The development adds to uncertainties related to trade tensions and the risk of a government shutdown.

After opening with an uptrend, the US stock market quickly turned down around mid-session and maintained a downtrend until the end of the trading day.

In New York, the Dow Jones Industrial Average fell 0.7% to 45,952.24 points at the close. The S&P 500 lost 0.6% to 6,629.07 points, while the Nasdaq Composite fell 0.5% to 22,562.54 points.

Explaining the decline of the US stock market, expert Angelo Kourkafas of financial consulting firm Edward Jones said that there are now some new concerns related to credit that have appeared, making investors more cautious.

Private credit markets have been in the spotlight after two auto-related businesses went bankrupt in recent weeks, including parts maker First Brands and lender Tricolor.

Shares of Zions Bancorp, a Salt Lake City-based bank, fell 13.1% after the bank reported two troubled loans involving businesses found to have made false statements and breached contracts. Zions said in a filing with securities regulators that it had incurred a $50 million loss from the incident in the third quarter of 2025.

Other mid-sized and regional banks suffered the same fate, including M&T Bank, Comerica and Fifth Third Bancorp. All of these banks' stocks lost between 4% and 7%.

Investors are getting overly nervous after some bad loans were exposed, and they are worried that similar risks could spread to other banks, according to Art Hogan of B. Riley Wealth Management.

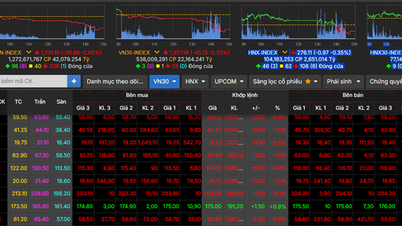

In Vietnam, at the end of the session on October 16, the VN-Index increased by 8.9 points, or 0.51%, to 1,766.85 points, while the HNX-Index added 0.96 points, or 0.35%, to 277.08 points.

Source: https://baotintuc.vn/thi-truong-tien-te/chung-khoan-my-giam-diem-do-cang-thang-tin-dung-vanguy-co-chinh-phu-dong-cua-20251017074342286.htm

![[Photo] Closing ceremony of the 18th Congress of Hanoi Party Committee](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/17/1760704850107_ndo_br_1-jpg.webp)

![[Photo] Collecting waste, sowing green seeds](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/18/1760786475497_ndo_br_1-jpg.webp)

![[Photo] General Secretary To Lam attends the 95th Anniversary of the Party Central Office's Traditional Day](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/18/1760784671836_a1-bnd-4476-1940-jpg.webp)

Comment (0)