Gold is facing challenging headwinds, raising concerns that the decline will continue.

The gold market ended the first half of this year significantly lower than at the end of last year and weak investor sentiment suggests further price declines are likely in the coming period as the precious metal faces challenging headwinds.

Christopher Vecchio, head of futures and forex at Tastytrade.com , said it was not surprising that investors were moving away from gold as a solid economic backdrop continued to support risk assets.

There are many concerns in the market, but so far none of them have materialized, he said. So investors feel more comfortable taking on more risk.

While gold appears to be holding support around $1,900 an ounce, any rebound is likely to be more of a profit-taking opportunity than a sustained rally, the expert said. “Gold is facing a difficult environment as real yields rise and will remain so for a long time,” Vecchio said.

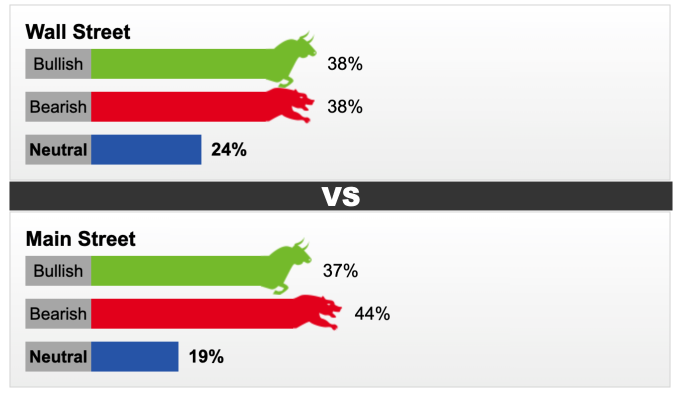

This week, 21 Wall Street analysts participated in Kitco’s survey, of which only 38% predicted the market could rise. Five analysts (24%) forecast sideways prices, while the rest forecast lower.

While Wall Street analysts are evenly split between bullish and bearish, retail investors remain bearish. Of the 845 respondents in the online poll, only 37% expect gold to rise next week, 44% see it falling and 19% see it moving sideways.

Kitco's gold price forecast for the week of July 3-7. Photo: Kitco News

Marc Chandler, managing director at Bannockburn Global Forex, said he is bullish on gold due to recent short-term moves in currency markets. “I expect a stronger dollar and higher US interest rates. However, gold momentum indicators appear to be bottoming and technical indicators suggest a possible recovery in the near term,” he said.

However, Chandler said he prefers to hold a short position and could do so if gold recovers to around $1,920-$1,930.

Adrian Day, chairman of Adrian Day Asset Management, is cautious about the upside, explaining that while gold prices could see a modest rise next week, the precious metal remains caught in a tug-of-war between multiple market factors.

“There are still risks in the short term as the gold market does not appear to have fully priced in future interest rate hikes in the US and elsewhere, while the large financing needs of the US government will drain liquidity and hurt gold,” he said.

Gary Wagner, editor of TheGoldForecast.com , also said that improving economic conditions will continue to put pressure on gold prices. "A strong economy, low unemployment and rising yields will confirm to the Fed that the US economy can absorb further rate hikes," he said. "This will put pressure on gold prices," he added.

However, on the flip side, a factor supporting gold prices is rising geopolitical uncertainty. Most analysts bullish on gold have noted that increased uncertainty and risk will support gold as a safe-haven asset.

Minh Son ( according to Kitco )

Source link

![[Photo] Keep your warehouse safe in all situations](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/1/3eb4eceafe68497989865e7faa4e4d0e)

![[Photo] Hanoi morning of October 1: Prolonged flooding, people wade to work](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/1/189be28938e3493fa26b2938efa2059e)

![[Photo] President of the Cuban National Assembly visits President Ho Chi Minh's Mausoleum](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/1/39f1142310fc4dae9e3de4fcc9ac2ed0)

Comment (0)