An experiment was recently conducted on the Russian economy , in which the extreme stress scenario was set as zero growth, a weakening ruble and plummeting oil and gas revenues, Germany-based bne IntelliNews reported, citing the results of the experiment published in late April.

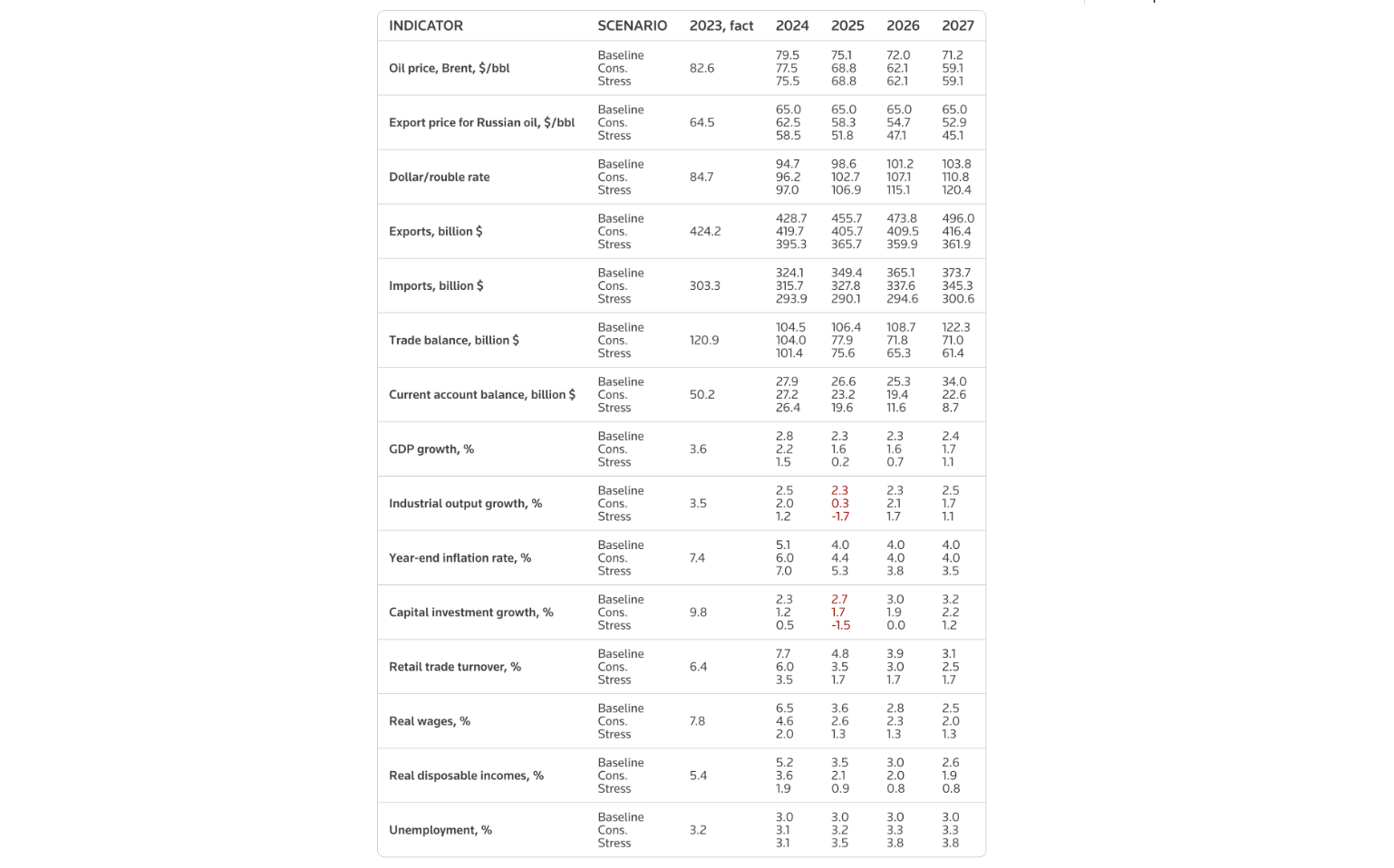

Accordingly, the worst-case scenario set by the Ministry of Economic Development of the Russian Federation (MinEcon) for 2024 predicts stagnant GDP growth and household income, the Ruble hovering around the 100 Rubles to 1 USD mark, while the country's crude oil export price falls to 58.5 USD/barrel from 64.5 USD/barrel in 2023.

Conditions for 2025 are even more difficult. MinEcon expects the indicators to be more bleak: GDP will be 0.2%, the average exchange rate will be 106.9 rubles to the dollar, and crude oil prices will be just $51.8 per barrel.

The most severe stress test scenario paints a picture that is in stark contrast to MinEcon's baseline growth scenario for this year of 2.3%.

The Central Bank of Russia (CBR) predicts growth of 2.2% in 2024. The Russian Finance Ministry is even more optimistic, predicting a repeat of the 3.6% growth the Eurasian giant achieved in 2023 this year.

The International Monetary Fund (IMF) also recently updated its growth outlook forecast from 1.1% to 3.2%, making Russia the fastest growing country among major economies this year.

Economy Minister Maxim Reshetnikov presented a more optimistic baseline scenario in late April, suggesting GDP growth would improve to 2.8% in 2024. However, even this more favorable forecast carries concerns, as it includes a worsening inflation outlook and a further weakening of the ruble.

Inflation, at 7.7% in March, remains a headache for Russia despite its key interest rate of 16%. CBR Governor Elvia Nabiullina kept rates unchanged last week, citing continued inflationary pressures.

Ms. Nabiullina also said that the authorities expect inflation to return to 4% by 2025. Accelerating inflation, along with other factors such as labor shortages, will force companies to raise wages to attract and retain employees, while the market will not have enough goods and services at the old prices.

Scenarios for the Russian economy from 2024 to 2027 were set by the Ministry of Economic Development of the Russian Federation.

Under all MinEcon scenarios, including both the conservative and stress test scenarios, the forecasts point to a downturn in Russian oil and gas production and exports. The most stressful scenario predicts that Russia’s oil export prices could fall to $58.5 per barrel in 2024, dropping to $51.8 in 2025 – a significant drop from the current trading price of around $79 per barrel for the country’s Urals crude.

If these lower commodity prices materialize, GDP growth is expected to slow to 1.5% this year, falling to 0.2% in 2025, from stronger forecasts of 2.8% and 2.3% in the baseline scenario.

Forecasts for investment and real income growth are similarly bleak in the stress test scenario. Fixed capital investment is forecast to rise by just 0.5% this year before falling by 1.5% next year. Furthermore, disposable income growth, which was 5.4% last year, is forecast to slow to 1.9% this year and 0.9% next year.

Russian authorities also predict a sharp depreciation of the ruble, expecting it to surpass the 100 ruble mark and reach 106.9 rubles per dollar by 2025, with a potential further slide to 120 rubles per dollar by 2027.

These forecasts highlight the significant economic challenges Russia could face in the event of difficult external and internal conditions, as outlined in the stress test scenario .

Minh Duc (According to bne IntelliNews)

Source

![[Photo] Hanoi morning of October 1: Prolonged flooding, people wade to work](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/1/189be28938e3493fa26b2938efa2059e)

![[Photo] Keep your warehouse safe in all situations](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/1/3eb4eceafe68497989865e7faa4e4d0e)

![[Photo] President of the Cuban National Assembly visits President Ho Chi Minh's Mausoleum](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/1/39f1142310fc4dae9e3de4fcc9ac2ed0)

Comment (0)