Fecon (FCN) stock 'evaporated' 26% of its value in just two weeks of trading

In just two trading weeks from September 18, 2023 to September 28, 2023, stock code FCN of Fecon JSC has had consecutive sessions of deep decline.

Specifically, in the 9 trading sessions from September 18 to September 28, there were only 2 price increases on September 20 and September 27. The remaining 7 sessions had price decreases, of which 4 sessions hit the floor.

Fecon (FCN) stock price has been continuously decreasing over the past 2 weeks.

The floor price drop continued in the trading sessions of September 19, September 22, September 25 and September 26 amid market panic. The closing price of FCN code fell from the peak of VND19,400/share on September 18 to only VND14,350/share, losing 26% in just 2 trading weeks.

The downward trend has shown no signs of stopping, especially as Fecon's business operations have recently revealed a number of problems.

After half a year of operation, Fecon only completed 1% of its target.

In early 2023, Fecon set a business target of VND 3,800 billion in revenue, an increase of 24% compared to the previous year. The target profit after tax is VND 125 billion, an increase of 142.2%. However, the operating results of the first 6 months of the year show that the above target is still out of reach for Fecon.

In the first quarter of 2023, the company's revenue reached 609.1 billion VND, and its after-tax profit was only 2.8 billion VND. Entering the second quarter of 2023, the situation did not improve at all but even went backwards.

In the first half of the year, Fecon (FCN) only completed more than 1% of the annual profit plan (Photo TL)

Fecon's revenue in the second quarter of 2023 reached VND674 billion, down 35.1% year-on-year. Cost of goods sold accounted for VND549 billion, making after-tax profit only VND124.9 billion, equivalent to a gross profit margin of 18.5%.

Financial revenue in the second quarter decreased by half, to only 5.2 billion VND while interest expenses increased by 33.7%, to 70.6 billion VND. Sales expenses and administrative expenses reached 5 billion and 49.5 billion VND respectively. After deducting all expenses, Fecon had a loss after tax of 1.4 billion VND in the second quarter.

Fecon's accumulated revenue in the first 6 months of the year reached 1,282.7 billion VND, equivalent to 33% of the revenue plan. Profit after tax reached 1.3 billion VND, completing only 1% of the profit plan.

Negative net cash flow from business, increased debt by 324 billion, where does Fecon get capital to do 4 new projects that won bids?

Recently, Fecon announced the winning bid for 4 new projects with a total value of up to 500 billion VND. The bid packages include:

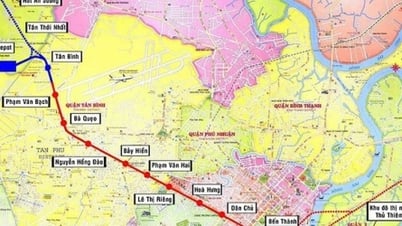

The package "supply, mass pile construction and pile testing" at Nhon Trach 3&4 power plant project with a total value of 179 billion VND; The package "construction of the southern diaphragm wall of station 11" worth more than 62 billion VND under the pilot urban railway project (metro line 3) of Hanoi City; The contract worth 75 billion VND at Vung Ang II thermal power plant project (Ha Tinh); The package "construction of the section Km91+800 - Km114+200" worth 147 billion VND.

Winning four consecutive bids took place in the context of Fecon's declining business results, and its asset structure also revealed some issues that need attention.

At the end of the second quarter, Fecon's total assets reached VND 7,686.2 billion. Of which, the company is holding a large amount of assets in the form of receivables, accounting for VND 3,017.4 billion, equivalent to 39.2% of total assets.

Accounts receivable from customers also accounted for 1,741 billion VND. Inventory also increased from 1,669.3 billion to 1,739.3 billion VND.

Fecon's capital structure also shows that the majority of capital used is debt, accounting for 4,278.3 billion VND, equivalent to 55.7%. Notably, short-term debt is showing a strong increase of 324.3 billion VND, reaching 2,091 billion.

Owner's equity at the end of the second quarter reached VND3,407.9 billion. Of which, VND1,574.4 billion was contributed capital by owners. Undistributed profit after tax accounted for only VND91 billion, development investment fund accounted for VND343.6 billion.

At the end of the second quarter, Fecon's net cash flow from operating activities also recorded a negative 101.9 billion. Of which, the largest amount of cash spent was interest, amounting to 137.1 billion VND. This shows the pressure from debts and interest on Fecon's cash flow and business results.

Source

![[Photo] Prime Minister Pham Minh Chinh launched a peak emulation campaign to achieve achievements in celebration of the 14th National Party Congress](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/5/8869ec5cdbc740f58fbf2ae73f065076)

![[Photo] Prime Minister Pham Minh Chinh chairs the Government's online conference with localities](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/5/264793cfb4404c63a701d235ff43e1bd)

Comment (0)