This is a golden opportunity to turn "underground" capital into a driving force for development, affirming the country's position on the global digital economic map.

"Underground" capital flow: Investors are worried

Having been involved in the crypto asset market for nearly a decade, Ms. Nguyen Thu Trang has repeatedly struggled to see the huge capital flow, estimated at tens of billions of USD, operating out of control, seeping through unofficial trading channels. For long-time investors like her, this legal "gray zone" is not only a risk in terms of assets, but also a lack of a legal protection mechanism, directly affecting confidence in the market.

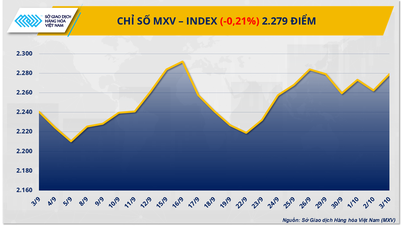

In fact, Vietnam is currently one of the hot spots of the global crypto-asset market. International reports and domestic analysis estimate that about 17 million Vietnamese people participate in digital asset transactions - equivalent to nearly one-fifth of the adult population. The total annual trading volume even exceeds the 100 billion USD mark, demonstrating the scale and potential for outstanding growth. However, these huge numbers pose strong management pressure, as most transactions still take place through foreign exchanges or channels that are not within the legal framework. This situation not only poses great risks to individual investors, making them vulnerable to scams and unpredictable fluctuations, but also causes a significant loss of revenue for the State budget, while missing out on important capital flow management opportunities to promote the sustainable development of the digital economy.

Vietnam legalizes digital asset market, attracting $100 billion in capital flows

Unable to let this capital flow freely, the Government has taken strong action. Resolution No. 05/2025/NQ-CP dated September 9, 2025 officially approved the pilot of the crypto asset market for 5 years. This is a milestone marking the introduction of crypto asset activities into the legal framework, with three core principles: "prudence - control - transparency". The goal is not only to protect investors, manage risks but also promote the development of domestic financial technology.

New Playground: Investors must be protected from A-Z

The spirit of Resolution 05 is a commitment to a "clean" market, where transparency must originate from the technology platform itself and public reporting of operations. Accordingly, pilot exchanges will no longer be allowed to "hide" information but must clearly disclose the prospectus, shareholder structure, digital asset custody mechanism, and incident handling process.

In particular, the Resolution sets extremely high technical security standards for information technology (IT) systems. Exchanges must comply with smart contract auditing, proof of reserves, periodic security reporting, and real-time public dashboard display.

Vietnam is currently one of the hot spots of the global crypto asset market.

From an expert perspective, market expert Tran Manh Hung said that smart contract auditing, proof of reserves and regular security reports will be the standards that international investors value. According to him, transparency in technology and new custody processes are key factors for financial giants to feel secure in cooperating.

In addition to the transparency of the exchange, investor protection is also reinforced by a solid "defense layer" from the State. This is no longer the sole task of the exchange but an inter-sectoral responsibility. Resolution 05 has clearly assigned coordination tasks between the Ministry of Finance, the State Bank and the Ministry of Public Security . Regulations on KYC (Know Your Customer) and AML/CFT (Anti-Money Laundering/Anti-Terrorist Financing) will be strictly enforced, especially with large transactions or those showing signs of abnormality. This requires a mechanism for rapid information sharing, the application of advanced monitoring technology and a clear incident handling process so that all cash flows are closely monitored.

Three pillars shaping the future of digital capital flows in Vietnam

Vietnam develops crypto asset market

To turn Resolution 05 into a real driving force for development, Vietnam needs a strategy that balances safety and competition, management and innovation. High standards on charter capital, technology and cybersecurity are necessary to filter out weak players. However, if regulations are too strict - such as setting charter capital too high or technical requirements too strict - they can inadvertently stifle liquidity, increase transaction fees and stifle creativity. Therefore, a reasonable solution is a roadmap for increasing capital in stages, accompanied by technical support programs for domestic exchanges and startups, and policies to stimulate healthy competition.

Notably, economic and financial experts believe that the future of Vietnam's digital capital flow will be shaped by three important strategic pillars. First of all, it is necessary to complete comprehensive operating standards and investor protection mechanisms. Exchanges must audit smart contracts, publicize dashboards proving reserves, establish transparent domestic custody and incident handling procedures; and publish detailed prospectuses. Along with that, it is necessary to build an inter-industry "shield", strengthen KYC/AML/CFT enforcement, form a compensation fund and a mechanism for rapid dispute resolution. Dr. Can Van Luc emphasized: "Without a strong enough defense layer, just one major incident can create a chain effect, causing damage to investors and shaking market confidence. It is necessary to be transparent about risks and establish a sustainable protection mechanism."

Next, policies to support competition and enhance domestic capacity need to be well-focused. Encouraging service provider diversity through phased capital raising and technical assistance programs will help ensure liquidity and promote innovation. At the same time, maintaining high safety standards is also a key factor in attracting international investors.

Finally, exploiting the opportunity from tokenizing real assets (RWA) is considered a breakthrough. Tokenization models of real estate, commercial invoices or carbon credits - when ownership is standardized and independently audited - will create liquidity for traditional assets, while opening up new capital mobilization channels, contributing to promoting the green economy. This is also a global trend, where real assets are "digitized" to expand access to capital, reduce transaction costs and increase transparency.

When the three pillars mentioned above are deployed synchronously, experts predict that the impact will spread in many aspects. A clear legal framework will help Vietnam become an attractive destination in the eyes of international investment funds and large financial institutions. It is estimated that if only 5% of global capital flows into the field of real estate and commodity tokenization, Vietnam can receive an additional 5-7 billion USD of foreign capital each year. As for the domestic fintech ecosystem, the expansion of competition will create opportunities for financial technology startups to participate more deeply in the field of blockchain custody, payment and auditing. This will not only promote innovation, but also form an ancillary service market worth hundreds of millions of USD.

In terms of budget, if the digital asset market is legalized with a tax rate equivalent to that of securities (0.1% of transaction value), revenue can reach 10,000-15,000 billion VND per year, while limiting losses from illegal transactions on foreign exchanges. At the macro level, Vietnam has the opportunity to become the digital asset center of Southeast Asia, thanks to the advantages of a young population, high technology access rate and a progressive legal framework. This will be a "bridge" for digital capital to connect with traditional finance, thereby enhancing the country's position on the global digital economic map./.

Source: https://vtv.vn/viet-nam-dinh-hinh-dong-von-so-hang-chuc-ty-usd-100251004185305922.htm

![[Photo] Prime Minister Pham Minh Chinh launched a peak emulation campaign to achieve achievements in celebration of the 14th National Party Congress](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/5/8869ec5cdbc740f58fbf2ae73f065076)

![[Photo] Prime Minister Pham Minh Chinh chairs the Government's online conference with localities](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/5/264793cfb4404c63a701d235ff43e1bd)

![[Photo] Opening of the 13th Conference of the 13th Party Central Committee](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/6/d4b269e6c4b64696af775925cb608560)

Comment (0)