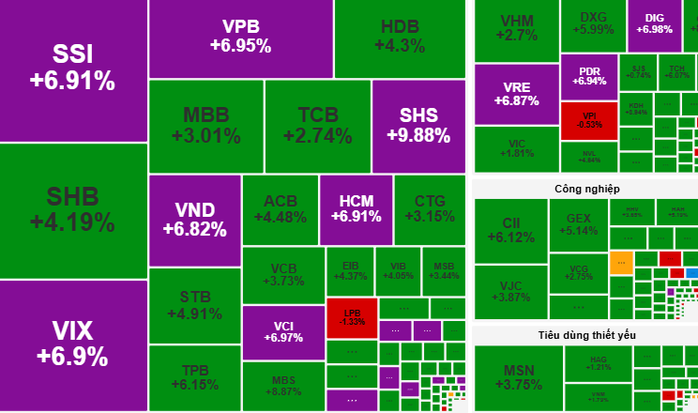

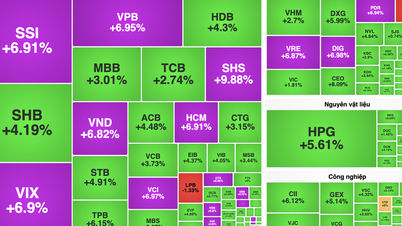

VN-Index on October 6 increased strongly under the leadership of large-cap stocks VCB, VPB, HPG, VIC...

Vietnamese stocks on October 6 recorded a spectacular breakthrough of VN-Index when the index opened up nearly 30 points, reaching 1,690 points, thanks to the pull from large-cap stocks. The momentum of the increase spread from key industries such as banking, retail and steel, helping green stocks dominate.

In particular, midcap stocks (stocks of companies with capitalization from 1,000 to 10,000 billion VND in the securities and real estate sectors) showed an impressive recovery, attracting the attention of cash flow.

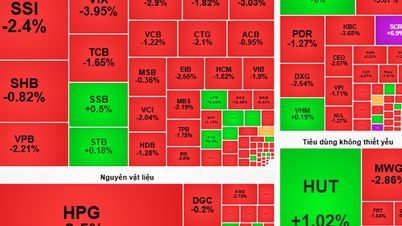

In the afternoon session, VN-Index maintained a steady increase, fluctuating within a narrow range around 1,680 before breaking out above 1,690 and closing at the session's highest level, reaching 1,695 points, up 49.6 points (equivalent to 3.02%). Market liquidity improved significantly, reflecting the excitement of disbursed cash flow. However, foreign investors continued to sell strongly with a total value of 1,856 billion VND, focusing on codes such as MWG, MBB, andFPT , creating opposite pressure on domestic investors.

VCBS Securities Company believes that the increase on October 6 is a positive signal, led by large-cap stocks such as VCB, VPB, HPG, and VIC, combined with improved liquidity. "Investors can hold stocks that are showing a good upward trend, while looking for opportunities to disburse stocks in the banking, securities, and real estate groups, which are attracting cash flow for the purpose of surfing" - VCBS Securities Company recommends.

According to Dragon Capital Securities (VDSC), the market is supported by positive information from GDP in the third quarter of 2025. Liquidity increased compared to the previous session, showing that cash flow is reacting positively. The momentum of the increase may push the VN-Index to a strong resistance zone of 1,710 points (the old peak zone). However, supply and demand pressure in this zone will increase, possibly leading to strong disputes.

Therefore, VDSC recommends that investors take advantage of the uptrend to close short-term positions, avoid chasing high prices, and consider investing in stocks with good accumulated price bases.

Source: https://nld.com.vn/chung-khoan-ngay-7-10-vn-index-but-pha-manh-me-nha-dau-tu-can-lam-gi-19625100619134868.htm

Comment (0)