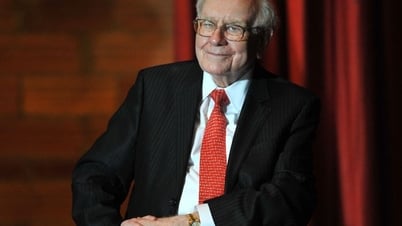

Warren Buffett's value investing strategy is the key to picking profitable stocks.

Forbes estimates that as of July 30, Warren Buffett's assets reached 117.4 billion USD, ranking 6th on the list of the richest people on the planet. One of the important factors that helped the American billionaire achieve a large fortune is the ability to choose stocks according to the value investing school.

He selects stocks based on a number of factors such as stable earning capacity, good return on equity (ROE), competent management and appropriate price peak. Value investing strategy considers the intrinsic value of stocks instead of focusing only on technical indicators such as volume, average price, etc. To determine the intrinsic value of a company, according to Warren Buffett, investors should rely on financial reports and indicators published in the reports.

To put his investment philosophy into perspective, here are some questions the 92-year-old billionaire uses when picking stocks.

How does the company operate?

Investors should look at ROE, return on equity, to see how much profit shareholders can get from their investment. This also shows the rate at which investors can earn from the stock. Buffett always looks at ROE to see how the company is performing and compares its performance with other companies in the same industry. To make an accurate assessment, investors should look at the company's ROE for at least 5 to 10 years.

How much debt does the company have?

A company with a high debt-to-equity ratio will not appeal to Buffett because most of the revenue will be used to pay down debt. The American billionaire prefers businesses that can grow revenue from shareholders' equity (SE). A company with positive equity means that the company can generate cash flow to cover its debts and does not rely on debt to maintain operations. Low debt and strong equity are two key factors in choosing potential stocks.

What is the profit margin?

Buffett looks for companies with good profit margins, specifically profit margins that are trending upward. Like ROE, he looks at profit margins over several years to determine trends. Companies that Buffett favors have management that controls operating costs well, which helps increase profit margins year after year.

What is unique about the company's products?

The American billionaire considers it risky for a company to produce products that can be replaced by another business. He believes that if a business is not different from its competitors, it is unlikely to generate outstanding profits.

Is the stock valuation attractive?

The key point in investing as pointed out by Warren Buffett is to look for companies with good fundamentals that are undervalued to find profit opportunities.

The goal of value investors like Buffet is to find companies that are undervalued compared to their intrinsic value. A potential business is evaluated by him on a number of factors such as corporate governance, revenue generation potential...

Focus on investing in yourself

Buffet has many investment principles, but one immutable principle is investing in yourself. He emphasizes that with enough knowledge and experience, anyone can become a good investor. Investing in yourself, according to the 92-year-old billionaire, includes good financial practices such as not spending more than you earn, avoiding credit card debt, saving and reinvesting...

Thao Van (according to Investopedia )

Source link

![[Photo] General Secretary To Lam chairs the meeting of the Central Steering Committee on preventing and combating corruption, waste and negativity](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/fb2a8712315d4213a16322588c57b975)

Comment (0)