Geopolitical tensions push oil prices up sharply

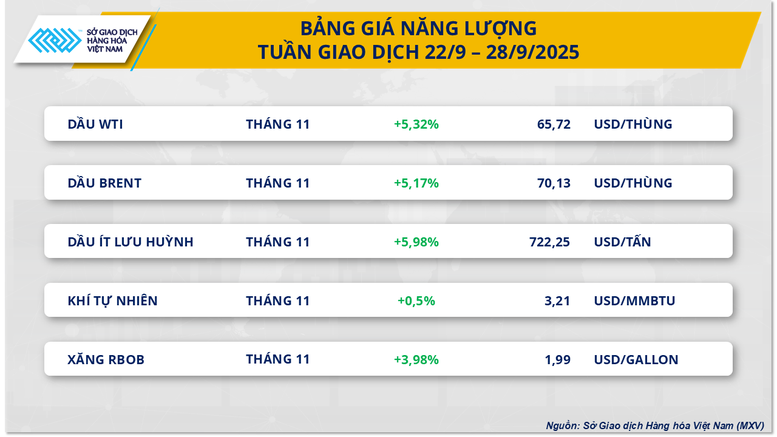

According to the Vietnam Commodity Exchange (MXV), the energy market last week witnessed overwhelming buying power when all 5 commodities in the group increased sharply. In particular, the price of two crude oil commodities simultaneously increased sharply by more than 5% to 65.7 USD/barrel for WTI oil and 70.1 USD/barrel for Brent oil.

Global crude oil prices have been boosted by rising geopolitical tensions over the past week, particularly developments surrounding the conflict between Russia and Ukraine. Attacks on Russian energy facilities have raised concerns about supply disruptions from the world’s second-largest crude producer, while the situation in the Gaza Strip has also affected security and supply in the Middle East.

In addition, oil prices were also supported by positive data from the weekly report of the US Energy Information Administration (EIA) released on September 24, showing that commercial crude oil reserves in the US decreased by 607,000 barrels in the week ending September 19, contrary to previous expectations of a slight increase. Previously, the American Petroleum Institute (API) also reported a decrease of nearly 4 million barrels, contributing to increasing confidence in the recovery of oil prices.

Notably, refined product inventories such as gasoline also fell sharply, notably gasoline inventories fell by more than 1 million barrels, even though domestic refineries increased capacity with crude oil input and output both increasing compared to the previous week. This development reflects that consumption demand in the world's largest economy remains stable, despite the end of the peak travel season.

This is also reflected in the US GDP growth data in the second quarter of 2025, when this index reached its highest level since the beginning of 2024, according to the official report from the US Bureau of Economic Analysis. This positive macroeconomic situation is expected to continue to support energy demand, but also makes the US Federal Reserve (Fed) more cautious in deciding to cut the base interest rate in the near future.

Coffee prices recover amid supply pressure

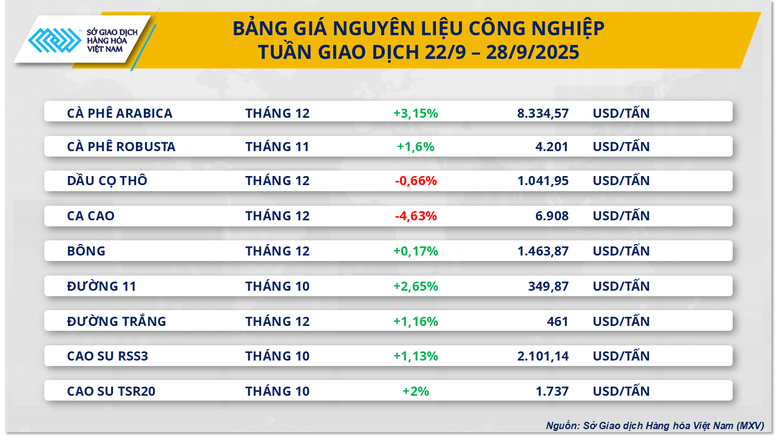

Meanwhile, not outside the general trend of the whole market, the group of industrial materials also recorded relatively positive developments, especially two coffee products. In particular, the price of Arabica coffee increased by more than 3.1% compared to the previous week, reaching 8,334 USD/ton while the price of Robusta coffee also increased by about 1.6% to 4,201 USD/ton.

According to MXV, concerns surrounding supply in Brazil continue to surround the market, thereby supporting the prices of these two commodities to recover this week. Last week, the country's carryover inventories continued to remain low, along with Brazil's 2025-2026 crop production falling more than forecast, raising concerns about the quality and volume of the harvest in the coming crop. At the same time, the unfavorable weather situation also reinforced analysts' concerns, causing prices to quickly recover.

Source: https://baochinhphu.vn/thi-truong-hang-hoa-sac-xanh-ap-dao-102250929112232873.htm

![[Photo] General Secretary To Lam attends the ceremony to celebrate the 80th anniversary of the post and telecommunications sector and the 66th anniversary of the science and technology sector.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/8e86b39b8fe44121a2b14a031f4cef46)

![[Photo] Many streets in Hanoi were flooded due to the effects of storm Bualoi](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/18b658aa0fa2495c927ade4bbe0096df)

![[Photo] General Secretary To Lam receives US Ambassador to Vietnam Marc Knapper](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/c8fd0761aa184da7814aee57d87c49b3)

![[Photo] National Assembly Chairman Tran Thanh Man chairs the 8th Conference of full-time National Assembly deputies](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/2c21459bc38d44ffaacd679ab9a0477c)

Comment (0)