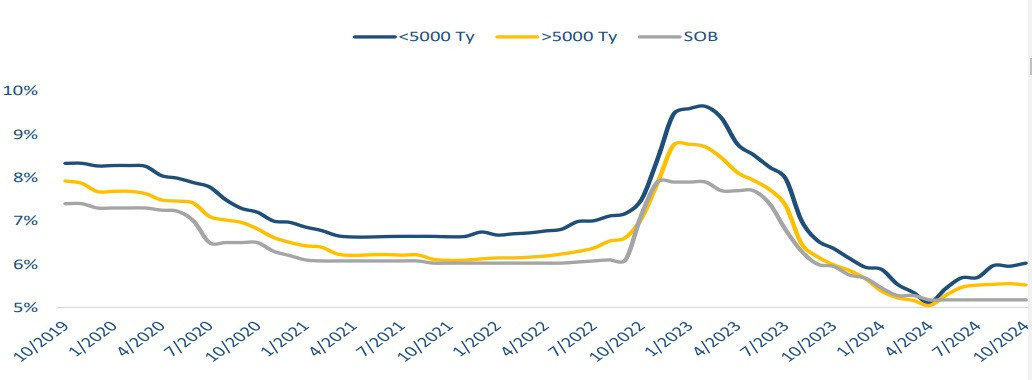

Compared to October 10, 2023, the interest rates mobilized at the "big four" banks have had less adjustment than those of private joint stock commercial banks, but the interest rates at these banks have decreased by a common level of 1.4%/year, some terms have decreased by 0.6-0.8%/year.

Interest rates at Vietcombank are always listed lower than the other 3 banks. Interest rates at Agribank , VietinBank and BIDV do not differ, except for 24-36 month deposit terms.

Currently, the online deposit interest rate for 24-36 months at VietinBank is 5%/year, which is the highest deposit interest rate in the big4 group. The deposit interest rate for this term at BIDV is 4.9%/year, Agribank is 4.8%/year, and Vietcombank is 4.7%/year.

However, Agribank has an advantage over the other three banks in terms of 3-month term deposit interest rates. Currently, this bank is listing 2.5%/year for 3-month term online deposits, while VietinBank and BIDV are still listing 2.3%/year, and Vietcombank is only 1.9%/year.

| ONLINE DEPOSITS INTEREST RATES FROM BIG4 BANKS IN THE PAST YEAR (%/YEAR) | |||||

| TERM | AGRIBANK | VIETINBANK | BIDV | VIETCOMBANK | |

| 1 MONTH | October 2024 | 2 | 2 | 2 | 1.6 |

| October 2023 | 3.4 | 3.4 | 3.2 | 3 | |

| 3 MONTHS | October 2024 | 2.5 | 2.3 | 2.3 | 1.9 |

| October 2023 | 3.85 | 3.85 | 3.7 | 3.3 | |

| 6 MONTHS | October 2024 | 3.3 | 3.3 | 3.3 | 2.9 |

| October 2023 | 4.7 | 4.7 | 4.6 | 4.3 | |

| 9 MONTHS | October 2024 | 3.3 | 3.3 | 3.3 | 2.9 |

| October 2023 | 4.7 | 4.7 | 4.6 | 4.3 | |

| 12 MONTHS | October 2024 | 4.7 | 4.7 | 4.7 | 4.6 |

| October 2023 | 5.5 | 5.5 | 5.5 | 5.3 | |

| 18 MONTHS | October 2024 | 4.7 | 4.7 | 4.7 | 4.6 |

| October 2023 | 5.5 | 5.5 | 5.5 | 5.3 | |

| 24 MONTHS | October 2024 | 4.8 | 5 | 4.9 | 4.7 |

| October 2023 | 5.5 | 5.5 | 5.5 | 5.3 | |

At joint stock commercial banks, today is the fourth consecutive day that the market has not recorded any changes in the deposit interest rate table. This is a rare occurrence in the past year.

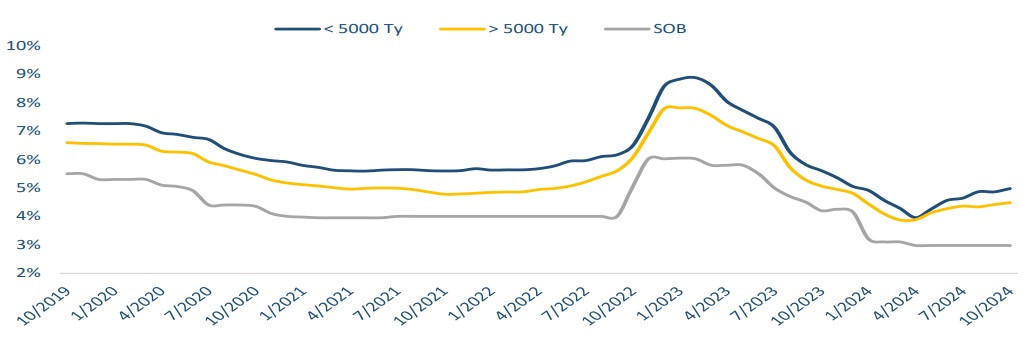

According to statistics, the average 6-month deposit interest rate in October reached 4.45%/year, an increase of 0.07%/year compared to September 2024. The average 12-month deposit interest rate in October reached 5.14%, a slight increase of 0.01%/year compared to September.

The increase in deposit interest rates mainly comes from a number of small banks. Meanwhile, the group of state-owned commercial banks continues to maintain stable deposit interest rates.

Thus, the rate of increase in deposit interest rates in recent months has slowed down significantly compared to the second quarter. Compared to the end of 2023, deposit interest rates are still down 12 basis points.

On average, since the beginning of the year, the mobilization interest rate is at 4.94%/year, still much lower than previous years, including the year of the Covid-19 pandemic (5.85%).

Low deposit interest rates continue to create conditions for banks to maintain low lending interest rates.

Source: https://vietnamnet.vn/lai-suat-ngan-hang-hom-nay-11-10-2024-ngan-hang-nao-cao-nhat-trong-nhom-big4-2330858.html

![[Photo] Keep your warehouse safe in all situations](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/1/3eb4eceafe68497989865e7faa4e4d0e)

![[Photo] President of the Cuban National Assembly visits President Ho Chi Minh's Mausoleum](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/1/39f1142310fc4dae9e3de4fcc9ac2ed0)

![[Photo] Hanoi morning of October 1: Prolonged flooding, people wade to work](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/1/189be28938e3493fa26b2938efa2059e)

Comment (0)