Gold prices have fallen in recent weeks, but some experts believe that this decline is only temporary and that gold prices will soon recover.

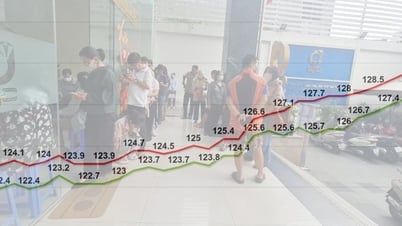

As gold prices plummeted from $2,800 an ounce to just over $2,500 an ounce in just two weeks, experts and traders have been trying to figure out why and predict how far the precious metal will fall in the coming time. Although gold holders are reassured that gold is still a good investment in the medium to long term, they are still worried about the continuous decline in gold prices.

“ Gold has fallen nearly 5% this week alone, marking its deepest weekly decline in nearly three years. The metal has fallen more than $250, or about 9%, from its peak, making it the longest losing streak since the start of the month,” notes Alex Kuptsikevich, senior market analyst at FxPro .

|

| Gold prices fell as the US dollar strengthened and interest rate cut expectations eased, but could recover on economic uncertainty and inflation. Photo: Kitco News |

However, market analyst Alex Kuptsikevich notes that the gold rally from last October is still intact, so even if gold falls to $2,400 an ounce, it will be a correction, returning the price to its 200-day average. At the current rate of decline, gold could reach that level before the end of the year.

Technically, Kuptsikevich pointed out that there is a significant bearish signal on the weekly chart. Gold prices have fallen sharply after rising too quickly, while the relative strength index (RSI) has also fallen from above 80. Such a reversal at extreme levels often signals a change in market momentum.

To better understand the impact of this signal, Kuptsikevich looked at historical events. He noted that in 2009 and 2011, there were also two sharp bearish reversals from all-time highs.

In 2009, gold prices fell 15% from peak to trough before rallying back to an all-time high thanks to renewed buying. This bull market lasted for nearly two years, with only brief pauses. Similarly, in 2011, gold prices fell nearly 20%. Although gold subsequently rose 17%, the bull market momentum was broken. Over the next four years, gold lost 45% of its value.

In both cases, Kuptsikevich said, the 50-week moving average acted as intermediate support during the decline. Currently, the moving average is at $2,330 an ounce and is trending up. Kuptsikevich predicts the moving average could reach $2,400 an ounce by the end of the year. If gold falls below that level, it is likely to fall further.

Naeem Aslam, chief investment officer at Zaye Capital Markets, confirmed that the precious metal has been weak recently but he sees a number of factors that could adjust the path of price action.

“ There has been significant downward pressure on gold prices in recent days due to a stronger US dollar and shifting expectations of Federal Reserve monetary policy ,” Aslam said, noting that gold prices are set to post their biggest weekly loss in months.

" Traders and investors are concerned that the price of the yellow metal could face a much more challenging time in the near term as the Federal Reserve is in no rush to change its monetary policy any time in the near future with fresh economic data, " Aslam said.

He pointed out that while a stronger US dollar and expectations of fewer rate cuts are weighing on gold prices, a number of factors could change the price trajectory in the coming months. " Gold's appeal as a safe-haven asset could be reinforced by global economic uncertainties such as trade disputes and geopolitical tensions. Investors may seek refuge in gold in the event of increased uncertainty ."

Inflation could also affect gold prices, Aslam said. The Fed may have to change policy if inflation continues to rise higher than expected. So gold prices could rise if inflation is higher than interest rate increases.

Ultimately, the US dollar’s recent outperformance could be reversed. “ Demand for gold could increase if the US dollar starts to depreciate due to domestic or external factors ,” Aslam said.

Comments from Federal Reserve members will also have an impact, as happened on Thursday when Governor Kugler suggested the pace of rate cuts could slow. " Upcoming speeches and statements from Federal Reserve officials, including Chairman Jerome Powell, will be closely watched. Any indication of a change in monetary policy could have a significant impact on gold prices," he added .

Next week, the economic calendar will focus heavily on housing. U.S. housing starts and building permits for October are due on Tuesday. The Mortgage Bankers Association (MBA) will release mortgage applications on Wednesday. On Thursday, October existing home sales data and the Philadelphia Federal Reserve (Philly Fed) manufacturing index (the Philly Fed index measures manufacturing activity in the Philadelphia area) are due. Also on Thursday, the University of Michigan will release November consumer sentiment data.

In addition, several central bank officials will speak next week. Investors will watch these speeches for clues about the pace and extent of future rate cuts. Specifically, Dallas Fed President Robert Kaplan will speak on Monday. Atlanta Fed President Raphael Bostic and Dallas Fed President Robert Kaplan will speak on Thursday.

Source: https://congthuong.vn/chuyen-gia-du-bao-lac-quan-ve-gia-vang-trong-tuan-moi-359212.html

![[Photo] Hanoi morning of October 1: Prolonged flooding, people wade to work](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/1/189be28938e3493fa26b2938efa2059e)

![[Photo] The 1st Congress of Phu Tho Provincial Party Committee, term 2025-2030](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/1507da06216649bba8a1ce6251816820)

![[Photo] President Luong Cuong receives President of the Cuban National Assembly Esteban Lazo Hernandez](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/4d38932911c24f6ea1936252bd5427fa)

![[Photo] Panorama of the cable-stayed bridge, the final bottleneck of the Ben Luc-Long Thanh expressway](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/391fdf21025541d6b2f092e49a17243f)

Comment (0)