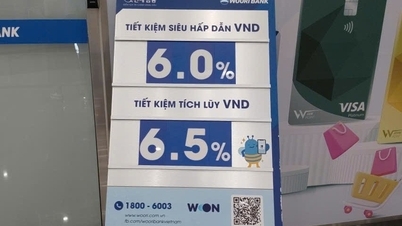

Online deposit interest rates at Vietnam Modern Commercial Joint Stock Bank (MBV ) are listed among the banks with the highest deposit interest rates on the market today.

However, according to information displayed on this bank's application, the actual interest rate is higher than the interest rate publicly listed by MBV.

Accordingly, the online savings interest rate listed by MBV for a 1-month term is 4.1%/year, a 2-month term is 4.2%/year and a 3-month term is 4.4%/year.

However, the actual savings interest rate MBV pays to depositors is 0.3%-0.4%/year higher than the listed rate.

Specifically, the actual savings interest rate received when customers deposit online for a 1-month term is 4.5%/year (0.4%/year higher than the listed rate); 2-month term is 4.5%/year (0.3%/year higher); 3-month term is 4.7%/year (0.3%/year higher).

Except for the above 3 terms, actual deposit interest rates for the remaining terms remain unchanged compared to the deposit interest rates listed by MBV.

Accordingly, the interest rate for online deposits with a term of 4-5 months is 4.7%/year. This is the highest current interest rate for deposits with a term of less than 6 months.

Besides MBV, only 2 banks maintain this deposit interest rate, including Eximbank (3-5 month term when opening a savings account on weekends) and VCBNeo (5 month term).

MBV also listed online deposit interest rates for the remaining terms at market-leading levels.

Currently, the interest rate for 6-8 month term is 5.5%/year, 9 month term is 5.6%/year, 10-11 month term is 5.7%/year, 12-15 month term is 5.8%/year and the highest mobilization interest rate listed by MBV for 18-36 month term is up to 5.9%/year.

MBV, along with the remaining 3 banks in the group of mandatory transfer banks, Vikki Bank, GPBank and VCBNeo, are among the top banks in the market in terms of deposit interest rates.

Vikki Bank listed interest rates for 1-month term up to 4.15%/year, 2-month term is 4.2%/year, 3-month term is 4.35%/year, 6-month term is 5.65%/year, 12-month term is 5.95%/year and 13-month term is 6%/year.

Vikki Bank recently announced an increase in interest rates for depositors who are customers over 80 years old (applied from September 3 to September 30), and customers working in the armed forces (from September 3 to December 31, 2025).

At VCBNeo Bank, the interest rate for 1-2 month term is up to 4.35%/year when making online savings. The interest rate for 3-4 month term is also up to 4.55%/year, 5 month term is 4.7%/year; 6-7 month term is 5.6%/year; 8 month term is 5.4%/year and 9-11 month term is 5.45%/year.

VCBNeo listed the 12-month deposit interest rate at 5.5%/year, while the deposit interest rate for terms from 13-60 months is listed at 5.55%/year.

With GPBank , the online deposit interest rate for 1-2 month term is 3.95%/year, 3 month term is 4.05%/year, 4-5 month term is 4.3%/year.

The interest rate for 6-8 month term deposits listed by GPBank is 5.65%/year, 9 month term is 5.75%/year and the highest interest rate is for terms from 12-36 months, up to 5.95%/year.

| ONLINE DEPOSITS INTEREST RATES AT BANKS ON SEPTEMBER 8, 2025 (%/YEAR) | ||||||

| BANK | 1 MONTH | 3 MONTHS | 6 MONTHS | 9 MONTHS | 12 MONTHS | 18 MONTHS |

| AGRIBANK | 2.4 | 3 | 3.7 | 3.7 | 4.8 | 4.8 |

| BIDV | 2 | 2.3 | 3.3 | 3.3 | 4.7 | 4.7 |

| VIETINBANK | 2 | 2.3 | 3.3 | 3.3 | 4.7 | 4.7 |

| VIETCOMBANK | 1.6 | 1.9 | 2.9 | 2.9 | 4.6 | 4.6 |

| ABBANK | 3.1 | 3.8 | 5.3 | 5.4 | 5.6 | 5.4 |

| ACB | 3.1 | 3.5 | 4.2 | 4.3 | 4.9 | |

| BAC A BANK | 3.8 | 4.1 | 5.25 | 5.35 | 5.5 | 5.8 |

| BAOVIETBANK | 3.5 | 4.35 | 5.45 | 5.5 | 5.8 | 5.9 |

| BVBANK | 3.95 | 4.15 | 5.15 | 5.3 | 5.6 | 5.9 |

| EXIMBANK | 4.3 | 4.5 | 4.9 | 4.9 | 5.2 | 5.7 |

| GPBANK | 3.95 | 4.05 | 5.65 | 5.75 | 5.95 | 5.95 |

| HDBANK | 3.85 | 3.95 | 5.3 | 5.3 | 5.6 | 6.1 |

| KIENLONGBANK | 3.7 | 3.7 | 5.1 | 5.2 | 5.5 | 5.45 |

| LPBANK | 3.6 | 3.9 | 5.1 | 5.1 | 5.4 | 5.4 |

| MB | 3.5 | 3.8 | 4.4 | 4.4 | 4.9 | 4.9 |

| MBV | 4.1 | 4.4 | 5.5 | 5.6 | 5.8 | 5.9 |

| MSB | 3.9 | 3.9 | 5 | 5 | 5.6 | 5.6 |

| NAM A BANK | 3.8 | 4 | 4.9 | 5.2 | 5.5 | 5.6 |

| NCB | 4 | 4.2 | 5.35 | 5.45 | 5.6 | 5.6 |

| OCB | 3.9 | 4.1 | 5 | 5 | 5.1 | 5.2 |

| PGBANK | 3.4 | 3.8 | 5 | 4.9 | 5.4 | 5.8 |

| PVCOMBANK | 3.3 | 3.6 | 4.5 | 4.7 | 5.1 | 5.8 |

| SACOMBANK | 3.6 | 3.9 | 4.8 | 4.8 | 5.3 | 5.5 |

| SAIGONBANK | 3.3 | 3.6 | 4.8 | 4.9 | 5.6 | 5.8 |

| SCB | 1.6 | 1.9 | 2.9 | 2.9 | 3.7 | 3.9 |

| SEABANK | 2.95 | 3.45 | 3.95 | 4.15 | 4.7 | 5.45 |

| SHB | 3.5 | 3.8 | 4.9 | 5 | 5.3 | 5.5 |

| TECHCOMBANK | 3.45 | 4.25 | 5.15 | 4.65 | 5.35 | 4.85 |

| TPBANK | 3.7 | 4 | 4.9 | 5 | 5.3 | 5.6 |

| VCBNEO | 4.35 | 4.55 | 5.6 | 5.45 | 5.5 | 5.55 |

| VIB | 3.7 | 3.8 | 4.7 | 4.7 | 4.9 | 5.2 |

| VIET A BANK | 3.7 | 4 | 5.1 | 5.3 | 5.6 | 5.8 |

| VIETBANK | 4.1 | 4.4 | 5.4 | 5.4 | 5.8 | 5.9 |

| VIKKI BANK | 4.15 | 4.35 | 5.65 | 5.65 | 5.95 | 6 |

| VPBANK | 3.7 | 3.8 | 4.7 | 4.7 | 5.2 | 5.2 |

Source: https://vietnamnet.vn/lai-suat-ngan-hang-8-9-2025-lai-suat-huy-dong-thuc-te-khac-xa-niem-yet-2440151.html

![[Photo] Hanoi morning of October 1: Prolonged flooding, people wade to work](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/1/189be28938e3493fa26b2938efa2059e)

![[Photo] President Luong Cuong receives President of the Cuban National Assembly Esteban Lazo Hernandez](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/4d38932911c24f6ea1936252bd5427fa)

![[Photo] The 1st Congress of Phu Tho Provincial Party Committee, term 2025-2030](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/1507da06216649bba8a1ce6251816820)

![[Photo] Panorama of the cable-stayed bridge, the final bottleneck of the Ben Luc-Long Thanh expressway](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/391fdf21025541d6b2f092e49a17243f)

![[Megastory] A term of creation: An Giang rises from historical imprints](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/10/1/2660ab96e53f4270bcc37f8d39c36c78)

Comment (0)