In the last trading session of September, the stock market fell 4.78 points to 1,661.7 points. Liquidity on the HoSE floor continued to move sideways, at VND32,227 billion, much lower than the average of VND40,000-50,000 billion of the previous breakout period.

The group of stocks related to billionaire Pham Nhat Vuong still maintained its position as a pillar supporting the general index. VIC ( Vingroup ) shares maintained their upward momentum for 4 consecutive sessions, reaching 174,900 VND/unit and conquering a new price peak.

VRE (Vincom Retail) code suddenly increased to the ceiling price of 32,100 VND/share and had a ceiling price buy surplus of more than 2.5 million units. VHM (Vinhomes) shares also increased by more than 1% to 103,000 VND/share.

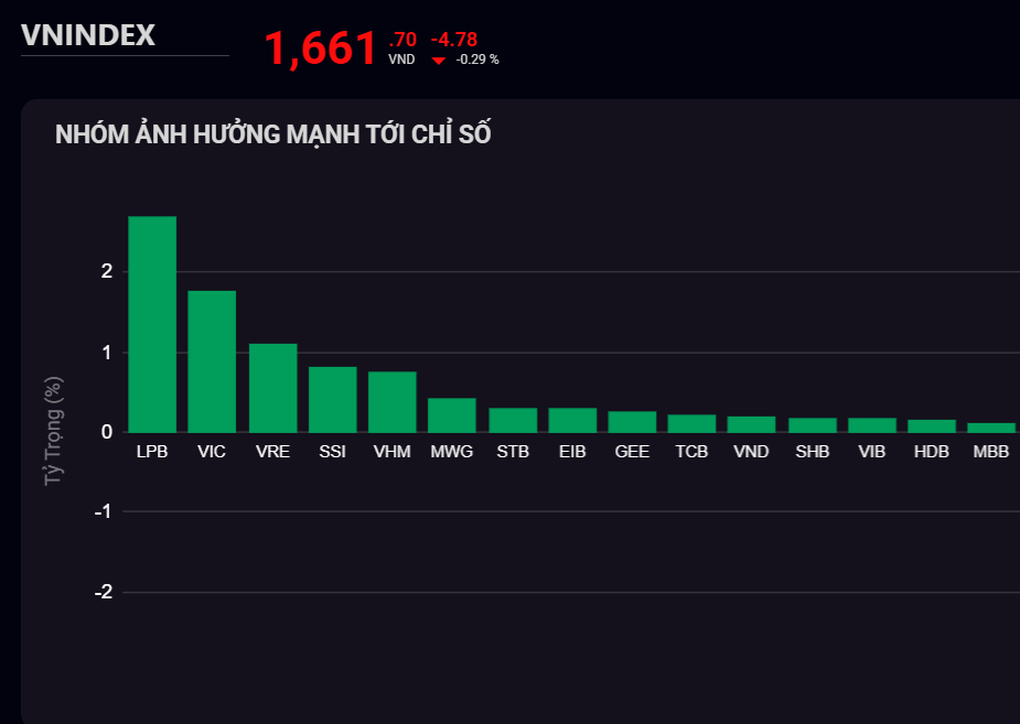

Vingroup stocks strongly affect the index (Screenshot).

Thus, the trio VIC, VRE and VHM are in the group with the strongest influence on the index. Billionaire Pham Nhat Vuong's assets reached 16.9 billion USD, an increase of 1 billion USD compared to yesterday and rose to 142nd place in the world's richest ranking, according to an update from Forbes.

On the other hand, two stocks,FPT and HPG, related to tycoon Truong Gia Binh and billionaire Tran Dinh Long, respectively, put pressure on the general index. FPT stock of FPT Corporation fell 2.6% to VND93,000/share. HPG of Hoa Phat Group fell 1.57% to VND28,150/share.

In addition, the real estate industry group also negatively affected the general index, such as DXG (Dat Xanh), KBC (Kinh Bac), CII (HCMC Technical Infrastructure), DIG (DIC Corp), NLG (Nam Long), NVL (Novaland).

In this trading session, foreign investors net sold nearly 1,300 billion VND. Codes that were strongly net sold were KDH, HPG, FPT, SSI, VHM... On the contrary, CII, SHB, TCB, LPB were bought a lot.

Source: https://dantri.com.vn/kinh-doanh/co-phieu-ho-vingroup-keo-vn-index-ong-pham-nhat-vuong-co-them-1-ty-usd-20250930155216637.htm

![[Photo] Binh Trieu 1 Bridge has been completed, raised by 1.1m, and will open to traffic at the end of November.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/2/a6549e2a3b5848a1ba76a1ded6141fae)

![G-DRAGON 2025 WORLD TOUR [Übermensch]](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/10/3/0dec353013874c2ead28385a8c4ccf55)

Comment (0)