The strong increase in codes FRT, MWG, DGW helped retail become one of the outstanding industry groups in today's stock market session, increasing by nearly 9 points.

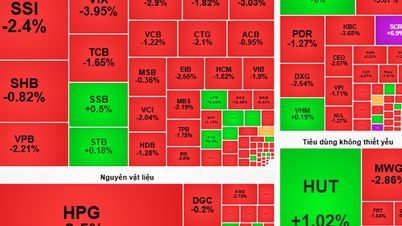

VN-Index opened in red as the sell-off from the previous session still lingered. The HoSE representative index was then pulled up to the reference level. At around 10am, the index continued to fluctuate but quickly recovered thanks to more buying pressure and green spread across the board, especially the midcap group.

In the afternoon, the index maintained its upward momentum, with only slight fluctuations. The VN-Index closed at 1,173 points, up nearly 9 points compared to yesterday.

On the HoSE floor, 270 stocks increased, while the number of stocks decreased was 177. The chemical, technology and retail groups led the increase in the industry index.

Retail stocks attracted cash flow from the morning and maintained good performance until the close of the session. Of which, MWG was the second most liquid stock in the market with a 2.7% increase in price. Although the trading value was lower, FRT accumulated up to 3.1%. DGW also closed today 1.5% higher than the reference price. PNJ increased slightly by 0.2%.

The chemical and technology group has two prominent codes: GVR andFPT . The shares of Vietnam Rubber Industry Group increased to the ceiling and ranked second in the group of codes contributing the most to the increase of VN-Index. FPT leads the market in liquidity with nearly 770 billion VND, the market price increased by 4.4%.

The market repeated the chorus of mixed liquidity scores. The total transaction value on the HoSE reached nearly VND15,300 billion, down more than VND8,000 billion. Foreign investors continued to net buy for the third consecutive session but the value fell to more than VND60 billion. They focused on buying PNJ, HPG, and MWG.

Vietcombank Securities (VCBS) advises investors to limit chasing when stock prices have increased sharply. Instead, they should consider taking advantage of the rising sessions to realize partial profits for stocks that have had a good increase. This analysis group believes that selling pressure is still likely to increase unexpectedly at the strong resistance zone around 1,180-1,190 points, especially in the remaining sessions before entering the long Lunar New Year holiday.

Siddhartha

Source link

![[Photo] Hanoi morning of October 1: Prolonged flooding, people wade to work](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/1/189be28938e3493fa26b2938efa2059e)

![[Photo] President Luong Cuong receives President of the Cuban National Assembly Esteban Lazo Hernandez](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/4d38932911c24f6ea1936252bd5427fa)

![[Photo] The 1st Congress of Phu Tho Provincial Party Committee, term 2025-2030](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/1507da06216649bba8a1ce6251816820)

![[Photo] Panorama of the cable-stayed bridge, the final bottleneck of the Ben Luc-Long Thanh expressway](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/391fdf21025541d6b2f092e49a17243f)

Comment (0)