TCBS will offer a maximum of 231.15 million shares in its initial public offering (IPO), equivalent to 11.1% of its current charter capital. The Board of Directors said that assuming a successful offering price of VND46,800/share, TCBS will collect nearly VND10,818 billion.

TCBS's book value according to the financial report for the second quarter of 2025 is about VND 14,308/share, meaning the current offering price is 3.27 times higher than the book value per share.

According to the resolution just passed by the Board of Directors (BOD) of TCBS, the company will offer a maximum of 231.15 million shares, equivalent to 11.1% of the current charter capital. With the expected price of 46,800 VND/share, the total value of this mobilization could reach nearly 11,000 billion VND, helping to increase the company's equity capital by about 35%.

Based on this price and the number of shares outstanding, TCBS's pre-offering valuation is around $3.7 billion. After completing the IPO, expected in early Q4 2025, the company's capitalization could reach around $4.1 billion.

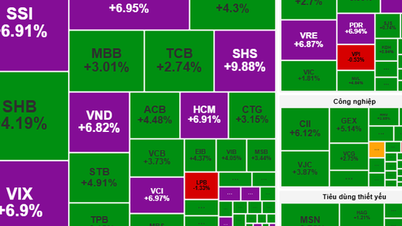

When considering the expected profit in 2025, the price of VND 46,800/share corresponds to a P/E ratio (price to earnings) of about 20 times. According to data from Fiinpro, the P/E of securities companies in the market is fluctuating between 20-25 times. Thus, the expected valuation of TCBS is at the low end of the industry's general valuation spectrum.

According to the company, TCBS's value is built on factors such as its industry-leading position in terms of profits and equity, its business model focused on Wealth Management and its WealthTech operating platform. The company currently holds the leading market share in many core businesses such as bond brokerage.

This IPO is part of TCBS's 5-year strategic plan for 2020-2025, with a target capitalization of 5 billion USD. A representative of TCBS shared at an investment conference in July 2025 that whether this target is achieved or not will depend on investor interest when the company is officially listed.

Source: https://baovanhoa.vn/kinh-te/chung-khoan-ky-thuong-tcbs-chot-gia-ipo-du-kien-46800-dongco-phieu-159256.html

![[Photo] Prime Minister Pham Minh Chinh chaired a meeting of the Steering Committee on the arrangement of public service units under ministries, branches and localities.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/06/1759767137532_dsc-8743-jpg.webp)

![[Photo] Prime Minister Pham Minh Chinh chairs a meeting of the Government Standing Committee to remove obstacles for projects.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/06/1759768638313_dsc-9023-jpg.webp)

Comment (0)