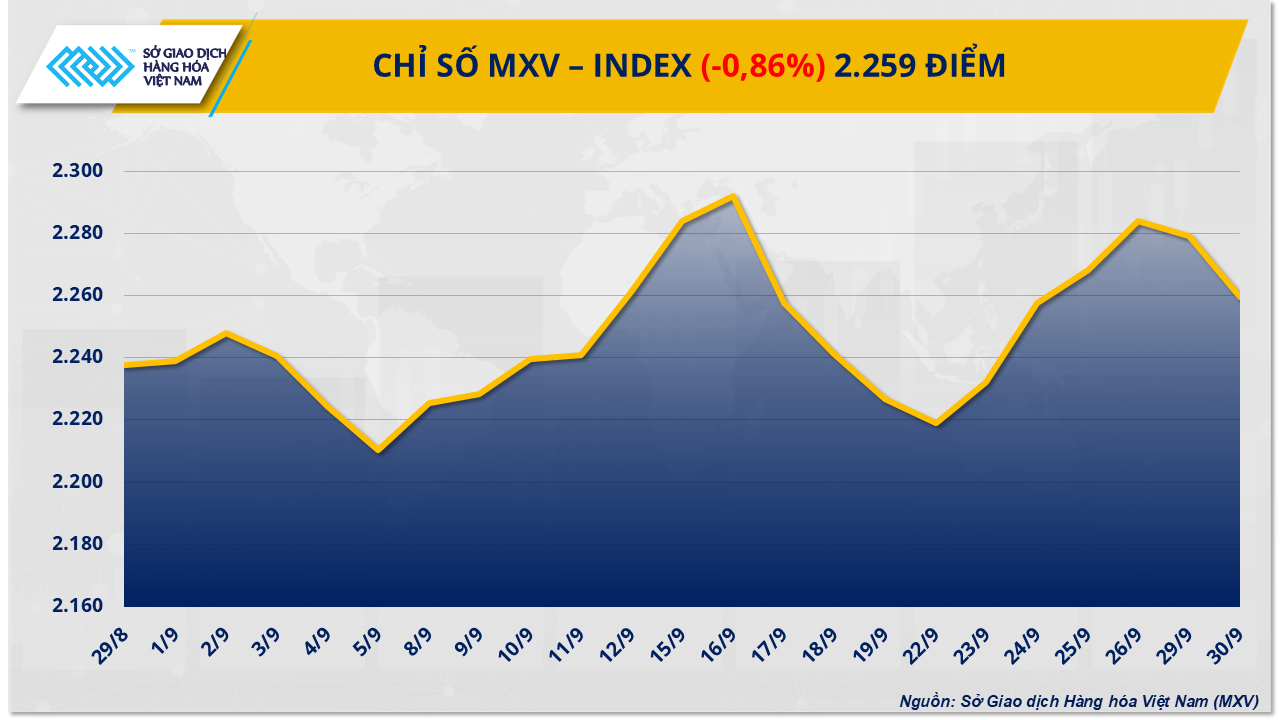

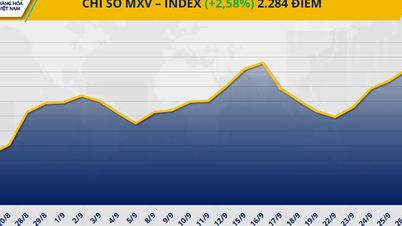

At the close, the MXV-Index continued to fall by another 0.86% to 2,259 points. Notably, in the industrial raw materials market, cocoa prices returned to their lowest level in the past 11 months. Meanwhile, concerns about the possibility of OPEC+ continuing to increase production next month pushed oil prices to extend their decline into yesterday's session.

Supply and demand pressures continue to dominate the world cocoa market.

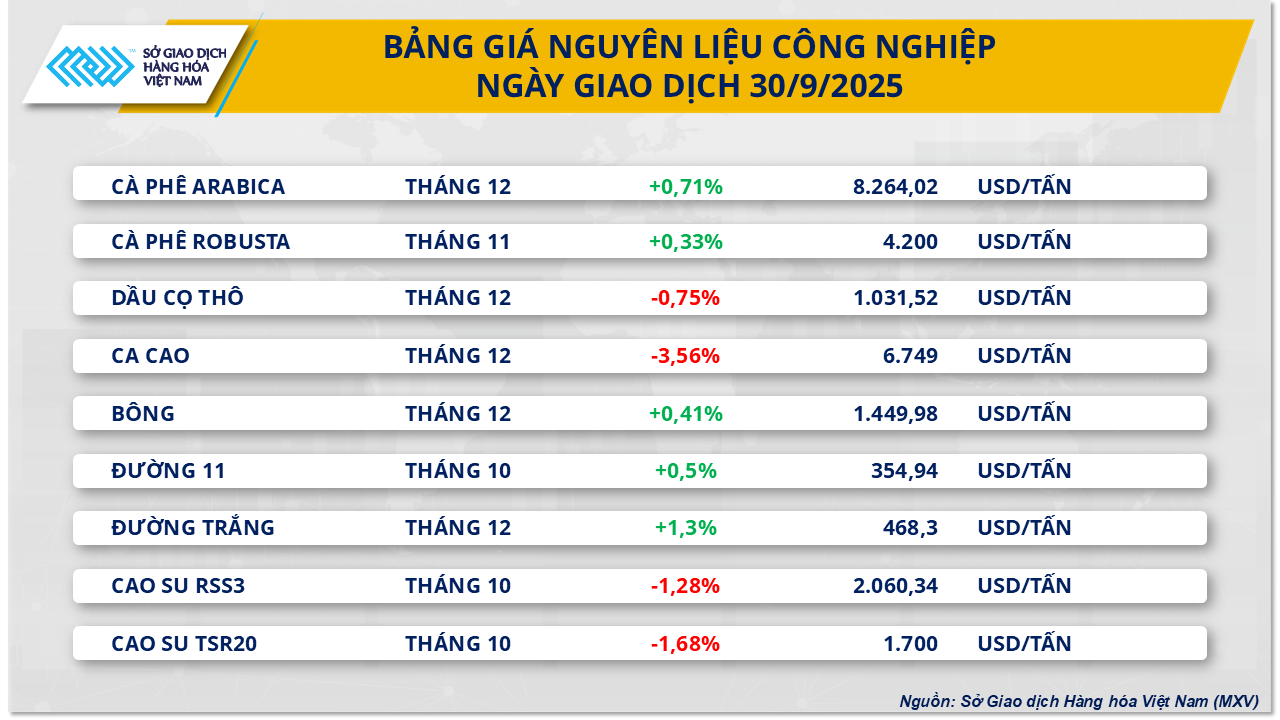

Closing yesterday's trading session, the industrial raw materials market recorded relatively mixed developments. Notably, cocoa recorded a decrease of 3.65% to 6,749 USD/ton - the lowest level in the past 11 months.

According to MXV, the pressure is mainly coming from the expectation of improved supply in Ivory Coast - the world's largest cocoa exporter. Above-average rainfall in the past week is raising hopes of a longer harvest season, with abundant and higher-quality output early next year. This prospect is enough to pull the market away from the severe shortage scenario that haunted the market throughout 2024.

But the pressure on cocoa prices is not just coming from the supply side. After seven weeks of pressure, high prices and heavy tariffs are causing a sharp decline in global purchasing power, putting the chocolate industry in a difficult period. Two major groups, Lindt & Sprüngli and Barry Callebaut, have both revised down their profit forecasts after first-half sales fell more than expected. Notably, Barry Callebaut, the world's largest chocolate maker, just recorded a 9.5% drop in second-quarter sales, the lowest quarterly decline in a decade.

In addition, third-quarter cocoa grinding figures for Europe, North America and Asia will be released on October 16. Previously, second-quarter data showed that European grinding output fell 7.2% year-on-year, Asia fell 16.3%, while North America recorded a 2.8% decline.

However, cocoa supplies in Côte d’Ivoire have continued to decline so far, helping to curb the recent decline in cocoa prices. In the week ending September 28, cocoa arrivals reached only 600 tonnes, down sharply from 5,000 tonnes the previous week and 17,000 tonnes in the same period last year. Cumulatively, since the beginning of the 2024–2025 crop year, total cocoa arrivals reached 1.691 million tonnes, down 3.5% from 1.75 million tonnes last year and 19% below the five-year average of 2.1 million tonnes. The new harvest has now begun to accelerate and is expected to peak between October and December.

Energy markets face speculation over OPEC+ output

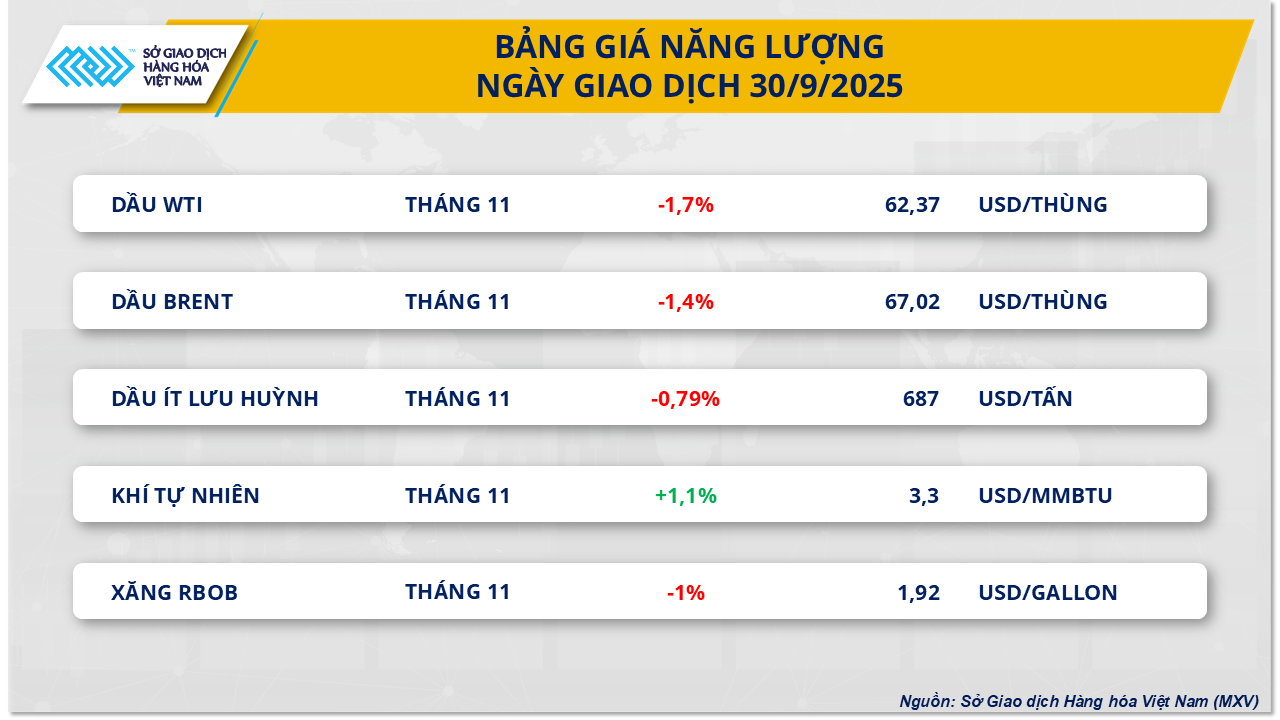

Not outside the general trend of the whole market, the energy group also witnessed overwhelming selling pressure on most of the key commodities in the group. Notably, the prices of both crude oil products have fallen to their lowest level in about 3 weeks. Specifically, Brent oil price stopped at 67.02 USD/barrel, corresponding to a decrease of about 1.4%; meanwhile, WTI oil price also recorded a decrease of about 1.7%, falling to 62.37 USD/barrel.

Currently, the focus of investors is still on OPEC+'s decision regarding the increase in crude oil production in November, with many speculations in the market about the possibility of increasing production in the range of 137,000-411,000 barrels/day. Notably, Bloomberg once reported on the scenario that OPEC+ could increase up to 500,000 barrels/day. However, OPEC officially denied the information about the increase of 500,000 barrels/day in a post on social media later. However, the prospect of increasing production to regain global market share is still the main drag on oil prices, especially when supply is also affected by the resumption of crude oil exports from the northern region of Iraq.

Meanwhile, the prospect of a global oil supply surplus continues to be reinforced by the monthly report of the US Energy Information Administration (EIA). Accordingly, US crude oil production in July increased by 109,000 barrels/day to 13.64 million barrels/day, higher than the record level in June. The International Energy Agency (IEA) and TotalEnergies also simultaneously forecast a prolonged oversupply situation in both 2025 and 2026.

In addition, concerns about political instability in the US continue to put downward pressure on oil prices. Currently, the Republican administration of President Donald Trump has not yet reached an agreement with Democratic lawmakers on a budget extension plan, in the context that the final deadline for Congress to pass the budget is this morning, October 1. If Congress fails to approve the budget in time and the government is forced to partially shut down, many public services will also be interrupted, leading to a delay in the publication of important economic reports.

According to analysis by ANZ bank, this risk puts downward pressure on oil prices as investors fear that political and social instability will reduce energy demand in the US in the near future.

Source: https://baotintuc.vn/thi-truong-tien-te/luc-ban-tiep-tuc-chiem-uu-the-gia-ca-cao-va-dau-tho-chiu-suc-ep-lon-20251001082755031.htm

![[Photo] Prime Minister Pham Minh Chinh chairs the Government's online conference with localities](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/5/264793cfb4404c63a701d235ff43e1bd)

![[Photo] Prime Minister Pham Minh Chinh launched a peak emulation campaign to achieve achievements in celebration of the 14th National Party Congress](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/5/8869ec5cdbc740f58fbf2ae73f065076)

![[VIDEO] Summary of Petrovietnam's 50th Anniversary Ceremony](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/10/4/abe133bdb8114793a16d4fe3e5bd0f12)

![[VIDEO] GENERAL SECRETARY TO LAM AWARDS PETROVIETNAM 8 GOLDEN WORDS: "PIONEER - EXCELLENT - SUSTAINABLE - GLOBAL"](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/7/23/c2fdb48863e846cfa9fb8e6ea9cf44e7)

Comment (0)