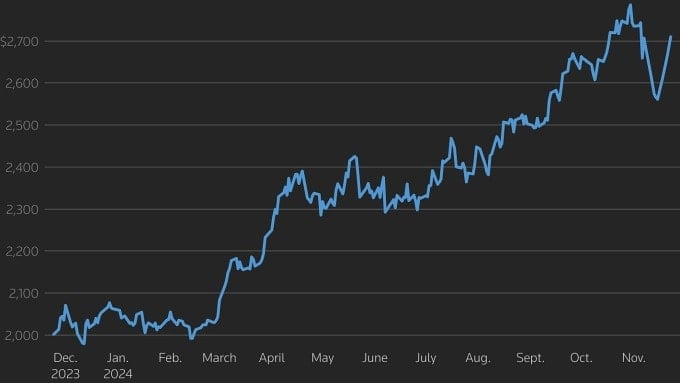

At the end of the trading session on November 22, the world spot gold price increased by 47 USD to 2,716 USD/ounce. This is the first time the price has exceeded 2,700 USD in the past 2 weeks, when the demand for shelter overshadowed the impact of the strong dollar and the possibility of the US lowering interest rates is increasingly unclear.

"Russia-Ukraine tensions seem to be spilling over into Russia-US tensions. This will certainly increase short-term demand for safe havens," said Alex Ebkarian, COO of Allegiance Gold.

Gold prices rose 5.7% this week, marking the strongest weekly gain since March 2023, when the US local banking crisis broke out. Prices have increased for five consecutive sessions, with a total of more than $170.

Gold is a popular tool in times of political and economic turmoil and low interest rates. Prices rose despite the Dollar Index hitting a two-year high yesterday and Bitcoin hitting a new record of $99,768 per coin.

The gold market also shrugged off the fact that the probability of the US Federal Reserve easing next month is decreasing. Investors now predict the possibility of the Fed cutting interest rates is only 53%, down sharply from 82% last week.

This week, some Fed officials expressed concern that the inflation slowdown was stalling and called for cautious action, while others stressed the need for further rate cuts.

Ebkarian predicts that by mid-next month, gold prices could rise to $2,750 an ounce due to policy fluctuations and inflation risks from US President-elect Donald Trump's import tax proposals.

Other precious metals were mixed on November 22. Silver rose 1.5% to $31.20, palladium fell 1.4% to $1,015, and platinum rose 0.6% to $964.

TB (synthesis)Source: https://baohaiduong.vn/gia-vang-the-gioi-vuot-2-700-usd-moi-ounce-398672.html

![[Photo] Prime Minister Pham Minh Chinh chairs the Government's online conference with localities](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/5/264793cfb4404c63a701d235ff43e1bd)

![[Photo] Prime Minister Pham Minh Chinh launched a peak emulation campaign to achieve achievements in celebration of the 14th National Party Congress](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/5/8869ec5cdbc740f58fbf2ae73f065076)

![[VIDEO] Summary of Petrovietnam's 50th Anniversary Ceremony](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/10/4/abe133bdb8114793a16d4fe3e5bd0f12)

![[VIDEO] GENERAL SECRETARY TO LAM AWARDS PETROVIETNAM 8 GOLDEN WORDS: "PIONEER - EXCELLENT - SUSTAINABLE - GLOBAL"](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/7/23/c2fdb48863e846cfa9fb8e6ea9cf44e7)

Comment (0)