During the trading week before the US election, world gold prices fluctuated strongly, at one point jumping to a record high of 2,790 USD/ounce, but fell more than 1.9% from the peak on the last day of October.

Near the US election day, world gold slid deeply from the peak of 2,790 USD/ounce

During the trading week before the US election, world gold prices fluctuated strongly, at one point jumping to a record high of 2,790 USD/ounce, but fell more than 1.9% from the peak on the last day of October.

Gold's new peak and the steep fall at the end of October

World gold experienced a volatile week. For most of the week, the upward trend dominated, bringing the gold price to a new record of 2,790 USD/ounce. However, the fall on Halloween (October 31) "blew away" almost all previous price increase efforts. In less than 24 hours, the gold price dropped more than 65 USD/ounce. At the end of the week, the world gold price closed at 2,736.2 USD/ounce, slightly up from the beginning of the week.

Although the increase was not much, this precious metal still extended its increasing streak to the fourth consecutive week. In October 2024, the world gold price increased by 100 USD/ounce, equivalent to an increase of 3.8%. Compared to the beginning of the year, gold increased by nearly 34%.

|

| Weekly world gold prices. Source: Trading Economics |

Investors continue to seek safety ahead of the upcoming US presidential election. The race remains tight, with both candidates within a 1 percentage point gap in the polls. Prolonged tensions in the Middle East have also increased the appeal of gold as a safe haven asset. Also next week, the market will receive updated data on the US consumer sentiment index from the University of Michigan. In Europe, industrial production figures, factory orders, Eurozone retail sales, etc. will provide an overview of the health of the European economy .

Meanwhile, the US Federal Reserve's (Fed) policy outlook ahead of its November 7 meeting to announce its interest rate decision is also being closely watched. According to CME Group's FedWatch tool, investors are still betting mainly on the possibility of a 25 basis point rate cut at the upcoming meeting. The remaining, only a small percentage bet on the possibility of the Fed keeping interest rates unchanged.

In addition to the Fed, the Bank of England (BOE) and the Swedish Central Bank (Riksbank) are also scheduled to make interest rate decisions next week. The BOE is expected to cut interest rates by 25 basis points after holding them steady in September. The diverging directions of major central banks could impact the greenback.

The DXY index measures the strength of the USD against six currencies of the countries that are major trading partners of the US and is calculated from the exchange rates of six currencies with the respective proportions of the euro (EUR) 57.6%, the Japanese yen (JPY) 13.6%, the British pound (GBP) 11.9%, the Canadian dollar (CAD) 9.1%, the Swedish krona (SEK) 4.2%, and the Swiss franc (CHF) 3.6%. After a sharp decline in the third quarter of 2024, the US Dollar Index (DXY) increased by 4.3% in October. Closing the trading session on November 1, the DXY index was still anchored around 104.3 points.

The purchase price of gold rings continues to exceed that of SJC gold bars.

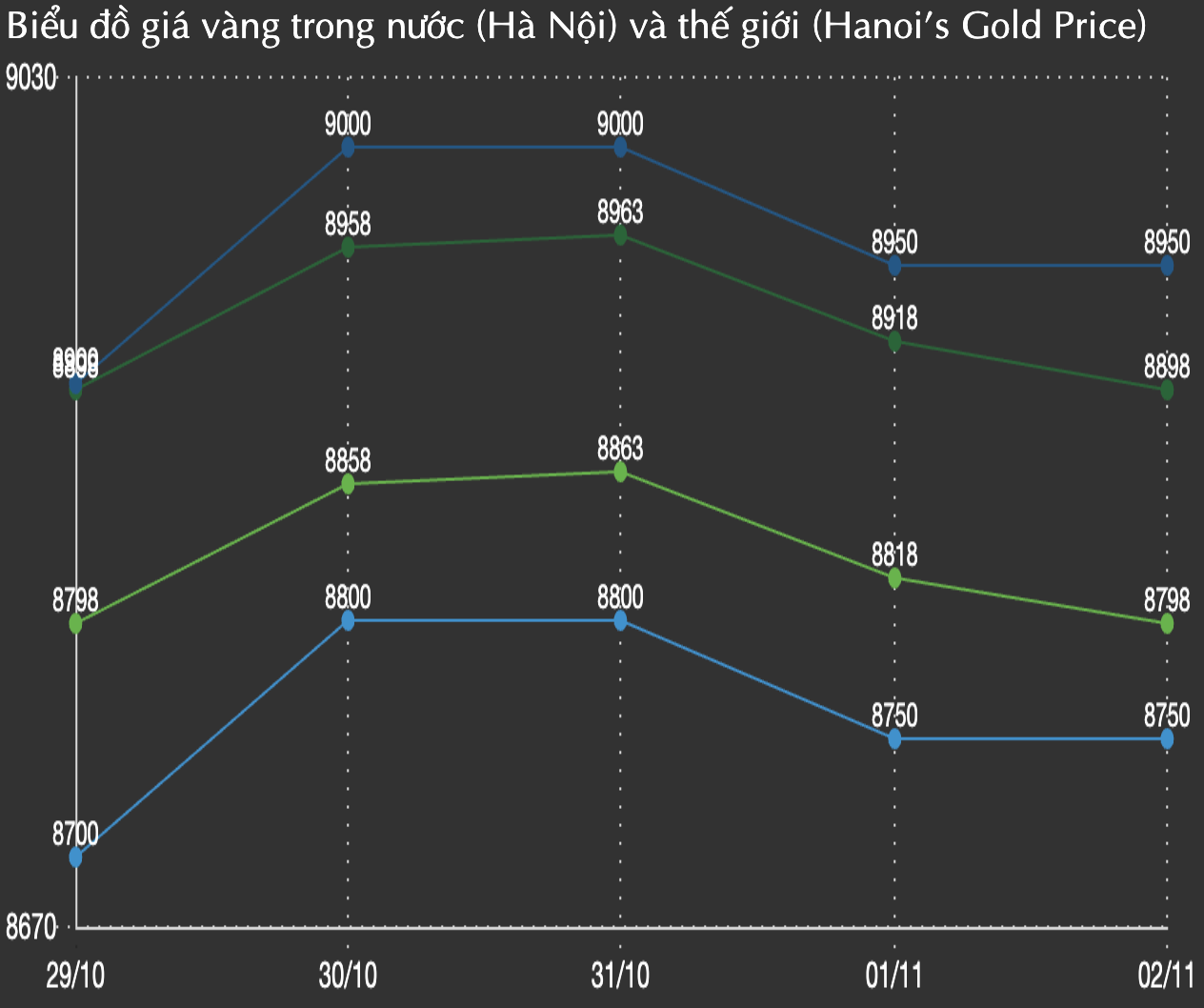

In line with the international market trend, gold prices also decreased significantly in the Vietnamese market. SJC gold bars decreased by 500,000 VND/tael on Friday, the first decrease since October 9. At Saigon Jewelry Company (SJC), the buying and selling price of gold bars is currently at 87.5 - 89.5 million VND/tael. On the buying side, SJC and most gold companies announced the buying price of 87.5 million VND/tael, also increasing correspondingly with the increase in the selling side. Particularly, Mi Hong Gold (HCMC) bought at 88.3 million VND/tael.

Similarly, the selling price of gold rings at gold companies has also been adjusted. Many gold companies such as Phu Quy, PNJ, DOJI ... listed the buying price of gold at 88 million VND/tael, continuing to be several hundred thousand VND/tael higher than the buying price of gold bars.

Meanwhile, at Saigon Jewelry Company (SJC), the selling price of gold rings is at 88.9 million VND/tael while the buying price is relatively low at 87.4 million VND/tael. Bao Tin Minh Chau gold rings are listed at 87.98 million VND/tael for buying and 89.98 million VND/tael. The difference between buying and selling prices is only about 1 million VND/tael.

|

| Gold price at Bao Tin Minh Chau decreased sharply when entering November 2024. |

The USD/VND exchange rate also increased rapidly under external pressure in October but also adjusted significantly last week. The State Bank reduced the exchange rate by 13 VND/USD during the week, down to 24,242 VND/USD. Exchange rates at commercial banks also decreased accordingly. Vietcombank is listing the exchange rate at 25,114 VND/USD (buying) and 25,454 VND/USD (selling), down 13 VND/USD compared to last week. The USD price on the free market is currently being bought at around 25,750 VND.

Source: https://baodautu.vn/can-ke-ngay-bau-cu-my-vang-the-gioi-truot-sau-tu-dinh-2790-usdounce-d229033.html

![[Photo] Prime Minister Pham Minh Chinh launched a peak emulation campaign to achieve achievements in celebration of the 14th National Party Congress](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/5/8869ec5cdbc740f58fbf2ae73f065076)

![[Photo] Prime Minister Pham Minh Chinh chairs the Government's online conference with localities](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/5/264793cfb4404c63a701d235ff43e1bd)

Comment (0)