Gold price today September 28, 2024: World gold prices have left the peak and temporarily "cooled down" in a long price increase cycle and reached unprecedented highs. The domestic market has recorded an unprecedented chase of SJC gold bars and gold rings. A new trend is emerging - despite the price of gold continuously reaching peaks, the demand for investment in precious metals is still increasing.

| 1. SJC - Updated: 09/27/2024 08:23 - Website supply time - ▼ / ▲ Compared to yesterday. | ||

| Type | Buy | Sell out |

| SJC 1L, 10L, 1KG | 81,500 | 83,500 |

| SJC 5c | 81,500 | 83,520 |

| SJC 2c, 1C, 5 phan | 81,500 | 83,530 |

| SJC 99.99 gold ring 1 chi, 2 chi, 5 chi | 81,500 ▲200K | 83,000 ▲300K |

| SJC 99.99 gold ring 0.3 chi, 0.5 chi | 81,500 ▲200K | 83,100 ▲300K |

| 99.99% Jewelry | 81,450 ▲250K | 82,700 ▲300K |

| 99% Jewelry | 79,881 ▲297K | 81,881 ▲297K |

| Jewelry 68% | 53,892 ▲204K | 56,392 ▲204K |

| Jewelry 41.7% | 32,139 ▲125K | 34,639 ▲125K |

Update gold price today September 28, 2024

World gold prices ' left the peak' but still headed for a weekly increase, due to growing expectations of another major US economic rate cut this year.

The US Federal Reserve’s rate cut has sparked a strong rally in gold, sending the precious metal to a record high and up about 1.8% so far this week. Gold is now up 29% against the US dollar so far this week, hitting record highs against all major currencies, including the euro, Canadian dollar, Australian dollar and Chinese yuan.

According to the World and Vietnam Newspaper at 6:20 p.m. on September 27 ( Hanoi time), world gold trading was at 2,667.20 - 2,668.20 USD/ounce, down slightly by 6.3 USD compared to the close of the previous trading session.

Gold prices are still in an uptrend but have fallen from the highs of recent trading sessions. However, the world gold price on the Comex December futures contract has managed to reach another record high of 2,708.70 USD/ounce. The technical chart also maintains a strong uptrend for both gold and silver, in which the most recent December gold futures price has reached 2,688.90 USD/ounce.

While the market is being impacted by the emergence of economic stimulus measures from China and safe-haven demand is supporting the demand for precious metals.

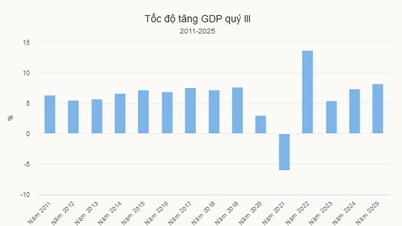

China's economic regulators have pledged to stabilize the property sector and add more fiscal stimulus, after the People's Bank of China announced its biggest monetary stimulus package since the Covid-19 pandemic earlier this week. Beijing has pledged to issue and use government bonds to support investment. The news, which has a strong impact on the world economy, comes amid speculation that the world's second-largest economy will struggle to meet its 5% GDP growth target this year.

Meanwhile, the military conflict between Israel and Hezbollah continues to escalate, with Israel now ordering its military to prepare for a possible ground invasion of Lebanon following recent heavy airstrikes. The situation is sending investors to safe havens like gold and silver and is likely to get worse before it gets better.

Gold is getting support from the Fed’s expected rate move and China’s stimulus measures, both of which weaken the dollar, said Kyle Rodda, a financial market analyst at Capital.com . The dollar fell for a fourth straight week, making commodities priced in the greenback cheaper for holders of other currencies.

Major markets saw the USD index fall today. The 10-year US Treasury yield is falling and is currently at 3.779%. Nymex crude oil prices fell sharply and traded around $68/barrel. Reports said that Saudi Arabia is considering pumping more oil, "the increase in OPEC+ production will lead to an oversupplied market" - that is the concern of analysts.

Domestic gold price is a chase between SJC gold bars and gold rings.

For the first time in the history of the domestic gold market, the price of gold rings closely follows the price of SJC gold bars and the increase shows no signs of stopping.

The price of SJC gold bars has gradually entered a period of stability thanks to the timely intervention of the State Bank. However, after recent strong fluctuations in the world, the current listed price of SJC gold bars at major trading centers such as Saigon Jewelry Company, DOJI Group, Phu Quy and Bao Tin Minh Chau is "same price" 81.5 - 83.5 million VND/tael (buy-sell).

The domestic price of SJC gold bars has not fluctuated much recently, there is no sudden "high wave" like gold rings. About 1 month ago, the price of SJC gold bars was 79 - 81 million VND/tael, if you bought gold at that time and sold it at this time, the investor would receive a profit of 500,000 VND/tael. However, investors in gold rings receive a profit many times higher than gold bars in just one month.

The price of plain round gold rings continues to have much more impressive "leaps" than SJC gold bars.

Following closely behind SJC gold bars, in the trading session on August 27, the price of 9999 Hung Thinh Vuong gold rings at DOJI Group was listed at around 82.5 - 83.35 million VND/tael (buy - sell); Saigon Jewelry Company adjusted the two-way gold ring price to increase to 81.5 - 83.1 million VND/tael; The gold ring price at PNJ was 82.5 - 83.3 million VND/tael; Bao Tin Minh Chau was 82.54 - 83.44 million VND/tael.

|

| Gold price today September 28, 2024: Gold price increased to a record high, there are abnormalities, 'dark clouds' are forming, what should investors do? (Source: Kitco News) |

Summary of SJC gold bar prices at major domestic trading brands at the closing time of the trading session on the afternoon of September 27:

Saigon Jewelry Company: SJC gold bars 81.5 - 83.5 million VND/tael; SJC gold rings 81.5 - 83.1 million VND/tael.

Doji Group: SJC gold bars 81.5 - 83.5 million VND/tael; 9999 round rings (Hung Thinh Vuong): 82.5 - 83.35 million VND/tael.

PNJ system: SJC gold bars 81.5 - 83.5 million VND/tael; 9999 gold rings 82.5 - 83.3 million VND/tael.

Phu Quy Gold and Silver Group: SJC gold bars: 81.5 - 83.5 million VND/tael; Phu Quy 999.9 round gold rings: 82.10 - 83.20 million VND/tael.

SJC gold price at Bao Tin Minh Chau is listed at: 81.5 - 83.5 million VND/tael. The price of round gold rings at Vang Rong Thang Long is listed at 82.54 - 83.44 million VND/tael.

Investment demand still increases, despite record high gold prices

One thing that has emerged quite differently from the normal is that investment demand is still strong, despite the record high gold price. Gold’s unstoppable rise into “uncharted territory” is attracting considerable attention as investment demand continues to rise very strongly.

The traditional market reaction is “high prices-take profits”, this time a new trend is emerging “high prices-buy more” - in fact, the demand for physical gold is also seeing strong activity. As observers say, the market has seen a surge in new demand over the past month.

Investors are turning to physical gold as a hedge against rising geopolitical and economic uncertainty, said Stuart O'Reilly, an analyst at The Royal Mint . He also highlighted an emerging trend for the precious metal - an unprecedented rally that is attracting a wave of new investors to the market.

In the current situation, Kitco Senior Analyst Jim Wyckoff said that gold bulls are still bullish for now, but he warned, "You know, I've said this many times: If you're a commodity investor/trader, keep a close eye on the crude oil market."

“Rising prices in any major commodity, including precious metals, will be difficult to sustain if crude oil reverses and begins to trend lower,” analyst Jim Wyckoff wrote in his weekly report this week. “In other words, weakening crude oil prices could be a leading indicator of when the gold and silver markets will peak.”

"In the market this weekend, crude oil prices are now starting to fall. This is absolutely not good news for precious metal speculators," Kitco 's veteran expert on the stock, financial and commodity markets reminded.

Source: https://baoquocte.vn/gia-vang-hom-nay-2892024-gia-vang-tang-ky-luc-co-diem-bat-thuong-may-den-dang-hinh-thanh-nha-dau-tu-nen-lam-gi-287859.html

![[Photo] Prime Minister Pham Minh Chinh chairs the Government's online conference with localities](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/5/264793cfb4404c63a701d235ff43e1bd)

![[Photo] Opening of the 13th Conference of the 13th Party Central Committee](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/6/d4b269e6c4b64696af775925cb608560)

![[Photo] Prime Minister Pham Minh Chinh launched a peak emulation campaign to achieve achievements in celebration of the 14th National Party Congress](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/5/8869ec5cdbc740f58fbf2ae73f065076)

Comment (0)