Banking, midcap and penny stocks are bustling

Today's trading session (August 12) marked an important milestone when the VN-Index officially surpassed the 1,600-point threshold, thanks to high cash flow and traction from bluechips in the final minutes.

After "missing" the 1,600-point mark in the previous session, the market continued to maintain its upward momentum with a series of 6 consecutive increasing sessions with stable liquidity. Technical analysis warned of pressure fluctuations around this point when trading became more cautious, especially after the unexpected fluctuations on August 5 and when many leading stocks were in the overbought RSI zone (the ratio between the average number of days of increase compared to the average price of days of decrease). However, the outlook is still positive if the cash flow remains stable and the demand is strong enough to maintain the breakout, although the increase will have some tug-of-wars.

The Stochastic Oscillator and MACD indicators continued to send buy signals, reinforcing the possibility of maintaining a sustainable uptrend. During the session, the VN-Index fluctuated strongly around the 1,600-point mark from the beginning due to divergence pressure, but buying pressure in the large-cap group helped the index bounce back at the end of the session.

At the end of the session, the HOSE floor had 176 stocks increasing and 156 stocks decreasing. VN-Index increased by 11.36 points (+0.71%) to 1,608.22 points. Liquidity reached more than 1.64 billion units, worth VND45,429 billion, equivalent to the previous session; of which negotiated transactions accounted for more than 34.1 million units, worth VND781 billion.

The banking group attracted attention with LPB increasing 6.3% to 38,050 VND, HDB +3.6% to 28,900 VND, BID +3.2% to 41,500 VND. The codes FPT, CTG, HPG, DGC, MBB, MSN, VJC increased slightly from 1% to 2.4%. On the opposite side, SSI decreased 2%, TCB, VHM,ACB , TPB, VIB lost from 0.1% to 1.97%.

The mid- and small-cap group accelerated, with many codes hitting the ceiling such as VOS, CII, KDH, VGC, POW, VSC, HAH, TAL, DHA. CII matched more than 69 million units, with a ceiling buy surplus of more than 6.1 million; POW matched 39.6 million units, with a ceiling buy surplus of more than 10.8 million.

HNX-Index increased, UpCoM-Index decreased

On the HNX floor, the HNX-Index increased by 0.01 point to 276.47 points, with 90 stocks increasing and 82 stocks decreasing. The matched volume reached more than 141.8 million units, worth VND3,133.6 billion; negotiated transactions reached more than 0.71 million units, worth VND17.4 billion. CEO and SHS narrowed the decline, matching 29.6 million and 20.5 million units, respectively. VGS increased by more than 4% to VND32,800, GKM increased by nearly 5% to VND4,400, TTH maintained the ceiling at VND2,800.

On UpCoM, the index decreased by 0.05 points (-0.05%) to 109.2 points, with liquidity of more than 119.6 million units, worth VND 1,668.8 billion; negotiated transactions reached 34 million units, worth VND 490 billion. AAH led the liquidity, matching 11.2 million units and increasing the ceiling to VND 4,700. MZG increased by more than 3%, G35 +5%, SGP +7%.

Derivatives and warrants both flourish

In the derivatives market, VN30F1M futures contracts increased by 11.9 points (+0.68%) to 1,749.4 points, matched more than 222,100 units, with an open volume of more than 54,500 units. In the warrant market, CHPG2406 led the liquidity with 6.4 million units, up 7.4% to VND1,750/unit; CLPB2502 matched 3.74 million units, up more than 46% to VND1,040/unit.

Source: https://phunuvietnam.vn/6-phien-tang-lien-tiep-vn-index-vuot-moc-1600-diem-cao-nhat-lich-su-20250812164408007.htm

![[Photo] Hanoi morning of October 1: Prolonged flooding, people wade to work](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/1/189be28938e3493fa26b2938efa2059e)

![[Photo] The 1st Congress of Phu Tho Provincial Party Committee, term 2025-2030](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/1507da06216649bba8a1ce6251816820)

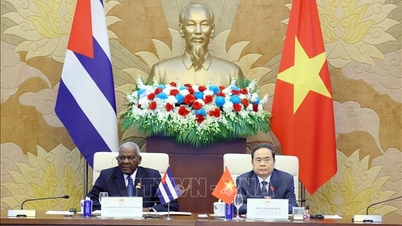

![[Photo] President Luong Cuong receives President of the Cuban National Assembly Esteban Lazo Hernandez](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/4d38932911c24f6ea1936252bd5427fa)

![[Photo] Panorama of the cable-stayed bridge, the final bottleneck of the Ben Luc-Long Thanh expressway](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/391fdf21025541d6b2f092e49a17243f)

Comment (0)