Nhat Viet Securities Corporation (VFS) has just announced its financial report for the second quarter of 2025, recording operating revenue in the period reaching VND 112.1 billion, an increase of 123% over the same period last year.

Of which, the largest contribution came from interest from held-to-maturity (HTM) investments with a profit of VND51.7 billion, 3.5 times higher than the same period last year. The profit from this activity contributed to 46% of VFS's operating revenue.

Next, interest from loans and receivables this period brought in 33.9 billion VND, equivalent to an increase of 54% over the same period, contributing 30% of revenue.

This period, the profit from assets recognized through profit and loss (FVTPL) of VFS also increased sharply compared to the second quarter of last year, bringing in 11.7 billion VND. However, after deducting the FVTPL loss of nearly 3 billion VND, this activity brought in about 8.7 billion VND. In the same period, although the FVTPL profit of VFS was very low, it benefited from the difference in revaluation of FVTPL assets, helping this securities company earn about 11 billion VND.

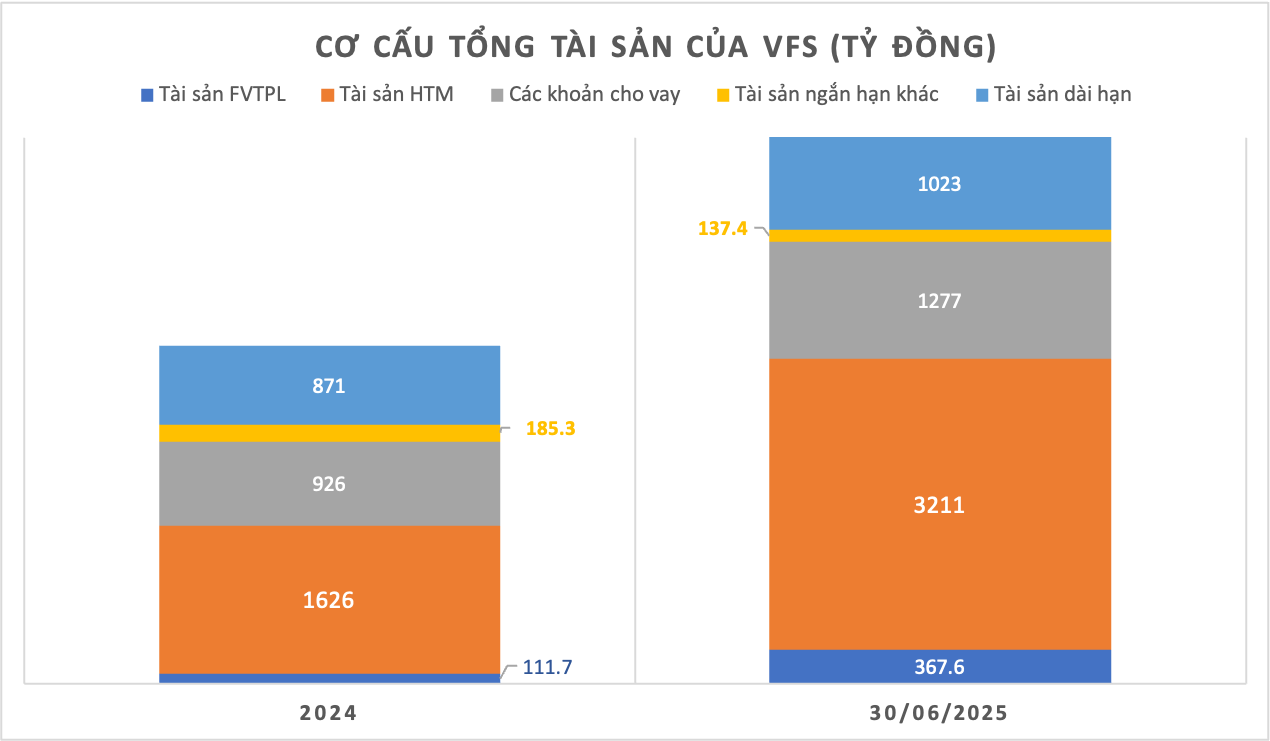

It is known that VFS's FVTPL asset value increased from VND111.6 billion to VND367.6 billion at the end of the second quarter, mainly due to a new investment worth VND264 billion in government bonds.

The change in VFS's FVTPL assets shows that this securities company has liquidated a number of investments in PVS shares (over VND 2.6 billion), VCG (VND 2.7 billion),SHB (VND 2.1 billion) in the first quarter of 2025. VFS increased its purchase of SSI in the first quarter and then sold out in the second quarter. Currently, the value of the stock is the largest FVTPL asset of VFS, HHC, with a market value of VND 103.5 billion.

At the same time, the financial report for the first quarter of 2025 recorded a number of FVTPL assets as listed stocks, including PC1, VCB, VNM, TSJ. However, in the financial report for the second quarter, these stock codes no longer appear in the report, showing that VFS has made short-term investments in these stocks.

In contrast to TVTPL asset investment activities, VFS has strongly increased HTM investments. At the beginning of 2025, the value of HTM assets was VND 2,476 billion, of which VND 1,626 billion was short-term deposits & certificates of deposit under 1 year and VND 850 billion was long-term unlisted bonds. But by the end of the second quarter, the value of HTM assets had increased to VND 4,211 billion, mainly increasing sharply in the second quarter (from VND 2,831 billion at the end of the first quarter) and accounting for 70% of total assets.

Of which, short-term deposits and deposit certificates are worth up to VND3,211 billion, equivalent to 53% of VFS's total assets. In addition, long-term unlisted bond investments are worth VND1,000 billion.

|

| The majority of Nhat Viet Securities' assets are HTM assets. |

By depositing most of its assets in banks and investing in bonds, the interest from HTM assets has now become the main revenue generating activity for VFS. However, capital allocation is also a problem for VFS.

In terms of capital, this securities company has equity of 1,650 billion VND. Liabilities are at 4,366 billion VND, double the liabilities at the beginning of the year and 2.6 times the equity.

Of which, the majority of VFS's liabilities are short-term debts. Short-term liabilities at the end of the second quarter accounted for VND4,358 billion, of which VND4,329 billion was short-term financial leasing loans from banks and financial institutions, equivalent to 72% of VFS's total capital coming from financial loans.

This shows that VFS is depositing most of its borrowed money in banks to earn interest.

As a result, VFS's after-tax profit in the second quarter of 2025 reached VND34.9 billion, up 16% over the same period last year. In the first 6 months of the year, this securities company achieved VND205 billion in operating revenue and VND66.6 billion in after-tax profit, up 83% and 17% respectively over the same period in 2024.

In 2025, VFS set a target of total revenue of over VND 515 billion and after-tax profit of VND 137.98 billion. With the results in 6 months, VFS has achieved 48% of the annual profit plan.

Source: https://baodautu.vn/chung-khoan-nhat-viet-vfs-dem-hon-mot-nua-tai-san-di-gui-ngan-hang-d337512.html

![[Photo] Hanoi morning of October 1: Prolonged flooding, people wade to work](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/1/189be28938e3493fa26b2938efa2059e)

![[Photo] President of the Cuban National Assembly visits President Ho Chi Minh's Mausoleum](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/1/39f1142310fc4dae9e3de4fcc9ac2ed0)

![[Photo] Keep your warehouse safe in all situations](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/1/3eb4eceafe68497989865e7faa4e4d0e)

Comment (0)