The State Capital Investment Corporation (SCIC) has just announced the list of divestments in the first phase of 2023, including 73 enterprises. Among them are many notable names on the stock exchange such as Binh Minh Plastics Joint Stock Company (BMP), Vietnam Seafood Corporation - JSC (Seaprodex - code SEA), Licogi Corporation - JSC (code LIC)...

At Binh Minh Plastics, the proportion of capital to be divested is very small. This is the final sale, completing the divestment of State capital at a leading plastic enterprise in Vietnam in terms of both brand and production and business efficiency.

Accordingly, SCIC will divest all 19,983 BMP shares (0.02% of charter capital). The transaction is expected to be carried out by order matching method, with a minimum price of VND 72,300/share. The expected implementation time is within 1 month from May to June 2023.

In the past 2 months, BMP shares of Binh Minh Plastics have increased sharply, from 57,000 VND/share to 87,000 VND/share. This level is about 20% higher than the minimum offering price in SCIC's divestment deal at BMP.

With positive developments, SCIC will be able to sell at a high price. However, the number of shares is insignificant so the value obtained is also very small.

BMP shares increased sharply, perhaps not because of SCIC divestment information, but because of good business results and high dividend payment plan.

In the first quarter of 2023, Binh Minh Plastics recorded a 7% increase in revenue to nearly VND 1,450 billion. Net profit was more than VND 280 billion, 2.2 times higher than the same period last year. EPS reached VND 3,430/share - a very impressive rate. By the end of the first quarter, BMP's undistributed profit after tax reached nearly VND 880 billion.

In 2023, BMP sets a business plan with a revenue target of 6,357 billion VND, an increase of 9% over the same period. Profit after tax is set at 651 billion VND.

From 2020-2022, the economy faced many difficulties, BMP still regularly paid cash dividends at a very large rate.

Thai shareholder The Nawaplastic Industries (Saraburi) Co., Ltd - a member of SCG Group currently holds 55% and "pockets" the largest amount of dividends.

Over the past decade, the Thai group has gradually acquired Vietnam’s leading plastic brand. Since March 2012, The Nawaplastic has become a major shareholder after spending more than VND240 billion to own more than 16.7% of BMP shares.

By mid-2018, this organization held 54% of BMP shares. Later, the Thai enterprise increased its holding rate to 55% at BMP.

It is estimated that this group spent about 2,700 billion VND to own 55% of BMP shares. Currently, these shares are worth about 4,000 billion VND. Thai shareholders also enjoy a large amount of cash dividends (84% in 2022) over the past many years, which could be up to 1,400 billion VND. BMP is considered the "golden goose" for The Nawaplastic.

A decade ago, Nawaplastic, a subsidiary of the Siam Cement Group (SCG), also intended to acquire Tien Phong Plastic (NTP) to become a major shareholder. This was the first step on the path to acquiring the value chain of the Vietnamese plastic industry.

However, Nawaplastic divested from NTP and switched to BMP to avoid antitrust issues.

According to the Competition Law, the dominant group of enterprises in the market is two enterprises with a total market share of 50% or more. At that time, if it dominates both BMP and NTP, the Thai group will hold 55% of the market share of the Vietnamese plastic industry.

In Vietnam, plastic is an industry with a relatively high profit margin compared to other industries in the construction sector. Thai SCG Group currently owns TPC Vina Company - the unit that supplies 15% of plastic pellets to Vietnam. This helps BMP to be proactive in raw material sources whose prices fluctuate constantly.

At the same time, BMP is also supported by an ecosystem of construction subsidiaries that SCG has acquired over the past decade.

In addition to BMP, SCG, through its subsidiaries, also acquired a series of famous plastic enterprises in Vietnam such as Tin Thanh Plastic, Viet - Thai Plastchem joint venture, Minh Thai Plastic Materials...

Previously, at the end of April 2023, Binh Minh Plastics had a Board of Directors Resolution on the election of the Chairman of the Board of Directors and Vice Chairman of the Board of Directors. Accordingly, Mr. Sakchai Patiparnpreechavud was elected as Chairman of the Board of Directors; Mr. Chaowalit Treejak was elected as Vice Chairman of the Board of Directors.

Regarding Binh Minh Plastics' business prospects, Vietcombank Securities (VCBS) believes that the recovery of supply from real estate projects will be the main driving force for BMP's revenue and profit. In addition, BMP is increasing its market share in the Northern and Central markets with attractive promotional policies.

However, according to KB Securities Vietnam (KBSV), Binh Minh Plastics may still face many challenges in 2023 and gradually recover from 2024. Experts believe that the business performance of construction plastic enterprises will be less optimistic because the demand for water pipes depends on the developments of the real estate and construction market along with economic growth prospects.

Source

![[Infographic] Notable numbers after 3 months of "reorganizing the country"](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/4/ce8bb72c722348e09e942d04f0dd9729)

![[Photo] General Secretary To Lam attends the 8th Congress of the Central Public Security Party Committee](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/4/79fadf490f674dc483794f2d955f6045)

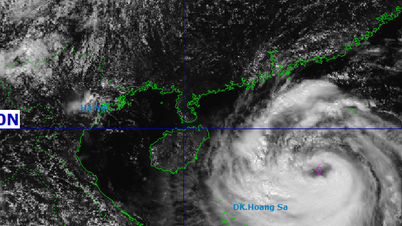

![[Photo] Prime Minister Pham Minh Chinh chairs meeting to deploy overcoming consequences of storm No. 10](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/3/544f420dcc844463898fcbef46247d16)

![[Photo] Students of Binh Minh Primary School enjoy the full moon festival, receiving the joys of childhood](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/3/8cf8abef22fe4471be400a818912cb85)

Comment (0)