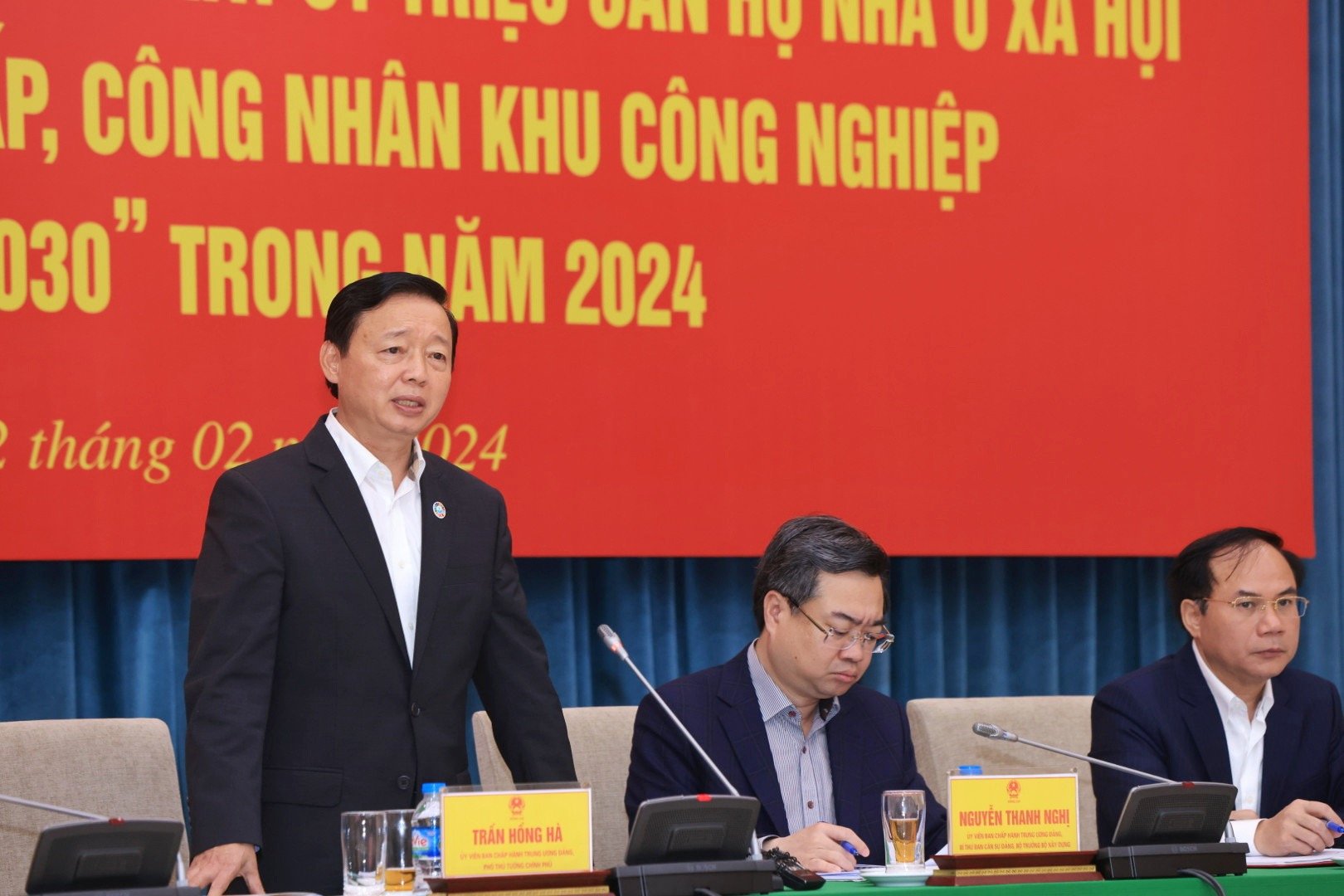

On the morning of February 22, the Ministry of Construction held a conference to deploy the Project of 1 million social housing units, with the participation of Deputy Prime Minister Tran Hong Ha.

Deputy Prime Minister Tran Hong Ha reminded that disbursement of loans for social housing projects is very slow.

Presenting a series of concerns from the implementation, Mr. Vuong Quoc Toan, Chairman of the Board of Directors of Lan Hung Group - a company specializing in social housing projects, said that he had "traveled" to dozens of provinces, but only received approval from 11 provinces, because the legal procedures related to land were too complicated and took too long.

This enterprise proposed that it is necessary to stipulate that provinces must allocate land for social housing. For example, Bac Ninh or Binh Phuoc only need to allocate 100 hectares for social housing, which will invest in 30,000 apartments, exceeding demand.

In particular, the "very difficult" access to loans has prevented the VND120,000 billion preferential credit package from being implemented. "I have met with many banks, but they are not interested. The reason is that the interest rate support is 1.5 - 2%, but when completing the procedures to submit to the State Bank to get the interest rate difference support, it takes a long time. Therefore, the disbursement is not worth much, like a grain of sand compared to the demand," Mr. Toan said and cited that the enterprise has sold more than 700 social housing units, but only more than 100 units have received loans.

Mr. Vuong Quoc Toan also suggested that the State Bank of Vietnam recalculate, possibly reducing the interest rate for home buyers to 5%, and for investors to 10%, "but must lend quickly". When it is social housing, has an investment license, and meets the conditions for lending, it should not be submitted to too many levels. This enterprise even said that there must be a "grease" fee to quickly implement the project.

On the other hand, the price approval and approval of subjects takes years. Any procedure takes 6 months or 1 year to complete, but incentives are only calculated for 3 years, while projects take 5-7 years. "The Minister of Finance said that the policy is to approve every social housing project, but in reality, our company sent a document requesting price approval for 5 months without approval, and 5 department directors but none of them dared to sign," Mr. Toan said.

Social housing businesses attend the conference

In response to the difficulties in accessing capital, Deputy Governor of the State Bank of Vietnam Pham Thanh Ha said that the VND120,000 billion package was not provided by the State Bank, but by commercial banks deciding to lend with preferential terms and interest rates. “There is no review or compensation procedure from the State Bank,” Mr. Ha affirmed.

Listening to the opinions of businesses, Deputy Prime Minister Tran Hong Ha asked: "How much of the 120,000 billion VND package has been disbursed so far?" According to the report, only 5 social housing projects in 5 localities have been disbursed with capital of about 416 billion VND.

Why is disbursement so slow?

“The issue of ‘where is the money’ is extremely important. We must ask why other sectors disburse funds very quickly, but this sector disburses funds extremely slowly. The Prime Minister is also very dissatisfied,” the Deputy Prime Minister stated.

According to the Government leader, businesses say it is difficult to access loans. Commercial banks also have to calculate profits, so the preferential policy of reducing interest rates by 1.5 - 2% may not be in line with the laws of the market economy, while loans in other sectors are 1.5 - 2% higher.

“The State Bank needs to recalculate, it cannot act arbitrarily, there is a lot of money left idle but it cannot be lent. It is necessary to review where the policy is unreasonable, it is possible to consider the state subsidizing commercial banks so that they can implement the policy of lowering lending interest rates,” the Deputy Prime Minister suggested.

At the conference, Deputy Minister of Construction Nguyen Van Sinh added that banks are very active in promoting and removing loan problems. However, the slow disbursement is due to two problems. One is that there are only a few projects being implemented. Two is that through working, banks said that some businesses have bad debts, which affects disbursement. The Prime Minister also asked banks to consider removing problems for each specific project.

According to the report, 27 localities have announced a list of 63 projects eligible for loans under the 120,000 billion VND credit program, with a loan demand of more than 27,966 billion VND.

However, only 5 social housing projects in 5 localities have been disbursed with capital of about 416 billion VND.

Source link

![[Photo] Prime Minister Pham Minh Chinh inspects and directs the work of overcoming the consequences of floods after the storm in Thai Nguyen](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/08/1759930075451_dsc-9441-jpg.webp)

![[Photo] Prime Minister Pham Minh Chinh attends the World Congress of the International Federation of Freight Forwarders and Transport Associations - FIATA](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/08/1759936077106_dsc-0434-jpg.webp)

![[Photo] Closing of the 13th Conference of the 13th Party Central Committee](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/08/1759893763535_ndo_br_a3-bnd-2504-jpg.webp)

Comment (0)