This is the activity of valuing assets in the fund portfolio to determine the value of fund certificates, helping investors know the real value of the investment and make reasonable buying and selling decisions. Along with that, financial institutions also close credit balances, in the context of foreign investors maintaining a long-term net selling trend, making the market more cautious.

Pressure weighs down the index

Saigon - Hanoi Securities Joint Stock Company (SHS) said that after a week of falling points due to selling pressure at the old peak of 1,700 points, VN-Index continued to adjust in the first sessions of the week to around 1,620 points before recovering. At the end of the week, the index increased slightly by 0.13% to 1,660.70 points, staying above the psychological support level of 1,600 points. Meanwhile, VN30 continued to decrease by 0.37% to 1,852.65 points, below the resistance of the old peak of around 1,880 points.

Market breadth is inclined towards correction and accumulation. Construction group has positive developments, insurance, oil and gas and industrial zones recover; on the contrary, technology - telecommunications, steel, retail, ports, real estate, securities and fertilizer - chemicals are under pressure to decrease.

Liquidity decreased for the second consecutive week, with trading volume on HOSE down 9.9% compared to the previous week, averaging 910 million shares/session, much lower than the 1.67 billion shares/session in August. This reflects a cautious sentiment as investment opportunities are limited.

Foreign investors continued to be net sellers for the 10th consecutive week. On HOSE, the net selling value reached VND7,355 billion. Since the beginning of the year, foreign investors have net sold VND96,522 billion, far exceeding the net selling level for the whole year of 2024.

According to SHS, VN-Index is accumulating less actively below the resistance zone of 1,665 points, corresponding to the average price zone of 20 sessions. After a strong price increase from April 2025 and surpassing the historical peak in 2022, many codes entered a short-term correction, accumulating to test the strength of the trend.

Many stocks, after peaking at the end of August 2025, have experienced a period of decline and are currently trying to recover to the old peak. However, selling pressure is likely to increase in this area. In the short term, VN-Index may retest the 1,680 point mark - the price level at the beginning of September 2025, but the fluctuation range is generally narrow and lacks breakthrough momentum.

SHS assessed that for the trend to improve significantly, the market needs new growth momentum from fundamental factors and expected business results in the third quarter of 2025. After about a month of adjustment, some codes have now reached reasonable prices, and can be accumulated with the expectation of profit growth in the third quarter and at the end of the year. However, this securities company recommends that investors do not chase buying when the VN-Index approaches the 1,680 - 1,700 point range.

Construction Securities Joint Stock Company (CSI) also said that VN-Index experienced many emotional levels during the week, reflecting the process of forming a balanced price base after an increase of more than 600 points since the beginning of April.

The trading week opened with a drop of more than 24 points, when the index fell below the 10-day moving average (MA10 - the average price of the last 10 sessions) and was at risk of losing the support level of 1,615 points. However, in the next two sessions, strong buying pressure entered the market in large-cap stocks after discounting to a reasonable price range, helping the market form a "morning star" candlestick pattern - a technical signal confirming a short-term bottom at 1,620 points.

The following sessions witnessed a clear differentiation. Cash flow left the banking and securities groups to find the mid-cap group, with the highlight being two consecutive ceiling-rise sessions of CII (public investment stocks) and the breakthrough of the real estate and construction groups. The liquidity of matched orders for the whole week only reached 995 million shares, down 9.43% compared to the previous week and down 21.4% compared to the 20-week average. The matched order value reached VND28,230 billion, down 16.26%.

Of the 21 industry groups, 14 decreased. Real estate (up 2.86%) thanks to VIC, construction (up 2.39%) and insurance (up 1.06%) were the three most positive industries. On the contrary, technology - telecommunications (down 3.69%), plastics (down 2.59%) and steel (down 2.36%) were the three industries with the sharpest declines.

At the end of the trading week, VN-Index only increased slightly by 0.13% compared to the previous week. According to CSI analysis, on the weekly chart, the index formed a Doji candlestick - a candle with a very small body - which often reflects the tug-of-war and hesitation between buyers and sellers, showing that investors are still cautious. Market liquidity continued to decrease for the second consecutive week, showing that the participating cash flow was not strong enough to create a clear bounce.

Cash flow observations show a tendency to focus more on the mid- and small-cap group, especially real estate, infrastructure construction and construction materials. CSI forecasts that next week, the VN-Index will likely continue to move sideways within a narrow range, unless liquidity improves significantly.

The Vietnamese stock market last week showed strong differentiation and cautious investor sentiment. The VN-Index remained above the important support level but lacked the momentum to break out, while liquidity continued to decline and foreign investors remained net sellers.

In the short term, investors are advised to maintain a reasonable proportion, prioritizing holding stocks with good fundamentals, leading in strategic sectors. A reasonable strategy is to observe corrections to accumulate gradually, instead of chasing buying in the context of the market approaching the resistance zone of 1,680 - 1,700 points.

The cautious developments in Vietnam are also in line with the global picture, as US stocks last week suffered strong fluctuations due to macroeconomic factors and monetary policy expectations.

S&P 500 and Nasdaq end three-week winning streak

In the last session of the week on September 26, the US market recovered thanks to the inflation report in line with the forecast. The Personal Consumption Expenditures (PCE) index in August - the preferred inflation measure of the US Federal Reserve (Fed) - increased 0.3% compared to the previous month and 2.7% compared to the same period last year, close to analysts' predictions. Along with that, personal income and consumer spending both exceeded expectations, showing that the health of the US economy is quite stable.

At the end of the session, the Dow Jones increased by 299.97 points (0.65%) to 46,247.29 points; the S&P 500 increased by 38.98 points (0.59%) to 6,643.70 points; and the Nasdaq Composite increased by 99.37 points (0.44%) to 22,484.07 points. However, for the whole week, all three indexes decreased: the Dow Jones lost 0.2%, the S&P 500 fell 0.3% and the Nasdaq decreased by 0.7%, ending the three-week winning streak of the S&P 500 and Nasdaq.

The market has been through volatile sessions. On September 25, US stocks fell for the second consecutive session as investors took profits after a long run of gains and were affected by a cautious statement from Fed Chairman Jerome Powell that stock prices “seem to be quite high”. Data released the same day showed that the US economy grew 3.8% in the second quarter, much higher than the previously announced 3.3% and the fastest pace in nearly two years, shaking expectations that the Fed will continue to lower interest rates.

At the beginning of the week, the market was excited when major indexes simultaneously hit new highs, led by the technology group. Nvidia rose 4% after the news that it would invest up to $ 100 billion in OpenAI, while Apple rose more than 4% thanks to improved demand for new iPhones. However, the rapid increase was restrained after the Fed's statement, sending the market into a correction phase.

According to analysts, Wall Street investors are restructuring their portfolios for the end of the third quarter, while waiting for the corporate profit reporting season to begin in mid-October. In addition, the September jobs report and the risk of a US government shutdown due to a budget impasse are also factors being closely monitored, as they could increase market volatility.

Source: https://baotintuc.vn/thi-truong-tien-te/khoi-ngoai-ban-rong-96522-ty-dong-tren-hose-vuot-xa-con-so-ca-nam-2024-20250928133709832.htm

![[Photo] Hanoi morning of October 1: Prolonged flooding, people wade to work](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/1/189be28938e3493fa26b2938efa2059e)

![[Photo] Panorama of the cable-stayed bridge, the final bottleneck of the Ben Luc-Long Thanh expressway](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/391fdf21025541d6b2f092e49a17243f)

![[Photo] The 1st Congress of Phu Tho Provincial Party Committee, term 2025-2030](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/1507da06216649bba8a1ce6251816820)

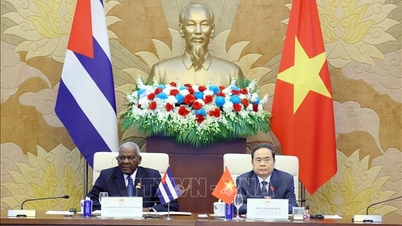

![[Photo] President Luong Cuong receives President of the Cuban National Assembly Esteban Lazo Hernandez](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/4d38932911c24f6ea1936252bd5427fa)

Comment (0)