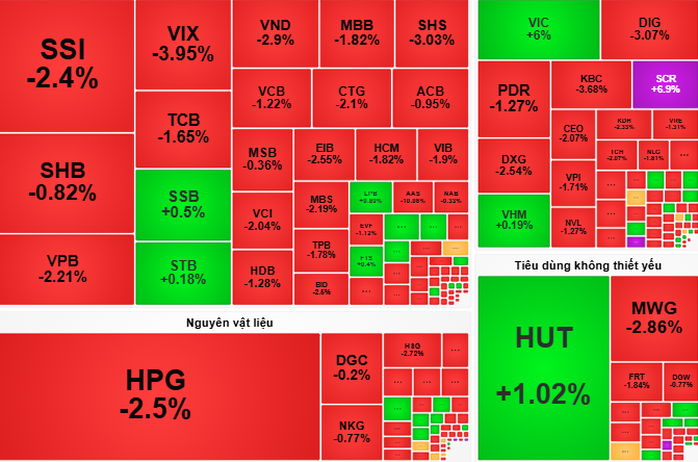

At the end of the session, VN-Index closed at 1,670 points, down 9.93 points (equivalent to 0.59%).

The VN-Index opened the morning session on September 17 with a slight downward trend, fluctuating within a narrow range around the reference level, reflecting the cautious sentiment of investors. Liquidity decreased significantly, showing widespread hesitation, along with a clear differentiation between stock groups.

In the afternoon session, VN-Index continued to struggle in the first half of the session, but selling pressure increased in the second half of the session, causing the index to weaken, at times falling to nearly 1,660 points. Red dominated with 201 stocks falling compared to 119 stocks rising. However, large-cap stocks such as VIC (increasing to near the ceiling), VNM, andFPT were still bright spots, helping to limit the index's decline.

At the end of the session, VN-Index closed at 1,670 points, down nearly 10 points (equivalent to 0.59%).

Rong Viet Securities Company (VDSC) believes that the supply of stocks has not yet caused much pressure. It is expected that the market will still be under downward pressure in the trading session on September 18.

According to VCBS Securities Company, the market is in a tug-of-war phase, testing supply and demand to reach a state of equilibrium before determining a clear trend. This reinforces the view that VN-Index needs more time to stabilize before returning to the uptrend.

"Investors can continue to hold stocks that have a strong upward trend or are in a period of alternating price increases and decreases, and patiently wait for the market to reach equilibrium, especially after receiving more information from the US Federal Reserve's interest rate meeting to determine the optimal disbursement time" - VCBS Securities Company recommends.

Source: https://nld.com.vn/chung-khoan-ngay-mai-18-9-cho-thi-truong-can-bang-de-giai-ngan-196250917164945696.htm

![[Photo] Discover unique experiences at the first World Cultural Festival](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/11/1760198064937_le-hoi-van-hoa-4199-3623-jpg.webp)

![[Photo] General Secretary attends the parade to celebrate the 80th anniversary of the founding of the Korean Workers' Party](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/11/1760150039564_vna-potal-tong-bi-thu-du-le-duyet-binh-ky-niem-80-nam-thanh-lap-dang-lao-dong-trieu-tien-8331994-jpg.webp)

![[Photo] Opening of the World Cultural Festival in Hanoi](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/10/1760113426728_ndo_br_lehoi-khaimac-jpg.webp)

![[Photo] Ho Chi Minh City is brilliant with flags and flowers on the eve of the 1st Party Congress, term 2025-2030](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/10/1760102923219_ndo_br_thiet-ke-chua-co-ten-43-png.webp)

Comment (0)