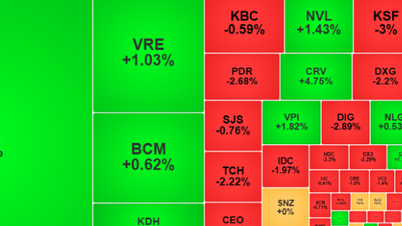

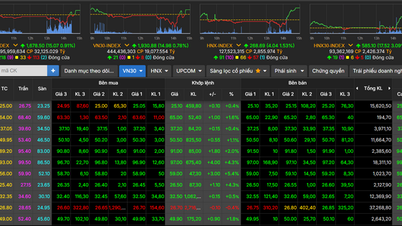

Market 2026 may exceed 2,000 points

Mr. Huynh Minh Tuan, Founder of FIDT Investment Consulting and Asset Management Joint Stock Company and Vice Chairman of APG Securities Joint Stock Company, said that there are three main factors supporting the market in the medium and long term. Specifically, the recent upgrade of the Vietnamese stock market to emerging market status has helped improve the market image and stimulate large-scale passive capital flows from global ETFs, creating a clear revaluation effect. More importantly, this is a milestone showing that Vietnam is entering the process of standardizing and making the system transparent, laying the foundation to approach the standards of stock indexes provided by Morgan Stanley Capital International (MSCI standards) in the period 2027-2028 and affirming its position as an emerging financial center of the region.

In addition, from now until 2027, the Vietnamese stock market is expected to be significantly more vibrant and diverse thanks to the IPO wave of a series of large enterprises, thereby providing more quality options, strongly increasing the attractiveness and depth of the Vietnamese capital market. At the same time, the State Securities Commission plans to launch three new investment indexes on November 3, 2025, including VNMITECH (focusing on technology), VN50 Growth (large-cap growth group), and VNDIVIDEND (dividend-paying stocks group) will contribute to diversifying products and providing more attractive investment options for the market.

In particular, the Vietnamese stock market in the medium term will be supported by the prospect of high economic growth as Vietnam is targeting 8.3-8.5% growth in 2025 and double-digit growth in the 2026-2030 period - the highest growth rate in a decade. Currently, the policy of stabilizing and stimulating the macro economy through promoting public investment disbursement and maintaining a reasonable monetary policy is expected to create momentum for profit growth for listed enterprises in addition to institutional reform, removing legal barriers, enhancing transparency and corporate governance, promoting equitization... In addition, in terms of valuation, the P/E index (an index assessing the relationship between the market price of a stock and earnings per share) of Vietnam at its peak of only about 20 times is considered relatively "cheap" compared to 25 times in Korea, 70 times in China, 32 times in Thailand... With these supporting factors, the Vietnamese stock market can exceed 2,000 points in 2026, Mr. Tuan predicted.

Limit overly optimistic scenarios

According to the World Bank (WB), total short-term capital flows before and after Vietnam's market upgrade could reach about 5 billion USD. In the long term, investment flows could reach 25 billion USD by 2030 if Vietnam continues to maintain strong reform momentum and macroeconomic stability.

Mr. Nguyen Viet Duc, VPBanks Digital Business Director, said that since the beginning of 2025, Vietnam's stock market has grown by over 30% and is one of the two fastest growing markets in the world. Therefore, "the short-term market correction like the past few days is just short-term profit-taking by investors after having very high profits since the beginning of 2025," Mr. Duc explained.

Regarding the medium-term outlook, the Vietnamese stock market has nothing to worry about because the economic growth rate continues to maintain a high level of 8-10%, plus inflation of about 3%, so stock investors can expect an average market return of 13-15%/year. With the strong growth of the market like this year, profit-taking pressure will occur and may cause the market to decrease by about 5%. However, this short-term decline will create new buying power for long-term investors to come to the market, Mr. Duc emphasized.

In particular, after the Vietnamese stock market is officially upgraded to a secondary emerging market in early September 2026 (according to FTSE Russell's announcement), it is estimated that the market will receive about 1.6-2 billion USD from foreign investors and passive funds. The market is also forecast to attract active capital flows of about 5-6 billion USD, which will be disbursed at appropriate valuation times.

In addition, with the forward P/E valuation (reserve P/E allows investors to evaluate the future profit potential of a business in the next 12 months) of stocks still at only 12 times, 20-30% lower than other emerging markets, the Vietnamese stock market is still attractive to investors, Mr. Duc said.

In fact, when the stock market has had a decline in recent days, foreign investors immediately started to disburse again. Therefore, the declines in the stock market will always have a support force from long-term investors including foreign investors and domestic investors.

In 2026, with high economic growth expectations, the Vietnamese stock market will continue to grow by about 15%. However, "investors should also limit overly optimistic scenarios because normally a year of growth of over 30% will only last for a short time and the stock market will adjust back to an average growth rate of 15-18%/year", Mr. Duc warned.

Source: https://baotintuc.vn/thi-truong-tien-te/chung-khoan-viet-nam-nhieu-yeu-to-ho-tro-tang-truong-trung-va-dai-han-20251023081307494.htm

![[Photo] Prime Minister Pham Minh Chinh chairs meeting on railway projects](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/23/1761206277171_dsc-9703-jpg.webp)

Comment (0)