Malware attacks Android operating system

Banks have just warned customers about the Anatsa malware. This is a type of malware that specializes in stealing financial information on devices using the Android operating system, and is spreading rapidly around the world.

Anatsa malware often disguises itself as utility applications such as PDF Reader, Document Reader... and appears on official app stores to lure users into installing. After users install, the application will automatically download an "update" containing malicious code to carry out the attack.

The attack mechanism of Anatsa malware is to disguise itself as legitimate applications and put them on Google Play to trick users into installing them.

Once installed, the app will ask for sensitive permissions like Accessibility or SMS to track and take control of the device.

When users access the banking application, the malware will insert a fake screen with a similar interface to steal passwords and OTP codes.

Some signs that your device may be infected with Anatsa malware include: Apps requesting special permissions such as Accessibility or SMS access; automatically opening banking apps and asking to log in again; or strange windows (overlay/pop-ups) appearing when accessing banking apps.

Additionally, the device may perform slowly, battery drain quickly, mobile data usage may spike; users may receive unusual OTP codes or not receive authentication codes.

The bank recommends that if you detect any unusual signs, handle them immediately by: Uninstalling the application; turning off sensitive permissions; changing your password and immediately reporting to the bank if you detect unusual transactions or suspect your account has been hacked.

To prevent malware attacks, banks recommend that users only install applications from reputable developers; carefully check the requested permissions and refuse if the application requests unnecessary permissions. At the same time, it is recommended to activate two-factor authentication (2FA) combined with biometric authentication for bank accounts.

Customers need to ensure that the operating system and applications on the device are always updated to the latest version.

Fraud scenarios are constantly evolving.

Not only attacking user accounts through fake applications, cybercriminals also constantly update new scenarios to scam.

According to data from the Ministry of Public Security , in the first 8 months of 2025, nearly 1,500 cases of online fraud were detected, causing losses of more than 1,660 billion VND. Although the number of cases of fraud and appropriation of property on the Internet in the third quarter of 2025 decreased, it accounted for a high proportion of the crime structure, and the number of victims in each case increased.

In the recent seminar “Protecting Personal Finance - Mastering Money”, Colonel Dr. Nguyen Hong Quan, Director of the Training Center, Department of Cyber Security and High-Tech Crime Prevention (A05), Ministry of Public Security shared: Fraudulent tricks on the internet are diverse and evolving every day. However, these tricks all target the two most basic human instincts: fear and greed.

Illustrating a typical scam scenario from a greed perspective, Colonel, Dr. Nguyen Hong Quan said that taking advantage of students' need for extra work or mothers' need for online jobs, scammers lure their "prey" into performing simple "tasks" such as liking a website to receive money into a virtual account. This virtual money increases rapidly, creating a feeling of easy money making and drawing the victim deeper in. When a "problem" occurs, the victim is asked to deposit real money to "reactivate" the account, leading to losses that can amount to billions of dong.

Another scam is to exploit emotions and greed, with sophisticated tricks. The subject pretends to be a foreign soldier, approaches women on social networks, shows kindness, shares feelings and then proposes love. After gaining trust, the scammer makes an excuse of encountering "barriers" in administrative procedures and asks the victim to transfer money to "resolve" it, or send gifts in advance, promising large profits. This type of incident has been reflected many times in the media.

Talking about the scam scenarios that play on fear, Colonel, Dr. Nguyen Hong Quan said that the subjects often impersonate police officers, prosecutors, courts... to provide fake information that makes the "prey" panic because they think they are involved in cases such as drugs, money laundering or serious traffic accidents.

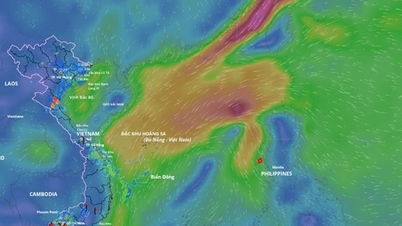

According to Mr. Quan, it is impossible to grasp all the tricks because they are created by organized crime groups and are constantly changing. The current situation of online fraud mostly comes from criminal networks and groups operating abroad such as Cambodia, Myanmar, the Philippines, the Middle East...

He warned that once the money was transferred to the scammers' accounts, it would be withdrawn almost immediately, making it very difficult to trace and recover. Even the information supporting the recovery of money was a scam scenario.

Therefore, each person must inject himself with “vaccines” to increase his understanding, thereby controlling his fear and greed. He must be vigilant against all natural resources “falling from the sky”.

“Any investment opportunity with super high and easy profits needs to be carefully considered. Always apply the principle of checking before taking any action in cyberspace, especially financial transactions. We need to accept it calmly and have rules for acceptance. In particular, do not put yourself in isolation because we have functional agencies, collectives... to handle arising situations,” Colonel Nguyen Hong Quan emphasized.

Source: https://vietnamnet.vn/canh-bao-ma-doc-danh-cap-tai-khoan-ngan-hang-tien-co-the-boc-hoi-sau-vai-giay-2453998.html

Comment (0)