Cases of tax payment extension 2024

Regulations on tax payment extension according to Article 60 of the Law on Tax Administration 2019 are as follows:

1. Tax payment extension will be considered based on the taxpayer's request if:

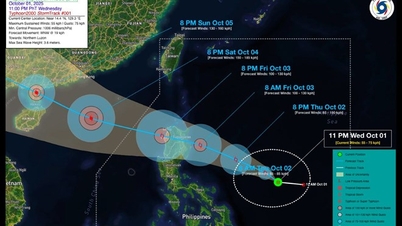

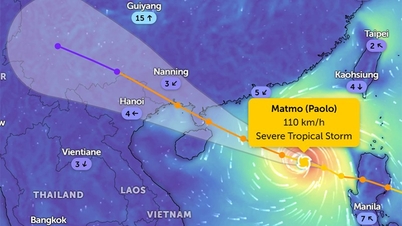

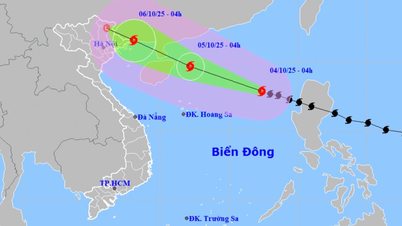

Suffering material damage, directly affecting production and business due to force majeure events specified in Clause 27, Article 3 of the Law on Tax Administration 2019, including: natural disasters, catastrophes, epidemics, fires, unexpected accidents and other force majeure events as prescribed by the Government .

Or must stop operations due to relocation of production and business facilities at the request of competent authorities, affecting production and business results.

2. Taxpayers eligible for tax payment extension as prescribed in Clause 1, Article 62 are entitled to an extension for paying part or all of the tax payable.

3. The tax payment extension period is specified as follows:

No more than 2 years from the tax payment deadline in case of material damage, directly affecting production and business due to force majeure.

No more than 1 year from the date of tax payment deadline in case of having to stop operations and production results being affected due to relocation of production and business facilities at the request of competent authorities.

4. Taxpayers are not subject to penalties and do not have to pay late payment fees calculated on the tax debt amount during the tax payment extension period.

5. The head of the directly managing tax authority shall base on the tax payment extension dossier to decide the tax amount to be extended and the tax payment extension period.

Notes when preparing tax extension application

Documents and records for tax payment extension are prescribed in Article 64 of the 2019 Law on Tax Administration, including:

1. Taxpayers eligible for tax payment extension under the provisions of this Law must prepare and submit tax payment extension dossiers to the directly managing tax authority.

2. Tax payment extension application includes:

A written request for tax payment extension, stating the reason, tax amount, and payment deadline. At the same time, prepare documents proving the reason for tax payment extension.

Source

![[Photo] Students of Binh Minh Primary School enjoy the full moon festival, receiving the joys of childhood](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/3/8cf8abef22fe4471be400a818912cb85)

![[Infographic] Notable numbers after 3 months of "reorganizing the country"](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/4/ce8bb72c722348e09e942d04f0dd9729)

![[Photo] Prime Minister Pham Minh Chinh chairs meeting to deploy overcoming consequences of storm No. 10](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/3/544f420dcc844463898fcbef46247d16)

![[Infographic] Notable numbers after 3 months of "reorganizing the country"](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/10/4/ce8bb72c722348e09e942d04f0dd9729)

Comment (0)