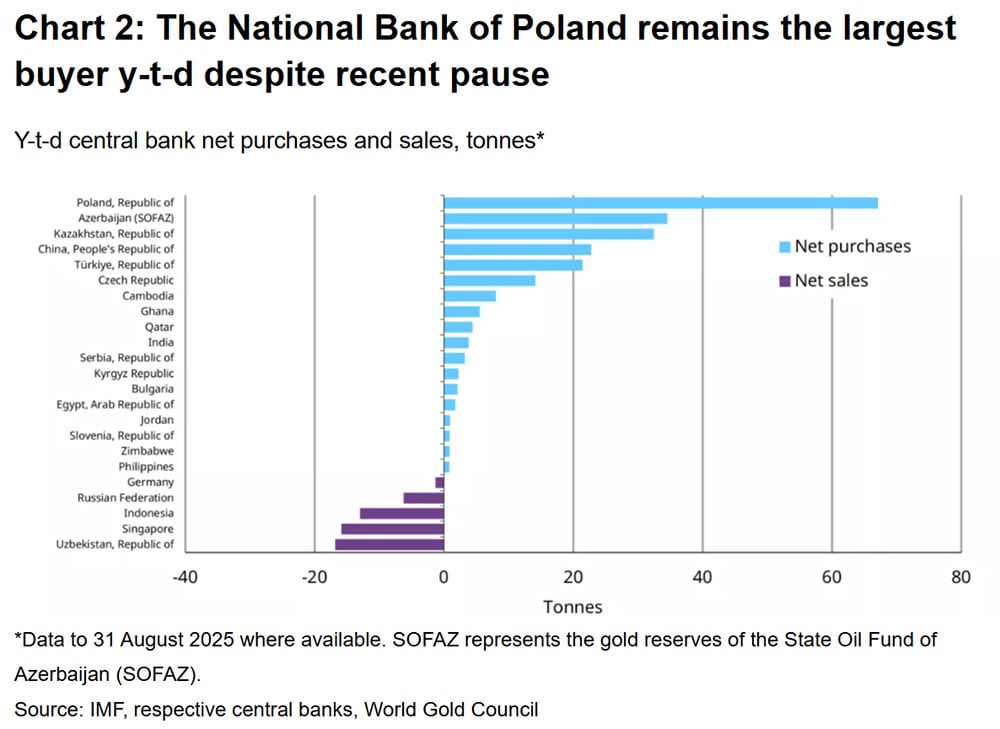

After a pause in July, central banks resumed strong gold purchases in August, according to Krishan Gopaul, senior analyst for EMEA at the World Gold Council (WGC).

Led by the National Bank of Kazakhstan, along with Bulgaria and El Salvador, it has joined the list of countries buying gold by 2025.

Central banks added a net 15 tonnes to global gold reserves in August, according to data released by the IMF and central banks. This was equivalent to the average monthly net purchases from March to June, indicating a return to gold buying after global reserves were unchanged in July.

Gopaul said seven central banks increased their gold reserves by at least 1 tonne in August, while only two reported a decrease.

The National Bank of Kazakhstan added 8 tonnes, marking the sixth consecutive month of purchases. Kazakhstan's total gold reserves now stand at 316 tonnes, 32 tonnes higher than at the end of 2024.

The National Bank of Bulgaria increased its gold reserves by 2 tonnes - the largest monthly increase since it bought 8 tonnes in June 1997 - bringing its total reserves to 43 tonnes. From January 2026, Bulgaria will become the 21st member state of the eurozone and may have to transfer some of its gold to the ECB as part of the accession procedure.

The Turkish Central Bank also added 2 tonnes to its official gold reserves. Since the beginning of the year, official reserves have increased by 21 tonnes to 639 tonnes.

The People's Bank of China reported buying another 2 tonnes, marking the 10th consecutive month of gold reserves increase. Total gold holdings have surpassed 2,300 tonnes, but still account for only 7% of total foreign exchange reserves.

The Central Bank of Uzbekistan also bought another 2 tonnes during the month. Total gold reserves now stand at 366 tonnes, 17 tonnes lower than at the end of 2024.

The Czech National Bank (CNB) continued its steady accumulation, purchasing another 2 tonnes. This extended the streak of monthly gold purchases to 30 consecutive months, bringing its total gold reserves to 65 tonnes. The CNB aims to reach 100 tonnes of gold in international reserves by the end of 2028.

The Bank of Ghana also bought an additional 2 tonnes, bringing the total amount of gold purchased since the beginning of the year to 5 tonnes and reserves to 36 tonnes.

On the other hand, the Central Bank of Russia (3 tonnes) and Bank of Indonesia (2 tonnes) were the only two entities that sold gold. The decrease in Russia's gold reserves may be related to the coin minting program.

Poland, the biggest buyer of gold last year, has also shown no intention of slowing down its purchases. The National Bank of Poland (NBP) confirmed it would raise its target for the share of gold in its foreign reserves from 20% to 30%. The NBP met its previous target earlier this year thanks to both strong purchases and rising gold prices.

Even with the recent pause, the NBP remains the biggest central bank buyer of gold this year, with 67 tonnes added to reserves by 2025, bringing its total holdings to 515 tonnes as of the end of August.

The Central Reserve Bank of El Salvador also reported adding 13,999 ounces (less than 0.5 tons) of gold to its reserves in September. The gold purchase is a long-term strategy based on a careful balance of international reserve assets. The bank currently has nearly 2 tons of gold in its reserves.

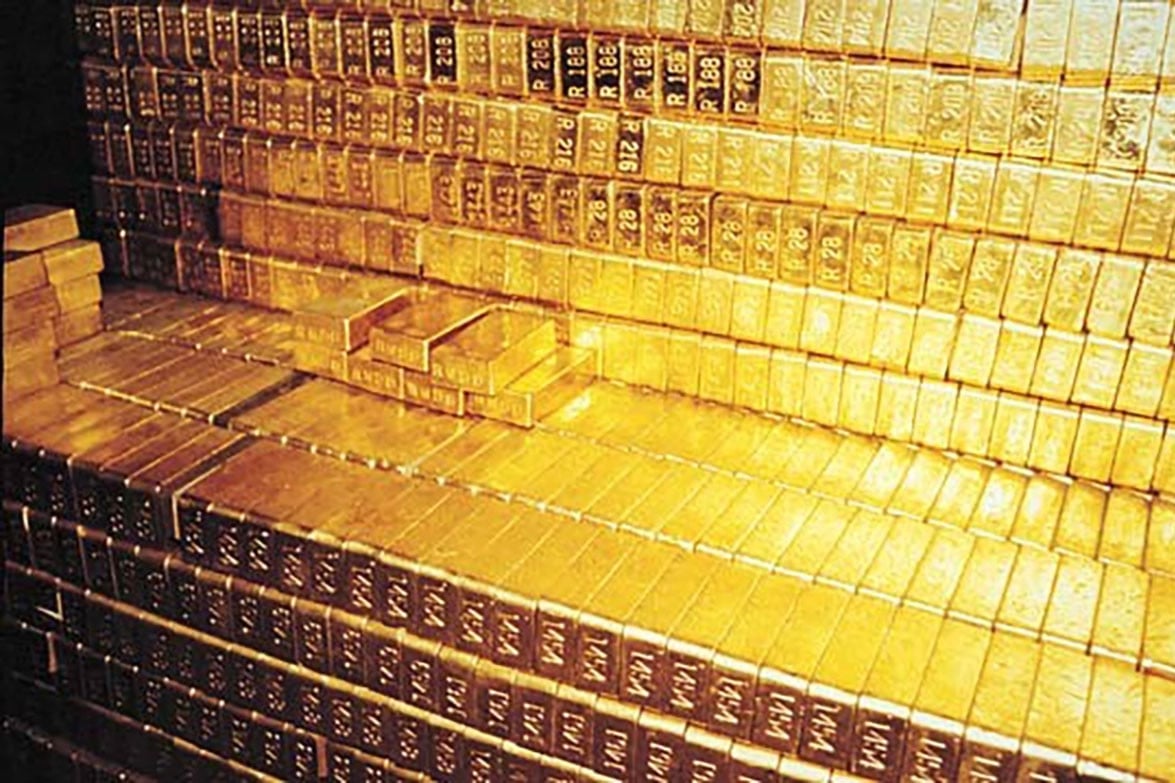

The WGC’s 2025 survey found that 95% of central banks believe global gold reserves will increase over the next 12 months. Notably, a new record 43% said their gold reserves will increase over this period. No bank predicted a reduction in gold holdings.

Factors driving the trend are said to be gold’s stable performance during times of crisis, its ability to diversify portfolios and its role as an inflation hedge. In addition, gold continues to be seen as a strategic asset due to its ability to store value and its efficiency in allocating reserves.

The proportion of central banks actively managing gold reserves increased from 37% in 2024 to 44% in 2025.

In terms of storage location, the Bank of England remains the most preferred location, with 64% of banks surveyed storing gold there.

Source: https://vietnamnet.vn/cuoc-dua-gom-vang-dai-gia-moi-lo-dien-2449149.html

![[Photo] Solemn opening of the 8th Congress of the Central Public Security Party Committee, term 2025-2030](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/4/f3b00fb779f44979809441a4dac5c7df)

![[Photo] General Secretary To Lam attends the 8th Congress of the Central Public Security Party Committee](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/4/79fadf490f674dc483794f2d955f6045)

![[Photo] Bustling Mid-Autumn Festival at the Museum of Ethnology](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/4/da8d5927734d4ca58e3eced14bc435a3)

![[VIDEO] Summary of Petrovietnam's 50th Anniversary Ceremony](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/10/4/abe133bdb8114793a16d4fe3e5bd0f12)

![[VIDEO] GENERAL SECRETARY TO LAM AWARDS PETROVIETNAM 8 GOLDEN WORDS: "PIONEER - EXCELLENT - SUSTAINABLE - GLOBAL"](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/7/23/c2fdb48863e846cfa9fb8e6ea9cf44e7)

Comment (0)