Net profit of 28 billion in the third quarter, Nafoods completed 71% of the profit plan after 9 months

Focusing on risk management, product quality control, targeting the premium segment compared to the market, Nafoods Group's (HOSE: NAF) revenue in the first 9 months of the year decreased but gross profit margin improved strongly compared to the same period.

In the first 9 months of 2024, Nafoods Group completed 71% of the year's profit plan.

|

| Source: Investor Newsletter Q3/2024 – Nafoods Group |

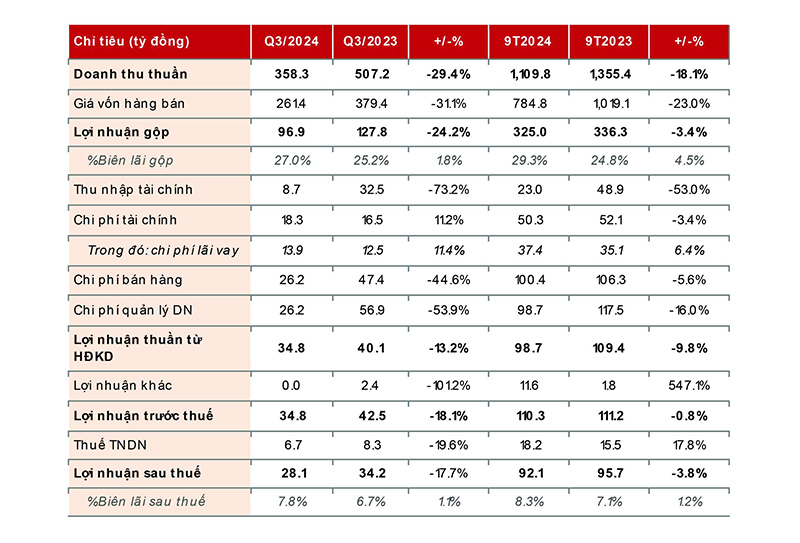

In the third quarter of 2024, NAF achieved net revenue of VND 358.3 billion, down 29.4% year-on-year. Gross profit reached VND 96.9 billion, down 24.2% year-on-year. Gross profit margin reached 27.0%, up 1.8 percentage points year-on-year, the 11th consecutive quarter with improved gross profit margin year-on-year. Profit after tax in the third quarter reached VND 28.1 billion, down 17.8% year-on-year. Profit after tax margin reached 7.8%, up 1.1 percentage points year-on-year.

Accumulated in the first 9 months of 2024, NAF's net revenue reached VND 1,109.8 billion, down 18.1% year-on-year. Gross profit reached VND 325 billion, down 3.4% year-on-year. Gross profit margin reached 29.3%, up 4.5 percentage points year-on-year. Profit after tax reached VND 92.1 billion, down 3.8% year-on-year. Profit after tax margin reached 8.3%, up 1.2 percentage points year-on-year.

With this result, after the first 9 months of the year, NAF achieved 50.5% of the announced revenue plan and 71.4% of the announced annual profit plan.

Gross profit margin improved thanks to strategy focusing on high-quality segment and risk management

The company said the reason for the decrease in revenue was due to a decrease in output of about 10% compared to the same period last year, mainly due to a poor crop of some key products such as lychee this year, passion fruit facing competition from South American countries due to increased sea freight costs... At the same time, the average selling price also decreased due to the decrease in raw material prices this year, especially passion fruit.

Meanwhile, gross profit margin has continuously improved due to the effectiveness of the company's restructuring process starting from mid-2022. The strategy of cooperating to develop raw material areas, investing in the Nafoods Tay Nguyen factory, merging Nghe An Food factory and Nafoods Tay Bac factory has helped the company complete the value chain, manage the entire supply chain, more closely control product quality and costs, and better take advantage of opportunities from the market and seasons. In addition, the company has also changed its strategy, not pursuing price competition but focusing on risk management, product quality, and premium segments compared to the market, helping to improve gross profit margins, reduce the risk of claims, complaints, and loss of reputation with customers.

The company also said that with this foundation, the strategy in the coming time will focus on developing and expanding new markets such as China, Australia... new fruits such as durian, coffee... and new product segments such as fresh fruit, B2C consumer products... to rebalance, minimize risks, maximize the capacity of the chain and grow more effectively. With the increasing demand for delicious, healthy tropical fruit products in the market, along with the impact of trade agreements and protocols on expanding access for Vietnamese fruits in some markets, it is expected that this strategy of NAF will be effective, helping sales return to growth in the coming time.

Capital restructuring

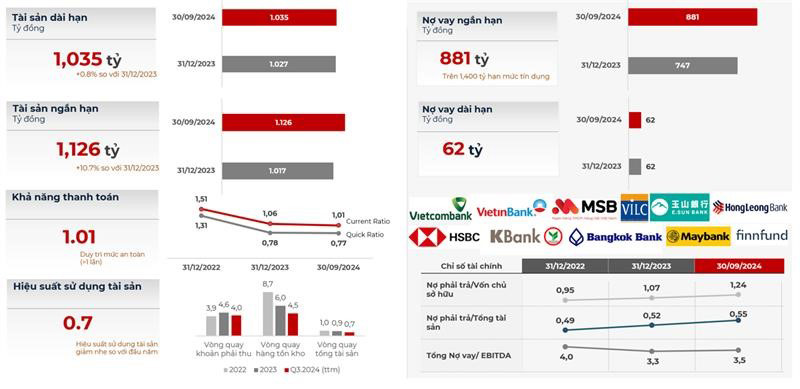

At the end of the third quarter of 2024, the total assets of the enterprise increased by 5.7% compared to the beginning of the year, reaching VND 2,161 billion, with VND 1,126 billion in short-term assets, up 10.7%; and VND 1,035 billion in long-term assets, up 0.8% compared to the beginning of the year. The amount of cash held at the end of the third quarter reached VND 242 billion, up 33% compared to the beginning of the year. The value of ending inventory reached VND 274 billion, equivalent to the beginning of the year.

On the other side of the balance sheet, liabilities are mainly short-term debt with 1,110 billion VND, up 15% compared to the beginning of the year. Of which, short-term debt is 881 billion VND, up 18% compared to the beginning of the year. The company continues to maintain a payment capacity greater than 1 time, the debt/EBITDA ratio has gradually improved and is currently at 3.5 times, relatively safe.

The company also said that recently the company has been actively restructuring its capital sources to ensure financial security and better suit the current situation. The company has continuously approached and expanded its credit relationships with many new domestic and foreign banks and credit institutions to have new sources of capital and new credit limits. Currently, the company has credit relationships with over 10 banks, with a total credit limit of about 1,400 billion VND, much higher than the current outstanding loan balance.

|

| Source: Investor newsletter Q3/2024 Nafoods Group |

During the period, NAF also completed the issuance of shares to pay dividends to shareholders at a rate of 10%, and spent more than VND 72.8 billion to buy back 2,675,000 redeemable preference shares (phase 1), with a buyback price of VND 27,200/share. The remaining redeemable preference shares are 9,683,933 shares, which NAF plans to continue buying back in the fourth quarter of 2024 and the first quarter of 2025. This is the total number of redeemable preference shares that NAF issued to the International Finance Corporation (IFC) in 2019.

At the 2024 Annual General Meeting of Shareholders earlier this year, NAF said the reason for buying back these redeemable preferred shares was that both NAF and IFC agreed that after 5 years this investment had fully played its role and was no longer suitable for the current context. In addition, the annual financial costs for this investment were quite high compared to the general level. Therefore, the two sides agreed to end this investment by NAF buying back IFC's shares, and IFC was also ready to reinvest in Nafoods at the right time, with more suitable financial instruments in the future.

Stock price increased nearly 50% compared to the beginning of the year

In the market, NAF shares have performed quite positively recently. At the end of the trading session on October 30, 2024, NAF closed at VND 20,700, up 48% compared to the beginning of the year. Stock liquidity has also shown improvement recently with an average trading volume of 326,000 shares/session in 20 days, much higher than in the first 8 months of the year.

This result, in addition to reflecting positive information from the company's production and business activities, position and growth potential, is also partly due to improvements in the company's IR activities. During the period, NAF was honored to be one of three small-cap companies honored at the IR Award 2024, co-organized by Vietstock newspaper with two award categories: small cap with IR activities most loved by investors, and small cap with IR activities most highly appreciated by financial institutions.

In addition, NAF also surpassed hundreds of other listed enterprises to enter the final round of the 2024 Listed Enterprise Selection jointly organized by the two Stock Exchanges and Investment Newspaper in both categories of Listed Enterprise with the Best 2023 Annual Report and Listed Enterprise with Best Corporate Governance.

![[Photo] Prime Minister Pham Minh Chinh attends the World Congress of the International Federation of Freight Forwarders and Transport Associations - FIATA](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/08/1759936077106_dsc-0434-jpg.webp)

![[Photo] Prime Minister Pham Minh Chinh inspects and directs the work of overcoming the consequences of floods after the storm in Thai Nguyen](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/08/1759930075451_dsc-9441-jpg.webp)

Comment (0)