SGGPO

The Vietnamese stock market on September 29th maintained the 1,150 point mark despite a sharp drop in liquidity and its lowest level in 3 months. In particular, the strong increase of the three Vingroup stocks contributed to supporting the index quite a bit.

|

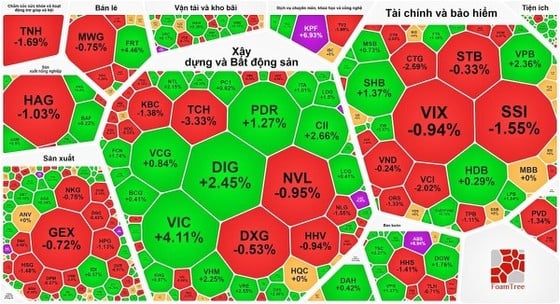

| VN-Index maintains the 1,150 point mark at the end of September 2023 |

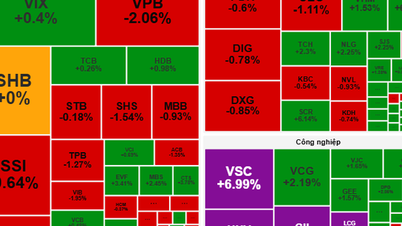

Investors holding money are still hesitant to buy stocks because of the previous strong fluctuations. In addition to the three Vingroup stocks that increased strongly, VHM increased by 2.25%, VIC increased by 4.11%, VRE increased by 2.55%, VPB increased by 2.36%, BCM increased by 3.42%, contributing to helping the index maintain its green color.

Other stock groups have differentiation within the industry, but the real estate stock group outside the Vingroup trio also has some stocks that have increased well such as: CII increased by 2.66%, DIG increased by 2.45%, PDR increased by 1.27%...

The securities group mainly leaned towards red, in which SSI decreased by 1.55%, VCI decreased by 2.02%, CTS decreased by 2.03%, VIX, VND decreased by nearly 1%, ORS decreased by 1.33%... Only a few stocks remained green, SBS increased by 1.2%, FTS increased by 1.16%.

Banking stocks were more inclined to green with ABB up 1.18%, EIB up 2.87%,SHB up 1.37%, LPB up 1.84%; ACB, MSB, HDB up nearly 1%. On the contrary, STB, VCB, CTG, TPB decreased.

At the end of the trading session, VN-Index increased by 1.72 points (0.15%) to 1,154.15 points with 277 stocks increasing, 212 stocks decreasing and 61 stocks remaining unchanged. At the end of the session at Hanoi Stock Exchange, HNX-Index also increased by 1.85 points (0.79%) to 236.35 points with 108 stocks increasing, 74 stocks decreasing and 68 stocks remaining unchanged. Liquidity continued to decline sharply, with the total trading value in the whole market being only about 16,300 billion VND, of which the HOSE floor reached less than 14,000 billion VND.

Foreign investors sold off for the second consecutive session with a total net selling value of nearly 537 billion VND on the HOSE floor. The stocks with the most net sales all decreased in points, including CTG (89.46 billion VND), VCI (76.54 billion VND), HPG (51.90 billion VND), DPM (47.12 billion VND)...

Source

![[Photo] Prime Minister Pham Minh Chinh chairs a meeting of the Government Standing Committee to remove obstacles for projects.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/06/1759768638313_dsc-9023-jpg.webp)

![[Photo] Prime Minister Pham Minh Chinh chaired a meeting of the Steering Committee on the arrangement of public service units under ministries, branches and localities.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/06/1759767137532_dsc-8743-jpg.webp)

Comment (0)