Stocks on January 11th turned green

The January 11 stock market session began with investors' worries because yesterday, the VN-Index fell into a state of green on the outside and red on the inside. That means the VN-Index closed in green but the number of stocks that decreased in price was much higher than the number of stocks that increased in price. The reason was that banking stocks, especially blue-chips, increased strongly, supporting the VN-Index.

However, in the stock market session on January 11, the situation of green on the outside and red on the inside no longer existed. VN-Index remained green and the number of stocks increasing in price was higher than the number of stocks decreasing in price.

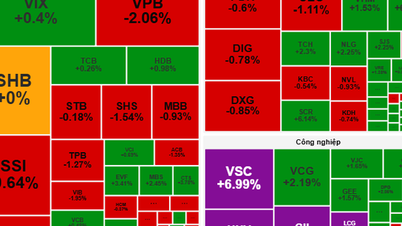

Specifically, during the morning session of January 11, the electronic trading board was covered in green. In the afternoon, the VN-Index suddenly adjusted down due to selling pressure. However, the "ATC miracle" appeared again. Although before the ATC session, red dominated, at the end of the January 11 session, the VN-Index unexpectedly regained green when closing at 1,162.22 points, up 0.68 points, equivalent to 0.06%; the VN30-Index increased 0.88 points, equivalent to 0.08% to 1,163.56 points.

After a session of “rescuing” the VN-Index to the point of distorting the market, in the stock market session on January 11, bank stocks stumbled. Another highlight that must be mentioned is the dizzying “roller coaster” of Mr. Duc’s HAG. Illustrative photo

The liquidity of the January 11 session decreased but remained at a good level, reaching 860 million shares, equivalent to 17,317 billion VND. The entire floor had 250 codes increasing in price, 115 codes remaining unchanged and 221 codes decreasing in price. The VN30 group recorded 287 million shares, equivalent to 7,374 billion VND being successfully traded. There were 20 codes increasing in price, 0 codes remaining unchanged and 7 codes decreasing in price.

Bank stocks stumble

As mentioned above, in the VN30 group, there are only 7 stocks that decreased in price. However, those 7 stocks are large stocks, having a very strong impact on the general index of the market. Or more specifically, they are the banking group.

If yesterday, blue-chips in the banking sector were the "saviors" that helped VN-Index escape a session of decline, then in the stock market session on January 11, this group pulled the index down, almost causing VN-Index to close in red.

Specifically, the big banks that closed the January 11 stock market session in red include BID (down 900 VND/share, equivalent to 1.9% to 46,500 VND/share), MBB (down 250 VND/share, equivalent to 1.2% to 20,650 VND/share), VCB (down 200 VND/share, equivalent to 0.22% to 89,300 VND/share), TCB (down 250 VND/share, equivalent to 0.73% to 34,150 VND/share).

On the contrary, some lucky banking stocks stopped in the green, such asSHB , HDB, STB,... but overall, in the stock market session on February 11, the banking industry group still declined with a decrease of 0.22%.

Mr. Duc's stock "roller coaster"

In the first trading session of 2024, banking was the most prominent industry group. In terms of individual stocks, HAG of Hoang Anh Gia Lai Group and HNG of Hoang Anh Gia Lai International Agriculture Joint Stock Company, the codes related to Mr. Duc, attracted the most attention because of their "roller coaster" fluctuations, sometimes increasing very strongly, sometimes decreasing very deeply.

In the stock market session on January 11, after 3 consecutive sessions of deep decline, HAG shares continued to "reverse gear". At one point, HAG fell to the "bottom" of 13,200 VND/share. However, after that, demand appeared, helping HAG reach a purple price at times. Closing the stock market session on January 11, HAG increased by 850 VND/share, equivalent to 6.42%, stopping at 14,100 VND/share, only 50 VND/share lower than the ceiling price. HAG liquidity increased sharply, reaching nearly 36 million units, nearly 6 times higher than the previous session.

Similarly, HNG shares also recovered at the end of the session despite trading at the reference price at the beginning of the session. At the end of the stock market session on January 11, HNG increased by VND180/share, equivalent to 3.7% to VND5,040/share.

Source

![[Photo] Closing ceremony of the 18th Congress of Hanoi Party Committee](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/17/1760704850107_ndo_br_1-jpg.webp)

![[Photo] General Secretary To Lam attends the 95th Anniversary of the Party Central Office's Traditional Day](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/18/1760784671836_a1-bnd-4476-1940-jpg.webp)

![[Photo] Collecting waste, sowing green seeds](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/18/1760786475497_ndo_br_1-jpg.webp)

Comment (0)