Attract capital, attract technology, attract talent

Nearly 40 years since Doi Moi, the first International Financial Center (IFC) will help complete Vietnam's financial ecosystem.

Quang Thang, a personal investor of Generation Y (those born between 1981 and 1996) in Ho Chi Minh City, enthusiastically believes that if Vietnam has an international financial market, many new types of transactions will be born and become more vibrant. Currently, young people in Vietnam only have the stock investment channel, so there are few choices, while traditional investment channels such as real estate and gold are not attractive enough for them to participate. "Besides stocks, if digital assets and digital currencies can be traded publicly, many people will participate. I think foreign investors in general, including individuals, will come to Vietnam to live, work and invest more. Who knows, Ho Chi Minh City will become a bustling place not only for tourists but also for large-scale investors like we often see in Singapore," Quang Thang shared.

Perspective of international financial center in Ho Chi Minh City

Source: Ho Chi Minh City People's Committee

In fact, in countries where the financial market is operating, it creates an important driving force for the entire economy . In the context of the country preparing to enter a new era, the international financial market will be an important channel to attract capital for us to carry out important projects.

Associate Professor Dr. Tran Hoang Ngan, National Assembly delegate, member of the National Financial and Monetary Policy Advisory Council, said that the financial market is not only a channel to attract capital but also creates momentum, creating a "locomotive" for the economy to accelerate strongly. "Vietnam is about to enter a new era, the financial factor is very important. Because to accelerate, investment and development must go first, hundreds and thousands of projects are in need of large capital. TTTC will help mobilize foreign currency capital right in our country at the lowest possible cost instead of having to borrow on the world market. Or our country has strengths in agriculture , many agricultural products are the world's leading exporters but cannot control prices. When there is TTTC and commodity exchanges, it will greatly support agricultural prices... We will attract many investors, human resources, talents of the world, as well as Vietnamese people working in global financial institutions who are ready to cooperate and work in our country. Thus, we will achieve many goals: attracting capital, finance, technology and attracting talents. In particular, TTTC requires financial institutions and banks in the center to comply with international standards, thereby helping the financial system operate safely. "More effective", Associate Professor, Dr. Tran Hoang Ngan analyzed.

According to Dr. Do Thien Anh Tuan, Fulbright School of Public Policy and Management, although Vietnam's financial market has made significant progress in the past two decades, the gap between Vietnam and financial markets in the region is still very large. Currently, we still do not have an integrated financial trading facility on an international scale, nor support dual listing or specialized financial derivative products to serve international investors... This makes Vietnam lack the capacity to attract global financial institutions. Meanwhile, modern financial markets are the center for trading digital assets, carbon credits, and green bonds. These are important financial tools in the context of the digital economy, green economy, and circular economy. Without quickly building a financial market with international standard infrastructure, including a multi-asset trading floor, an AI-powered financial data center, and a cross-border payment system, Vietnam will not be able to capture new generation capital flows and miss the opportunity to become a financial hub in Southeast Asia.

Create tens of thousands of high-income jobs

Up to now, Vietnam has not recognized or allowed the trading of cryptocurrencies and digital currencies. This trading market is considered a "gray area", posing many risks for investors. However, many statistics from foreign units in recent times show that the number of Vietnamese people owning digital currencies is quite large. The Wall Street Journal in May 2023 pointed out that Vietnamese people traded the fourth most digital currencies in the world on the Binance exchange. By 2024, a report from the Triple-A Electronic Payment Gateway showed that in the top 10 countries with the largest proportion of people owning digital currencies in the world, Vietnam ranked second, just after the UAE. The world's leading crypto data analysis company Chainalysis said that for 3 consecutive years from 2022 to 2024, Vietnam has a crypto asset inflow of over 100 billion USD, more than double the annual foreign direct investment (FDI) inflow... Therefore, when Vietnam has a crypto asset exchange, including cryptocurrencies, this capital is likely to be attracted and traded in Vietnam. Just calculating the proposed personal income tax rate for investors for crypto asset transactions at 0.1% equal to that of securities transactions, Vietnam will have an additional revenue of about 100 million USD per year. That is not to mention a series of other related activities such as advertising, marketing... which will increase the country's revenue. At the same time, domestic enterprises are also allowed to offer and issue crypto assets. This is an opportunity to raise long-term capital for Vietnamese enterprises, similar to through the stock market.

Vietnam begins opening crypto-asset exchange to help attract global investment capital

Photo: Dao Ngoc Thach

Of course, the crypto-asset exchange is only part of the ecosystem surrounding the financial market. Dr. Do Thien Anh Tuan analyzed: Building a financial market is a core condition to attract long-term and quality FDI capital flows to Vietnam. In terms of economic structure, the proportion of the financial sector in Vietnam's GDP is currently only about 6.8% while in countries with developed international financial markets such as Singapore or South Korea, this figure fluctuates from 15 - 20% of GDP. Therefore, if properly invested, the financial market can directly contribute to GDP growth through the strong development of high-end financial and logistics services, while creating about 100,000 - 150,000 high-income jobs in the next 10 years.

In addition, one of the practical and long-term benefits of TTTC is the ability to promote the development of the domestic financial market in a diversified, transparent and effective manner. At the same time, Vietnam will create a solid foundation for the development of digital finance and Fintech, increasing the competitiveness of the country's strategic position on the world financial map. "The establishment of the International Financial Market will not only bring benefits in terms of capital flows and institutions, but also contribute to promoting the comprehensive development of the high-quality labor market, attracting and retaining talent. At the same time, it will create positive pressure for Vietnam to accelerate the application of international standards on information disclosure, financial reporting, independent supervision and anti-money laundering. This is not only a requirement of investors but also a condition for Vietnam to upgrade its national credit rating and expand its ability to borrow international debt at lower costs. The International Financial Market will also help Vietnam gradually become self-sufficient in financial transaction infrastructure, improve the economy's resilience to external shocks, and increase its initiative in managing exchange rates, interest rates, and capital flows," Dr. Do Thien Anh Tuan analyzed.

There must be a mechanism to attract large financial institutions.

Vietnam's advantages that have been mentioned in recent times are low labor costs and a stable political, economic and social environment. In addition, a young workforce that quickly grasps science and technology will be one of the advantages when Vietnam develops into a new generation financial market model. However, the most important thing is still the policy for the new ecosystem to develop. Associate Professor, Dr. Tran Hoang Ngan gave an example: Singapore has a developed financial market thanks to its superior institutions, transparent legal system, developed financial technology as well as a large international transit port. Moreover, this country has had a freely convertible currency market (SGD) very early. On the Vietnamese side, we have liberalized current accounts, but not yet freed capital accounts, so we need to take very cautious steps. This is also a big challenge and difficulty for international financial markets in Vietnam. Therefore, we must have clear policies and regulations on foreign exchange management. The later formation helps Vietnam learn from experience and issue the most attractive institutions for investors. "We need to introduce the most competitive incentive policies, attracting many large investors, financial intermediaries and large financial organizations in the world to register as members. A financial market that wants to succeed must have large financial groups. There needs to be policies for strategic investors so that they can come and invite their friends to invest in Vietnam. This is the first thing to do. However, the most important factor at present is still human resources. Therefore, the recruitment of human resources to serve the financial market plays a very important and decisive role," said Associate Professor, Dr. Tran Hoang Ngan.

Dr. Do Thien Anh Tuan also said: It is necessary to build a special, outstanding and flexible financial institution because this is the core of every successful financial market in the world. For example, it is necessary to establish a comprehensive financial sandbox model, where businesses, startups and international organizations can test new business models and financial products... At the same time, to attract international financial institutions, it is necessary to establish a "one-stop" licensing mechanism, quick with electronic processes and centralized legal support. Vietnam must have preferential tax policies with conditions such as exemption and reduction of corporate income tax for 5-10 years; apply flexible tax rates linked to investment efficiency and technology transfer; need to build a smart financial urban governance model to create trust for investors and policy effectiveness.

Raising Vietnam's position

The determination to form an international financial center is not only an aspiration to raise Vietnam's position but also a key to open the door to attract global financial institutions. This will create a new wind for capital supply, while helping the domestic financial market become transparent, effective and more deeply integrated with international standards. However, to build an international financial center into operation is a fierce competition, posing great challenges. Forming an international financial center is not only an economic dream but also an opportunity for Vietnam to affirm its position in the region and internationally. With the right strategy, methodical investment and determination, Vietnam can completely turn that dream into reality in the near future.

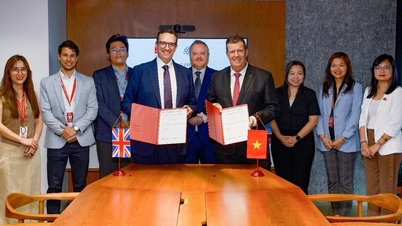

Mr. Brook Taylor - CEO and Director of VinaCapital Fund Management Company

Photo: Thien An

Platform for Vietnam to upgrade its position in the global financial value chain

The world is witnessing a strong shift in global capital flows and financial structures. Traditional financial centers such as Singapore, Hong Kong, and Dubai are not only trading places but also "financial superconnectors" - integrating technological infrastructure, flexible legal institutions, big financial data, and the ability to attract high-quality capital flows. In that context, building an international financial center in Ho Chi Minh City and Da Nang is an inevitable strategic requirement. Not only to compete in the region, the international financial center must become an indispensable component of the country's development strategy in the coming period: a place where finance - technology - institutions - data crystallize, playing the role of capital intermediary, incubating financial innovation, testing policies, and ensuring national financial sovereignty in the context of the digital economy. This is also the foundation for Vietnam to upgrade its position in the global financial value chain, shifting from the role of a "processing factory" to a "capital creation and coordination center".

Dr. Do Thien Anh Tuan

Photo: FBNV

Thanhnien.vn

Source: https://thanhnien.vn/mo-kenh-hut-von-ngoai-de-phat-trien-kinh-te-dat-nuoc-185251010165519002.htm

![[Photo] Solemn opening of the 1st Government Party Congress](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/13/1760337945186_ndo_br_img-0787-jpg.webp)

![[Photo] General Secretary To Lam attends the opening of the 1st Government Party Congress](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/13/1760321055249_ndo_br_cover-9284-jpg.webp)

Comment (0)