Orient Commercial Joint Stock Bank (OCB ) has just issued a document announcing information on the results of the early bond buyback. Specifically, OCB has bought back all 500 bonds coded OCBL2124011 early, each bond worth 1 billion VND, equivalent to a total value of 500 billion VND.

The bonds were issued on December 15, 2021, with a term of 3 years and will not mature until December 15, 2024. The interest rate is fixed at 3.2% per annum. These are non-convertible, unsecured bonds and do not come with warrants.

This is the 15th batch of bonds that OCB has bought back before maturity since the beginning of the year. Previously, OCB spent about VND12,400 billion to buy back all 14 batches of bonds before maturity. The bonds all have a term of 3 years, issued between 2021 and 2022.

On the same day, Southeast Asia Commercial Joint Stock Bank ( SeABank ) also issued a document announcing information on the results of early bond buyback.

Accordingly, SeABank spent 1,700 billion VND to buy back all 2 lots of bonds coded SSBL2124014 and SSBH2124015 ahead of schedule. The 2 lots of bonds were issued consecutively on December 15 and 16, 2021. The term is 3 years and will not mature until the end of 2024.

Of which, the bond lot SSBL2124014 has a total issuance value of 700 billion VND and the bond lot code SSBH2124015 has a total issuance value of 1,000 billion VND.

The above two bonds have a fixed interest rate of 3.6%/year. They are non-convertible bonds, unsecured and without warrants. They are issued in the form of book entries. The purpose of issuance is to increase the working capital of SeABank.

2 bond codes were bought back by SeABank before maturity.

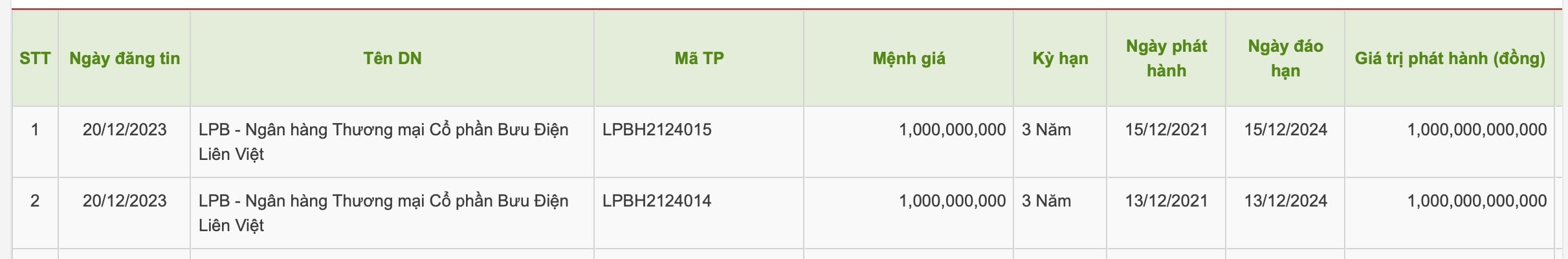

Previously, on December 20, Lien Viet Post Joint Stock Commercial Bank ( LPBank ) also issued a document announcing the repurchase of all 2,000 billion VND of 2 bond lots with codes LPBH2124014 and LPH2124015.

Bond code LPBH2124014 was issued on December 13, 2021, with a term of 3 years and will not mature until mid-December 2024. This is a non-convertible, unsecured bond, without warrants and is not a subordinated debt of the issuer.

The actual issuance interest rate is 3.3%/year. The purpose of issuance is to increase LPBank's operating capital scale, supplement medium and long-term mobilized capital to meet customers' medium and long-term loan needs. Code LPH2124015 was issued on December 15, 2021, with a term of 3 years, meaning it will not mature until December 15, 2024.

LPBank spends 2,000 billion VND to buy back 2 lots of bonds before maturity.

Vietnam International Commercial Joint Stock Bank (VIB) also conducted an early repurchase of all 2 bond lots with codes VIB_BOND_L1_2017_002 and VIB2128020 on December 13, 2023.

Specifically, the bond lot VIB_BOND_L1_2017_002 has a total of 800 bonds with a face value of 1 billion VND/bond, equivalent to a total value of 800 billion VND. The bond lot was issued on December 13, 2017, with a term of 7 years and will not mature until December 13, 2024.

The VIB2128020 bond lot has a total of 500 bonds with a face value of 1 billion VND/bond, the total issuance value is 500 billion VND. The bond issuance interest rate is 7.3%/year. The issuance date is December 13, 2021, with a term of 7 years. That is, this bond lot will not mature until December 13, 2028.

In 2023, VIB has continuously bought back bonds before maturity. According to information from the Hanoi Stock Exchange, from January 2023 to now, VIB has had a total of 16 early bond buybacks, with a total buyback value of VND 5,800 billion .

Source

![[Photo] Hanoi morning of October 1: Prolonged flooding, people wade to work](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/1/189be28938e3493fa26b2938efa2059e)

![[Photo] The 1st Congress of Phu Tho Provincial Party Committee, term 2025-2030](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/1507da06216649bba8a1ce6251816820)

![[Photo] Panorama of the cable-stayed bridge, the final bottleneck of the Ben Luc-Long Thanh expressway](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/391fdf21025541d6b2f092e49a17243f)

![[Photo] President Luong Cuong receives President of the Cuban National Assembly Esteban Lazo Hernandez](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/4d38932911c24f6ea1936252bd5427fa)

Comment (0)