Saigonbank unexpectedly increased interest rates

According to Lao Dong, on March 18, Saigon Bank for Industry and Trade (Saigonbank) posted a new interest rate schedule.

Compared to the only adjustment since the beginning of the year, this adjustment by Sacombank recorded a decrease in short-term interest rates. However, in long-term interest rates, the listed interest rates increased significantly.

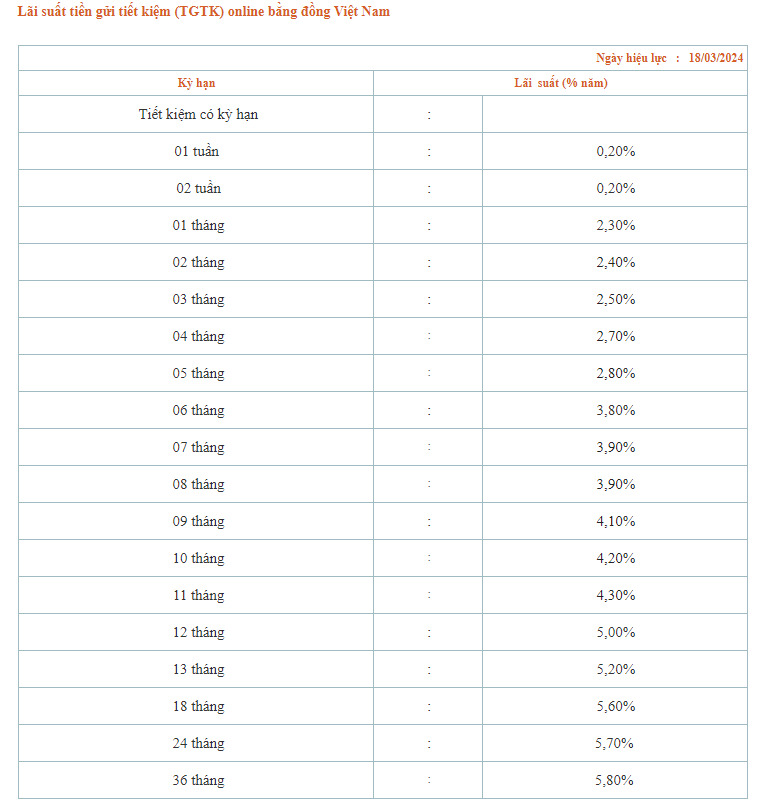

Accordingly, the online savings interest rate has been adjusted by Saigonbank as follows:

1-month term interest rate reduced from 2.5%/year to 2.3%/year.

3-month term interest rate reduced from 2.7%/year to 2.5%/year.

6-month term interest rate reduced from 3.9%/year to 3.8%/year.

The 9-month term interest rate remains at 4.1%/year.

The 12-month term interest rate remains at 5.0%/year.

18-month term interest rate increased by 0.2 percentage points, from 5.4%/year to 5.6%/year.

36-month term interest rate increased by 0.4 percentage points, from 5.4%/year to 5.8%/year.

Since the beginning of 2024, Saigonbank has been among the banks that have adjusted interest rates the least. As of March 2024, in the trend of lowering interest rates among banks, Saigonbank is the only bank that has decided to increase interest rates.

Banks still tend to reduce interest rates

Since the beginning of the year, the market has recorded 15 banks adjusting deposit interest rates, including: BVBank, PGBank,ACB , BaoVietBank, VPBank, GPBank, PVcombank and Dong A Bank, MB, Techcombank, NCB, KienlongBank, SCB, Saigonbank. The general trend at banks is still to lower interest rates, mostly in the main terms of 6, 9, 12 months...

Notably, BaoVietBank, BVBank, PGBank and ACB have reduced their interest rates twice since the beginning of the month. Among the Big 4 giants, Agribank also adjusted new interest rates in March.

Source

![[Photo] Keep your warehouse safe in all situations](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/1/3eb4eceafe68497989865e7faa4e4d0e)

![[Photo] President of the Cuban National Assembly visits President Ho Chi Minh's Mausoleum](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/1/39f1142310fc4dae9e3de4fcc9ac2ed0)

![[Photo] Hanoi morning of October 1: Prolonged flooding, people wade to work](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/1/189be28938e3493fa26b2938efa2059e)

Comment (0)