Statistics from the Vietnam Banking Association show that in September 2025, two commercial banks adjusted their deposit interest rates, including Vikki Bank, increasing from 0.1-0.15 percentage points for online deposit interest rates for terms of 1-13 months.

On the contrary, GPBank adjusted to reduce the mobilization interest rate for the entire online deposit term.

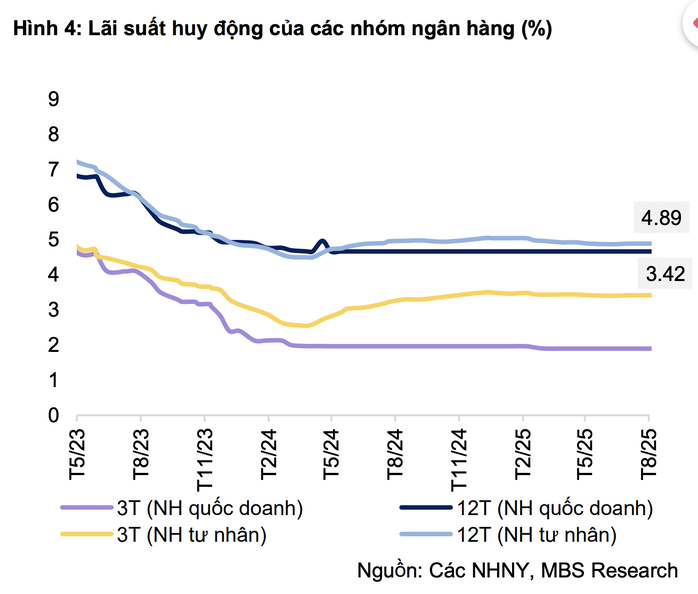

The mobilization interest rate level continues to be stable. According to statistics from MBS Securities Company, by the end of August 2025, the average 12-month term interest rate of the group of joint-stock commercial banks was at 4.89%/year (down 0.16 percentage points compared to the beginning of the year). Meanwhile, the interest rate of the group of state-owned commercial banks remained stable at 4.7%/year.

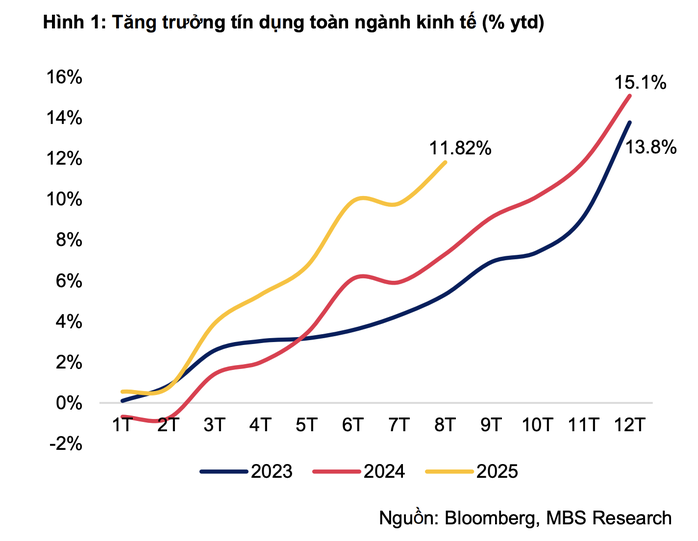

Notably, this occurred despite credit growth continuing to increase strongly, with the total outstanding credit balance of the entire system expected to reach about 14.8% by the end of the third quarter of 2025.

"The stable deposit interest rate level despite the acceleration of credit growth is due to the abundant liquidity of the system, supporting banks to maintain low interest rates to promote economic growth. The average lending interest rate as of the end of August has decreased by 0.56 percentage points compared to the end of last year, to 6.38%/year" - said MBS expert.

Savings interest rates at joint stock banks are forecast to remain at 4.7% per year by the end of this year.

The Vietnam Banks Association also believes that the low interest rate environment will continue to be the main driver for credit growth in the third quarter of 2025.

Bank bond issuance increased sharply

According to the reporter of Nguoi Lao Dong Newspaper, for commercial banks, the fact that credit increases faster than mobilization forces them to shift to other channels to have input capital.

Mr. Nguyen The Minh, Director of Retail Client Analysis, Yuanta Vietnam Securities Company, said that in the context of high credit growth compared to deposit growth, banks have increased the issuance of bonds to supplement capital sources when the bond interest rate level is low. In the first 8 months of 2025, banks have issued more than 272,600 billion VND in bonds, an increase of 50% over the same period last year.

According to MBS statistics, banking is the industry group with the highest bond issuance value (accounting for 72% of the total issuance value) in the past 8 months, with a weighted average interest rate of 5.7%/year, average term of 4.6 years. Banks with the largest issuance value since the beginning of the year include Techcombank,ACB , OCB...

Commenting on the upcoming deposit interest rates, experts said that the US Federal Reserve's (FED) move to cut interest rates and forecast several more cuts in the coming time will help the State Bank have more room to operate a loose monetary policy. At the same time, it will continue to be steadfast in its orientation of supporting economic growth.

Source: https://nld.com.vn/lai-suat-gui-tiet-kiem-thap-ngan-hang-quay-xe-huy-dong-von-qua-kenh-trai-phieu-196251001164807036.htm

![[Photo] Keep your warehouse safe in all situations](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/1/3eb4eceafe68497989865e7faa4e4d0e)

Comment (0)