Bank interest rates today October 24, 2024, in addition to employees calling to offer high interest rates, the bank also sent emails to customers inviting them to deposit money with interest rates much higher than the listed interest rates.

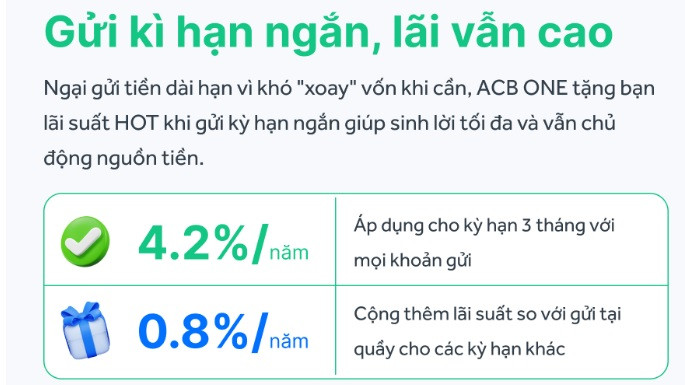

Asia Commercial Joint Stock Bank (ACB ) recently made a new move on interest rates when sending an email to customers, with the content of offering preferential interest rates on 3-month deposits up to 4.2%/year.

Accordingly, ACB customers who deposit savings online on ACB One will receive "hot" interest rates even if they only deposit for a short term.

ACB said that the preferential bank interest rate of 4.2%/year is only applied for 3-month term. However, this bank adds 0.8%/year interest rate compared to over-the-counter deposits for other terms.

Currently, ACB lists the interest rate for 3-month term deposits at the counter at only 2.7%/year. Thus, the difference between the listed interest rate and the preferential interest rate for 3-month term is up to 1.5%/year. Meanwhile, the online interest rate for 3-month term deposits according to ACB's listed interest rate schedule is 3.5%/year.

ACB is among the commercial banks listed with the lowest deposit interest rates today.

According to the interest rate table at the counter, the interest rates for 1-2 month terms are 2.3% and 2.5%/year respectively. The interest rates for 6-month, 9-month and 12-month terms are 3.5%/year, 3.7%/year and 4.4%/year respectively.

The highest interest rate when saving at ACB counter is 4.5%/year, applied for terms from 13 to 36 months.

With a policy of adding 0.8%/year interest rate compared to saving at the counter, the highest bank interest rate at ACB when customers deposit money online is 5.3%/year, term from 13 to 36 months.

ACB also has a bonus interest rate policy with a bonus of 0.1%/year for deposit accounts from 200 million to under 1 billion VND; a bonus of 0.15%/year for deposit accounts from 1 billion VND to under 5 billion VND and a bonus of 0.2%/year for deposit accounts from 5 billion VND or more.

In addition, ACB still maintains the "special interest rate" policy, with the highest interest rate of 6%/year (end-of-term interest) and 5.9%/year (monthly interest) when depositing from 200 billion VND for a 13-month term.

It is not surprising that ACB sent emails inviting customers to deposit money with interest rates 0.8% - 1.5%/year different from the interest rates listed at the counter, as recently banks have been trying to invite customers to deposit money with different methods.

Previously, SeABank staff called customers to invite them to make online savings deposits with interest rates of 5.25% and 6.15% per year for 6-month and 12-month terms, respectively.

This attractive interest rate is much higher than the interest rate officially listed by the bank, even higher than the 5.95%/year interest rate advertised by SeABank through signs placed in front of branches/transaction offices.

Some banks, although not officially raising interest rates, have placed signs advertising sky-high deposit interest rates in front of their transaction points. These interest rates are not officially announced in the interest rate tables posted by the banks.

Since the beginning of October, the number of banks adjusting deposit interest rates is not much, including: NCB (increasing term of 1-6 months), Agribank (increasing term of 1-5 months), MSB, LPBank, Eximbank, and Bac A Bank also increased interest rates in some terms.

On the contrary, Agribank reduced 0.1%/year deposit interest rates for terms of 6-11 months and Techcombank reduced 0.1%/year interest rates for terms of 1-36 months, NCB reduced 0.1-0.35% interest rates for terms of 13-60 months, while VPBank reduced 0.2%/year interest rates for terms of 6-36 months.

| INTEREST RATE TABLE FOR ONLINE DEPOSITS AT BANKS ON OCTOBER 25, 2024 (%/YEAR) | ||||||

| BANK | 1 MONTH | 3 MONTHS | 6 MONTHS | 9 MONTHS | 12 MONTHS | 18 MONTHS |

| AGRIBANK | 2.2 | 2.7 | 3.2 | 3.2 | 4.7 | 4.7 |

| BIDV | 2 | 2.3 | 3.3 | 3.3 | 4.7 | 4.7 |

| VIETINBANK | 2 | 2.3 | 3.3 | 3.3 | 4.7 | 4.7 |

| VIETCOMBANK | 1.6 | 1.9 | 2.9 | 2.9 | 4.6 | 4.6 |

| ABBANK | 3.2 | 3.7 | 5 | 5.2 | 5.6 | 5.7 |

| ACB | 3.1 | 3.5 | 4.2 | 4.3 | 4.9 | |

| BAC A BANK | 3.8 | 4.1 | 5.25 | 5.35 | 5.7 | 5.85 |

| BAOVIETBANK | 3.3 | 4 | 5.2 | 5.4 | 5.8 | 6 |

| BVBANK | 3.8 | 4 | 5.2 | 5.5 | 5.8 | 6 |

| CBBANK | 3.8 | 4 | 5.55 | 5.5 | 5.7 | 5.85 |

| DONG A BANK | 3.9 | 4.1 | 5.55 | 5.7 | 5.8 | 6.1 |

| EXIMBANK | 3.9 | 4.3 | 5.2 | 4.5 | 5.2 | 5.8 |

| GPBANK | 3.2 | 3.72 | 5.05 | 5.4 | 5.75 | 5.85 |

| HDBANK | 3.85 | 3.95 | 5.1 | 4.7 | 5.5 | 6.1 |

| KIENLONGBANK | 3.7 | 3.7 | 5.2 | 5.3 | 5.6 | 5.7 |

| LPBANK | 3.9 | 4.1 | 5.2 | 5.2 | 5.6 | 5.9 |

| MB | 3.3 | 3.7 | 4.4 | 4.4 | 5.1 | 5 |

| MSB | 3.9 | 3.9 | 4.8 | 4.8 | 5.6 | 5.6 |

| NAM A BANK | 3.8 | 4.1 | 5 | 5.2 | 5.6 | 5.7 |

| NCB | 3.9 | 4.2 | 5.55 | 5.65 | 5.8 | 5.8 |

| OCB | 3.9 | 4.1 | 5.1 | 5.1 | 5.2 | 5.4 |

| OCEANBANK | 4.1 | 4.4 | 5.4 | 5.5 | 5.8 | 6.1 |

| PGBANK | 3.4 | 3.8 | 5 | 5 | 5.5 | 5.8 |

| PVCOMBANK | 3.3 | 3.6 | 4.5 | 4.7 | 5.1 | 5.8 |

| SACOMBANK | 3.3 | 3.6 | 4.9 | 4.9 | 5.4 | 5.6 |

| SAIGONBANK | 3.3 | 3.6 | 4.8 | 4.9 | 5.8 | 6 |

| SEABANK | 2.95 | 3.45 | 3.95 | 4.15 | 4.7 | 5.45 |

| SHB | 3.5 | 3.8 | 5 | 5.1 | 5.5 | 5.8 |

| TECHCOMBANK | 3.25 | 3.45 | 4.55 | 4.55 | 4.85 | 4.85 |

| TPBANK | 3.5 | 3.8 | 4.7 | 5.2 | 5.4 | |

| VIB | 3.2 | 3.6 | 4.6 | 4.6 | 5.1 | |

| VIET A BANK | 3.4 | 3.7 | 4.8 | 4.8 | 5.4 | 5.7 |

| VIETBANK | 3.8 | 4 | 5.2 | 5 | 5.6 | 5.9 |

| VPBANK | 3.6 | 3.8 | 4.8 | 4.8 | 5.3 | 5.3 |

Source: https://vietnamnet.vn/lai-suat-ngan-hang-hom-nay-25-10-2024-goi-dien-gui-email-moi-lai-suat-cao-2335341.html

![[Photo] Keep your warehouse safe in all situations](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/1/3eb4eceafe68497989865e7faa4e4d0e)

Comment (0)