Oil prices fluctuate

According to the Vietnam Commodity Exchange, the world raw material market started the new week in the green, led by the strong increase of the energy group. Most notably, crude oil prices recovered despite OPEC+'s decision to increase production.

Of which, Brent oil price returned to the mark of 65.47 USD/barrel, corresponding to an increase of 1.46%; while WTI oil price also recorded a recovery of 1.33%, climbing to the mark of 61.69 USD/barrel.

However, in the following trading session, oil prices moved in opposite directions when the two crude oil products had two slight adjustments of less than 0.1%. Of which, Brent oil price retreated to 65.45 USD/barrel, corresponding to a decrease of 0.03%; while WTI oil price inched up to 61.73 USD/barrel, recording an increase of 0.06%.

Analysts at ING bank said that OPEC+'s production increase of 137,000 barrels per day was contrary to market expectations of a stronger increase, showing the alliance's caution in the face of a forecast of global oversupply in the fourth quarter of 2025 and 2026.

The recent Short-Term Energy Outlook report by the US Energy Information Administration (EIA) further reinforced the above forecast when it said that crude oil production in the US this year is expected to reach 13.53 million barrels/day, up 0.6% from the previous forecast. This contributes to the increase in global oil production, thereby continuing to put pressure on oil prices.

On the other hand, rising demand for crude oil, especially in China and India, has partly supported the price increase. Accordingly, India's fuel demand in September increased by 7% compared to the same period last year. Meanwhile, market reports show that by the end of 2026, Chinese oil and gas enterprises are expected to add about 169 million barrels of oil to the national reserve - a factor that can contribute to maintaining stable demand in the medium term.

Oil prices hit their highest level since the beginning of the month

Next in the trading session on October 8, oil prices continued to "heat up". According to MXV, the tense developments between Russia and Ukraine once again pushed world oil prices to their highest level since the beginning of the month.

Specifically, Brent oil price climbed to 66.25 USD/barrel, equivalent to an increase of about 1.22%; while WTI oil price also recorded an increase of about 1.33%, stopping at 62.55 USD/barrel. These are the two highest prices since the beginning of this month.

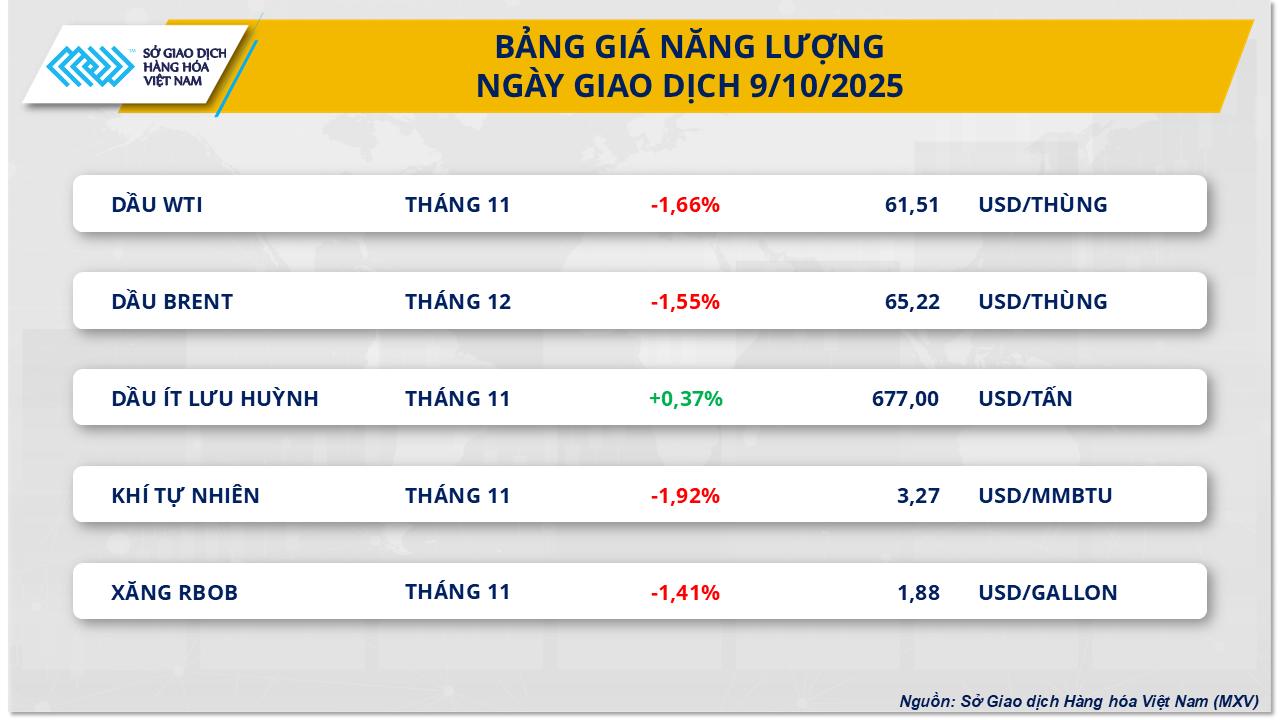

By October 9, red covered most of the key commodities in the energy group. In particular, Brent oil price returned to the mark of 65.22 USD/barrel, corresponding to a decrease of 1.55%; while WTI oil price also recorded a decrease of about 1.66%, falling to the mark of 61.51 USD/barrel.

The global oil market is strongly influenced by positive prospects as geopolitical tensions in the Middle East are gradually cooling down. Accordingly, Israel and Hamas forces have reached a consensus on the first phase of the peace plan.

The positive signals in the Gaza Strip also increase expectations for the security and stability of oil supplies from the Middle East. This further reinforces the prospect of oversupply that many major organizations have forecast for the rest of the year, in the context of global supply still on the rise, creating significant pressure on world oil prices.

At the same time, cautious sentiment also increased among investors as the US Congress has yet to pass a bill to extend the budget to reopen the government, creating a risk-averse sentiment in the market.

Recorded today, October 11 (Vietnam time), Brent oil price was at 63.77 USD/barrel, down 2.22% (equivalent to a decrease of 1.45 USD/barrel). Similarly, WTI oil price was at 59.88 USD/barrel, down 2.68% (equivalent to a decrease of 1.65 USD/barrel).

Analysts say the downward trend in crude oil prices could continue if geopolitical tensions continue to ease and demand recovers slowly.

Source: https://hanoimoi.vn/tuan-giang-co-nhay-mua-cua-gia-dau-719287.html

![[Photo] Discover unique experiences at the first World Cultural Festival](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/11/1760198064937_le-hoi-van-hoa-4199-3623-jpg.webp)

![[Photo] General Secretary attends the parade to celebrate the 80th anniversary of the founding of the Korean Workers' Party](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/11/1760150039564_vna-potal-tong-bi-thu-du-le-duyet-binh-ky-niem-80-nam-thanh-lap-dang-lao-dong-trieu-tien-8331994-jpg.webp)

Comment (0)