ANTD.VN - The value of imported goods traded via e-commerce that are exempt from tax is proposed to be no more than 1 million VND, but each individual and organization is exempt from tax on goods worth no more than 48 million VND/year.

Tax-free only for orders under 1 million VND

The above proposal was made by the Ministry of Finance in the draft Decree regulating customs management of exported and imported goods traded via e-commerce, which is being put out for comments.

Previously, in mid-2023, the Ministry of Finance submitted to the Government a draft Decree stipulating the subjects exempted from import tax as: Imported goods with customs value per order from VND 2,000,000 or less; or imported goods with customs value per order over VND 2,000,000 but with a total amount of import tax payable of less than VND 200,000.

In which, each organization or individual purchasing goods is only entitled to tax exemption for imported goods not exceeding VND 96,000,000/year.

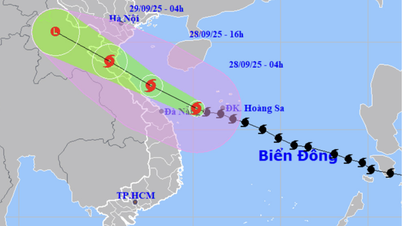

However, according to the Ministry of Finance, the current rapid growth of e-commerce in both scale and form can be exploited by organizations and individuals doing cross-border business to evade taxes, causing budget revenue loss. Businesses do not need to have a headquarters, conduct transactions electronically, and the server can be located abroad, making it difficult to identify taxpayers and the basis for tax calculation, and difficult to control cash flow because consumers can use both payment methods: cash and electronic money...

Therefore, the above draft is no longer suitable for the current situation. Therefore, to ensure a legal corridor for e-commerce and implement international commitments, it is necessary to issue a Decree regulating customs management of exported and imported goods traded via e-commerce with contents consistent with the current legal document system and current e-commerce practices.

|

Cross-border e-commerce is growing |

Accordingly, in this draft, the Ministry of Finance proposes 3 changes related to the above tax policy.

Specifically: Remove the regulation on tax exemption based on the minimum tax amount; Reduce the tax-free value from VND 2,000,000 to VND 1,000,000; Adjust the total tax-free limit from VND 96,000,000 to VND 48,000,000.

Therefore, the Ministry of Finance proposes the following regulation: Imported goods transacted via e-commerce with a customs value per order of VND 1,000,000 or less are exempt from import tax.

Each organization or individual purchasing goods is only entitled to tax exemption standards for imported goods specified in this clause not exceeding VND 48,000,000/year.

In addition to the above provisions on import tax exemption, tax policies for exported and imported goods transacted via e-commerce shall comply with the provisions of tax law.

Tax policy for imported goods transacted via e-commerce and sent via postal and express delivery services shall comply with the provisions of this Article, and shall not comply with the provisions of Clause 2, Article 29 of Decree No. 134/2016/ND-CP, amended and supplemented in Clause 11, Article 1 of Decree No. 18/2021/ND-CP.

Proposed cases of exemption from licenses and specialized inspections

In addition, the Ministry of Finance also proposed regulations on cases of exemption from licenses, conditions, and specialized inspections.

Accordingly, the Ministry proposed two options. First, goods in the List of exported and imported goods traded via e-commerce are exempt from licenses, conditions, and specialized inspections according to the decision of the Minister of the sector or field management ministry.

Second option: Imported goods traded via e-commerce with a customs value per order of 1,000,000 VND or less (except goods subject to quarantine, goods under the management list of the Ministry of Culture, Sports and Tourism, goods under the list of scrap allowed to be imported) are exempt from licenses, conditions, and specialized inspection, but the total value of exempted goods must not exceed 48,000,000 VND/year for each organization or individual.

The above-mentioned exemptions from licenses, conditions, and specialized inspections do not apply in cases where the ministries managing the sector or field have warnings about food safety, disease spread, harm to human health and life, environmental pollution, impact on social ethics, customs, and traditions, harm to the economy, national security, social order and safety, or have a written notice to stop applying the specialized inspection exemption regime.

It is strictly forbidden for individuals and organizations to collect goods according to the license-free standards, conditions, and specialized inspections of organizations and individuals purchasing goods via e-commerce.

Source: https://www.anninhthudo.vn/hang-nhap-khau-qua-thuong-mai-dien-tu-tren-1-trieu-dong-phai-chiu-thue-post607469.antd

![[Photo] Soldiers guard the fire and protect the forest](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/27/7cab6a2afcf543558a98f4d87e9aaf95)

Comment (0)