperity Bank ( VPBank ), at the seminar introducing stocks of VPBankS Securities Company in Ho Chi Minh City, on the evening of October 15.

According to Mr. Nguyen Duc Vinh, the initial public offering (IPO) of VPBank Securities Company, although it is a young securities company, is a long-term strategic decision of the bank. After the IPO, there will be other synchronous strategies to reach the level of leading securities companies in Vietnam.

Accordingly, VPBankS is offering a maximum of 375 million shares, equivalent to 25% of outstanding shares, at a price of VND33,900/share.

CLIP: VPBank CEO shares about being "a latecomer but still having advantages for a young securities company"

The total value of capital mobilized is expected to reach nearly VND12,713 billion, becoming the largest IPO in the history of the Vietnamese securities industry, creating a premise for the company to expand margin lending space and promote business activities. At this offering price, VPBankS is valued at about VND63,562 billion (more than USD2.4 billion) after the IPO.

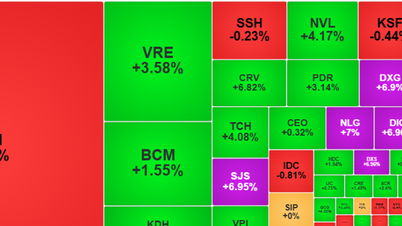

Mr. Nguyen Duc Vinh said that although it is only a young securities company, after 3 years of operation, VPBankS has risen to the top 3 in total assets, top 4 in outstanding margin loans and top 5 in profits by the end of the second quarter of 2025. VPBankS's growth momentum comes from its own advantages.

"The company is part of VPBank's expanded and differentiated financial ecosystem, spanning banking, securities, consumer finance, insurance, digital banking and fintech. The growing ecosystem allows VPBankS to exploit cross-selling opportunities, becoming an investment solution center for more than 30 million customers, three times larger than the current number of securities accounts in Vietnam," said Mr. Nguyen Duc Vinh.

Investors learn about VPBankS at the event

Vietnam has just been upgraded from a frontier market to a secondary emerging market by FTSE Russell. HSBC's global investment research department believes that in the most optimistic scenario, Vietnam could attract capital flows of up to 10.4 billion USD, boosting market liquidity and expanding the ability to raise capital for businesses.

In the above context, VPBankS has just held meetings with global investors in Thailand, Singapore, Hong Kong (China) and the UK to promote the company, share development strategies and expand international cooperation, preparing for the IPO.

VPBankS entered the IPO journey with a special advantage when inheriting the extensive experience from its parent bank. Previously, VPBank was one of the few units to successfully carry out two billion-dollar deals in Vietnam: Selling 49% of shares of consumer credit company FE CREDIT to a foreign partner and issuing 15% of VPBank shares to partner SMBC (Japan).

Source: https://nld.com.vn/tong-giam-doc-vpbank-noi-ve-quyet-dinh-chao-ban-thuong-vu-ipo-khung-nganh-chung-khoan-196251015201659331.htm

![[Photo] Many dykes in Bac Ninh were eroded after the circulation of storm No. 11](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/15/1760537802647_1-7384-jpg.webp)

![[Photo] Conference of the Government Party Committee Standing Committee and the National Assembly Party Committee Standing Committee on the 10th Session, 15th National Assembly](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/15/1760543205375_dsc-7128-jpg.webp)

![[Photo] General Secretary To Lam attends the 18th Hanoi Party Congress, term 2025-2030](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/16/1760581023342_cover-0367-jpg.webp)

![[Video] TripAdvisor honors many famous attractions of Ninh Binh](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/10/16/1760574721908_vinh-danh-ninh-binh-7368-jpg.webp)

Comment (0)