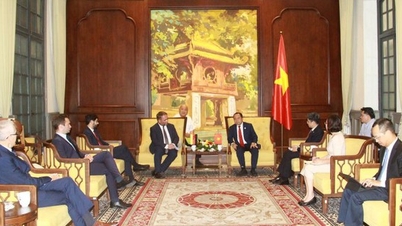

Meeting to deploy "Handbook for coordination in supporting risk handling for accounts, cards and payment acceptance units related to transactions suspected of fraud, counterfeiting and swindling" - Photo: VGP/HT

Strengthening coordination to protect customers

Speaking at the meeting to deploy the "Guidebook for coordinating support in handling risks for accounts, cards and payment acceptance units related to transactions suspected of fraud, counterfeiting and scams" on October 21, Mr. Pham Anh Tuan, Director of the Payment Department of the State Bank of Vietnam (SBV), emphasized: In recent times, Vietnam's digital payment system has developed very strongly. Vietnam is currently among the countries with the world's leading fast money transfer systems."

According to Mr. Tuan, compared to many developed countries, money transfer time in Vietnam is much shorter, making it more convenient for users, but also creating conditions for cybercriminals to take advantage. In some countries like the US, money transfer transactions via banks often have to wait until the next day to complete, unless using special express transfer systems.

Mr. Pham Anh Tuan, Director of the Payment Department of the State Bank of Vietnam (SBV) - Photo: VGP/HT

Therefore, the Vietnam Banks Association (VNBA) has initiated the issuance of the "Handbook on risk coordination process". This is an important document to specify how banks cooperate with each other in handling fraud risks.

"To comply with the consensus among banks to jointly protect customers requires high determination from both the professional departments and senior leaders at banks - those who are directly responsible to customers and society," Director Pham Anh Tuan emphasized.

Synchronize actions, efforts to create a common shield of the system

Dr. Nguyen Quoc Hung, Vice Chairman and General Secretary of the Vietnam Banking Association, said that interbank coordination is a key factor in preventing high-tech crimes. In the context of strong digital transformation, if each bank handles it individually without a cooperation mechanism, detecting and blocking fraudulent money flows will be very difficult.

Since 2023, Deputy Governor Pham Tien Dung has directed that a coordination mechanism for the entire system must be established as soon as possible. After nearly two years, four rounds of drafting, and many times of collecting opinions from member banks, NAPAS and State agencies, the Handbook will be officially issued on September 30, 2025.

Dr. Nguyen Quoc Hung, Vice Chairman and General Secretary of the Vietnam Banks Association - Photo: VGP/HT

Mr. Hung emphasized: The handbook is not a legal document, but is a unified guidance framework between banks, regulations of the Government and the State Bank, and at the same time harmonizes with the internal regulations of each credit institution.

In reality, many scams happen in minutes, with money moving through multiple accounts, making recovery nearly impossible. Without a coordinated mechanism, banks are unlikely to be able to freeze funds in time.

As stipulated in the Handbook, the maximum processing time is T+3, meaning that within 3 working days from the detection of abnormal signs, the relevant banks must exchange information and implement preventive measures. The information will be transmitted through the NAPAS system and the Association's communication channel, ensuring speed, accuracy and transparency.

According to Dr. Nguyen Quoc Hung, in the coming time, the Banking Association will continue to improve the coordination mechanism, expand data connection with the Ministry of Public Security, apply Big Data analysis technology and artificial intelligence (AI) to detect fraudulent behavior early. The ultimate goal is to build a safe and transparent financial ecosystem, in which banks, payment intermediaries and management agencies coordinate closely, maximally protecting users and market confidence.

From the perspective of a commercial bank, Ms. Do Thi Bich Mai, Permanent Deputy Director of VietinBank Operations, said that the bank has tested the internal SIMO system since September 2025, becoming a pioneer in preventing fraudulent transactions.

Ms. Do Thi Bich Mai, Permanent Deputy Director of VietinBank Operations Division - Photo: VGP/HT

The SIMO system allows for automatic screening and warning of accounts with unusual signs on multiple channels. Specifically, the on-us internal payment channel was piloted in September and officially reported to the State Bank in October. At the same time, VietinBank is coordinating with major banks such as BIDV, Agribank, MB and soon Vietcombank to expand SIMO connections in November, helping to process and warn immediately between state-owned banks.

According to Ms. Mai, the trend of transactions via e-wallets is increasing rapidly, many fraudulent money flows are transferred through wallets and then withdrawn or converted to digital assets, making control more difficult. Therefore, VietinBank recommends to soon expand the blocking mechanism for e-wallet accounts, and at the same time strengthen coordination between the State Bank, the Ministry of Public Security and banks.

According to VietinBank's internal report, in the week of October 6-12 alone, the bank reviewed more than 16,000 accounts suspected of fraud, of which about 6,000 accounts showed clear signs, related to cash flow of more than VND 11.5 billion. In addition, nearly 10,000 other transactions with a total value of about VND 26 billion were still being carried out, because customers complained late, so the blocking was not timely.

"VietinBank plans to expand the SIMO warning system to ATM channels in December 2025, then to transaction counters. The goal is to comprehensively monitor payment channels, including e-wallets, to prevent cross-bank and cross-border fraud," said Ms. Do Thi Bich Mai.

NAPAS representative, Ms. Le Thi Hong Nhung, Deputy Head of the Service Monitoring and Operation Center, said that the primary goal of the Handbook is to create a coordinated mechanism in handling accounts, cards and payment acceptance units suspected of fraud.

NAPAS representative - Photo: VGP/HT

When a suspicious account is detected, the bank can temporarily exclude that account from the system, preventing further transactions to limit the risk of spreading. This not only blocks new transactions but also supports the recovery of money for customers when the investigating agency verifies.

The coordination process also helps enrich the risk database between banks. From there, each unit can develop its own set of monitoring criteria, build early warning models and issue online warnings when customers transact to accounts with unusual signs.

Currently, NAPAS is working with the State Bank to connect to the national SIMO system, helping to warn customers immediately when they enter information to transfer money to an account on the suspect list. Customers will receive warnings directly on the interface, helping them avoid falling into fraud traps.

At the same time, NAPAS is also integrating data from the Ministry of Public Security and the State Bank of Vietnam, creating a centralized database of risk accounts, serving the investigation and prevention of financial crimes.

"Even if the first transaction cannot be blocked, the system still helps detect and block repeated transactions of fraudulent account groups, thereby minimizing damage and increasing the warning capacity of the entire system," emphasized the NAPAS representative.

Huy Thang

Source: https://baochinhphu.vn/cam-nang-dinh-huong-phoi-hop-lien-ngan-hang-ngan-chan-gian-lan-lua-dao-102251021154305507.htm

![[Photo] Da Nang residents "hunt for photos" of big waves at the mouth of the Han River](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/21/1761043632309_ndo_br_11-jpg.webp)

![[Photo] Prime Minister Pham Minh Chinh meets with Speaker of the Hungarian National Assembly Kover Laszlo](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/20/1760970413415_dsc-8111-jpg.webp)

![[Photo] Prime Minister Pham Minh Chinh received Mr. Yamamoto Ichita, Governor of Gunma Province (Japan)](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/21/1761032833411_dsc-8867-jpg.webp)

Comment (0)