One-third of Tri Viet’s assets are being invested in MWG shares and have temporarily recorded large profits. The company is also among the few businesses planning to buy back its own shares.

Tri Viet plans to buy back 8 million treasury shares, "bet" big on MWG shares

One-third of Tri Viet’s assets are being invested in MWG shares and have temporarily recorded large profits. The company is also among the few businesses planning to buy back its own shares.

|

| Tri Viet is among the few businesses that have bought back its own shares in recent years. |

Rare businesses buy treasury stocks

The Board of Directors of Tri Viet Asset Management Corporation (code TVC - HNX floor) has implemented the repurchase of 8 million shares of the company itself, equivalent to more than 6.7% of the charter capital of this enterprise.

The transaction is expected to be carried out through order matching and/or negotiation in 2024 after the State Securities Commission has notified it of the receipt of full documents reporting the share buyback and the company has made information disclosure as prescribed. The transaction period shall not exceed 30 days from the date of commencement of implementation.

The maximum share buyback price is VND 14,600/share, more than 1.4 times higher than the closing price on November 1, 2024 (VND 10,100/share).

According to current regulations in the Securities Law and the Enterprise Law issued in 2019 and both effective from January 1, 2021, organizations when repurchasing shares from shareholders will have to carry out procedures to reduce charter capital corresponding to the total value calculated by the par value of the shares repurchased by the company within 10 days from the date of completion of payment for the share repurchase.

This is also the reason why the number of treasury stock buyback transactions is no longer chosen by many businesses. Since the beginning of the year, there have been 4 businesses buying back from resigned employees. Vinhomes and Tri Viet are two rare organizations buying back treasury stocks from the market. Vinhomes' transaction is expected to record a historic transaction value (over 13,000 billion VND). From October 23, 2024 to November 3, Vinhomes is estimated to have disbursed over 3,000 billion VND to buy back 76.86 million VHM shares bought back, equivalent to 20.77% of the registered treasury shares.

With 8 million treasury shares expected to be bought back, Tri Viet estimates that it will spend a maximum of nearly 11.7 billion VND. Compared to the original plan, Tri Viet's treasury stock purchase plan has changed.

Previously, on June 20, 2024, the company's Board of Directors approved adjustments to a number of contents in the share buyback plan to reduce charter capital, including increasing the number to 8 million shares, the maximum price to 14,600 VND/share. Accordingly, the total number of shares registered for buyback was adjusted to 8 million shares, instead of registering to buy back the first phase of 5 million shares as originally planned. In addition, the maximum buyback price was also adjusted from 9,968 VND/share to 14,600 VND/share. Thus, instead of buying back at below par value, the maximum buyback price that Tri Viet accepts is up to 46% higher.

At the 2024 Annual General Meeting of Shareholders, Ms. Nguyen Thi Hang, Chairwoman of the Board of Directors of the company, said that the long-term major policy of the board of directors is to buy back shares to reduce capital and this can be considered a form of "dividend". According to Ms. Hang, it is even possible to create a surplus of equity if purchased below book value. The company's leaders also mentioned the possibility of buying back shares every 6 months.

Invest 1/3 of assets in MWG stocks, temporary big profit

Tri Viet suffered a heavy loss of VND887 billion in 2022. In addition to the unfavorable financial investment segment, which recorded revenue and expenses of VND72 billion and VND473 billion, respectively, the company also set aside hundreds of billions of dong in provisions for bad debts.

Although it returned to profit in 2023, in order to optimize the company's profits, the Board of Directors approved not to set aside funds and pay dividends in 2023. In 2022, Tri Viet also did not pay dividends. The most recent time, this enterprise paid the first interim dividend in 2021 at a rate of 8% in August 2021. Meanwhile, according to the original plan, the maximum dividend in 2021 was not more than 20% of charter capital. On March 30, 2022, the Board of Directors approved the plan to pay the second interim cash dividend in 2021 at a rate of 10%, but has not yet implemented it because "considering the distribution at the appropriate time, because otherwise it may lead to negative equity".

In the third quarter of 2024, the company achieved more than VND 85 billion in revenue, an increase of 613% over the same period last year. However, this period the company no longer had a refund like the same period last year, so the profit after tax decreased by 21% to VND 127 billion. Accumulated for 9 months, revenue reached VND 175 billion, an increase of 483% over the same period. Profit after tax reached VND 286 billion, an increase of 18%.

According to Chairman of the Board of Directors Nguyen Thi Hang, the company has focused on core investment activities, anticipated and made good use of market fluctuations, and built an investment portfolio in line with its strategy and plan. The company also closed a portion of its portfolio in line with its year-end operations, taking advantage of cash dividends from the stocks in its portfolio.

As of September 30, Tri Viet's asset size was approximately VND2,500 billion, an increase of VND520 billion compared to the beginning of the year. Capital was increased mainly thanks to retained earnings and increased margin loans at securities companies, using financial leverage in investing in the market.

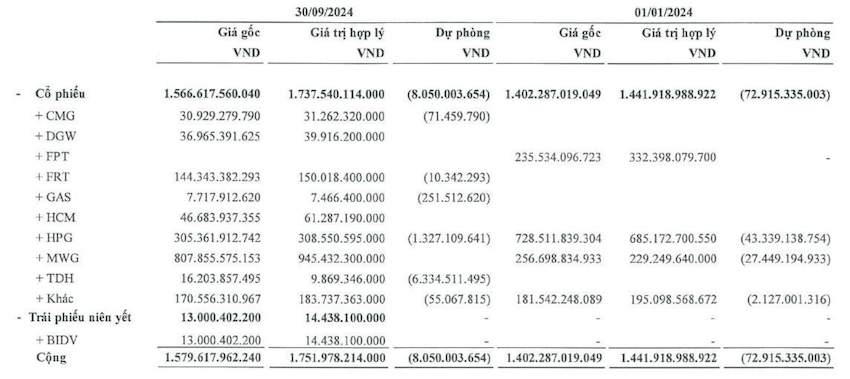

|

| Value of securities traded at Tri Viet. |

By the end of the third quarter, Tri Viet's investment portfolio value exceeded VND1,520 billion. Of which, MWG shares accounted for the largest proportion with the original investment price equal to nearly 1/3 of total assets. Tri Viet spent VND807 billion to buy MWG shares and is temporarily making a profit of nearly VND140 billion. On the other hand, this company reduced the value of its holdings of Hoa Phat's HPG shares from VND728 billion to VND305 billion. This is also the stock that Tri Viet sold the most in the year in its portfolio.

Source: https://baodautu.vn/tri-viet-du-tinh-mua-lai-8-trieu-co-phieu-quy-cuoc-lon-vao-co-phieu-mwg-d229074.html

![[Photo] Prime Minister Pham Minh Chinh chairs the Government's online conference with localities](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/5/264793cfb4404c63a701d235ff43e1bd)

![[Photo] Prime Minister Pham Minh Chinh launched a peak emulation campaign to achieve achievements in celebration of the 14th National Party Congress](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/5/8869ec5cdbc740f58fbf2ae73f065076)

![[VIDEO] Summary of Petrovietnam's 50th Anniversary Ceremony](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/10/4/abe133bdb8114793a16d4fe3e5bd0f12)

![[VIDEO] GENERAL SECRETARY TO LAM AWARDS PETROVIETNAM 8 GOLDEN WORDS: "PIONEER - EXCELLENT - SUSTAINABLE - GLOBAL"](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/7/23/c2fdb48863e846cfa9fb8e6ea9cf44e7)

Comment (0)