Unprecedented wave of wealth creation

2024 witnessed the explosion of large funding rounds from Anthropic, Safe Superintelligence, OpenAI, Anysphere... raising AI business valuations to record levels and creating huge fortunes on paper.

According to CB Insights, there are now 498 “AI unicorns” – those valued at $1 billion or more – with a combined value of $2.7 trillion. Of these, 100 were founded since 2023. More than 1,300 other AI startups have surpassed the $100 million valuation mark.

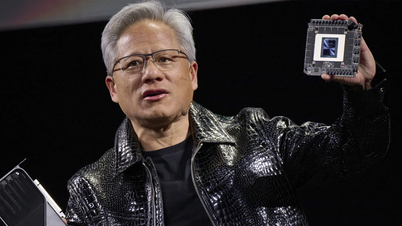

It’s not just private companies that are seeing a surge in shares, with Nvidia, Meta, Microsoft and other AI-related companies also seeing a surge. Combined with providers of data infrastructure, computing power and the need to hire AI engineers with sky-high salaries, the entire industry is creating personal wealth on an unprecedented scale.

Researcher Andrew McAfee (Massachusetts Institute of Technology) commented: "The past 100 years have never witnessed wealth creation on this scale and speed."

In March, Bloomberg estimated that the four largest private AI companies alone had created at least 15 billionaires with a combined net worth of $38 billion, a number that continues to grow as new unicorns emerge.

Some notable faces include Mira Murati - leaving OpenAI in September 2023 to found Thinking Machines Lab, raising $2 billion in seed funding in July 2024, valuing the company at $12 billion; Anthropic AI negotiating to raise $5 billion in funding, valuing it at $170 billion, triple that of March, CEO Dario Amodei and six other founders are about to become billionaires; Anysphere reached a valuation of $9.9 billion in June and quickly received a valuation proposal of $18-20 billion, which could put 25-year-old CEO Michael Truell on the billionaire list.

Most AI assets are held in private companies, making it difficult for founders and shareholders to sell their shares immediately. Unlike the dot-com boom of the late 1990s, AI startups can stay private longer thanks to capital from venture capital funds, sovereign wealth funds, family offices, and tech investors.

However, a rapidly growing secondary market is paving the way for shares to be traded between investors, providing liquidity through secondary sales or public tender offers. Some founders also borrow against the value of their shares.

OpenAI is negotiating a secondary sale of shares to employees at a valuation of $500 billion, up from $300 billion in March. Mergers and acquisitions also provide liquidity. CB Insights counts 73 liquid deals since 2023, including IPOs, reverse mergers, and majority stake sales.

Silicon Valley takes center stage

The AI boom is now concentrated in the San Francisco Bay Area, reminiscent of the dot-com era. By 2024, companies there will have received more than $35 billion in venture capital.

San Francisco now has 82 billionaires, surpassing New York (66), according to New World Wealth and Henley & Partners. The Bay Area's millionaire population has doubled in a decade, compared with 45% in New York.

The luxury real estate market is also heating up: a record number of homes sold for over $20 million in San Francisco last year, according to Sotheby's International Realty.

Rising home prices, rents, and housing demand—largely driven by AI—reverse the decline of the past few years. “The people who know how to start, fund, and grow tech companies are here,” McAfee said. “For the last 25 years, people have predicted that Silicon Valley would lose its status, but it’s still the center. Silicon Valley is still Silicon Valley.”

Over time, as AI companies go public, private assets will become more liquid, creating huge opportunities for the asset management industry.

Private banks, brokerage firms, and independent advisors are all looking to tap into the AI elite.

However, the majority of assets remain “locked” in private companies, limiting the ability to immediately allocate them to management accounts.

Simon Krinsky, CEO of Pathstone, predicts that the AI-driven super-rich will follow the model of the dot-com generation: initially reinvesting in technology through personal networks, then, realizing the risks of asset concentration, seeking professional management services to diversify.

In the 2000s, many dot-com entrepreneurs also started their own asset management companies, such as Jim Clark (Netscape) who helped found MyCFO.

Krinsky believes that AI founders will soon see the value of traditional services such as tax advice, inheritance and succession planning, philanthropy and investing. “After the ‘bruising’ of the early 2000s, billionaires appreciate diversification and hiring professional managers to protect themselves,” he said. “I predict the same will happen with the AI team.”

(According to CNBC)

Source: https://vietnamnet.vn/tri-tue-nhan-tao-tao-ra-ty-phu-moi-voi-toc-do-chua-tung-co-2430860.html

![[Photo] Hanoi morning of October 1: Prolonged flooding, people wade to work](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/1/189be28938e3493fa26b2938efa2059e)

![[Photo] President Luong Cuong receives President of the Cuban National Assembly Esteban Lazo Hernandez](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/4d38932911c24f6ea1936252bd5427fa)

![[Photo] Panorama of the cable-stayed bridge, the final bottleneck of the Ben Luc-Long Thanh expressway](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/391fdf21025541d6b2f092e49a17243f)

Comment (0)